AI & data center ETFs: Post-rotation flows and hardware leaders

As global markets rotate out of mega-cap technology dominance and into the deeper infrastructure themes supporting artificial intelligence, investors are discovering a new focal point: the data center and AI hardware ecosystem. In 2025, AI infrastructure has emerged as one of the most powerful and scalable investment narratives, spanning semiconductors, networking, digital infrastructure, and cloud facilities. AI and Data Center ETFs are at the frontline of this shift, capturing the companies enabling the world’s transition into high-intensity computing and next-generation cloud capacity.

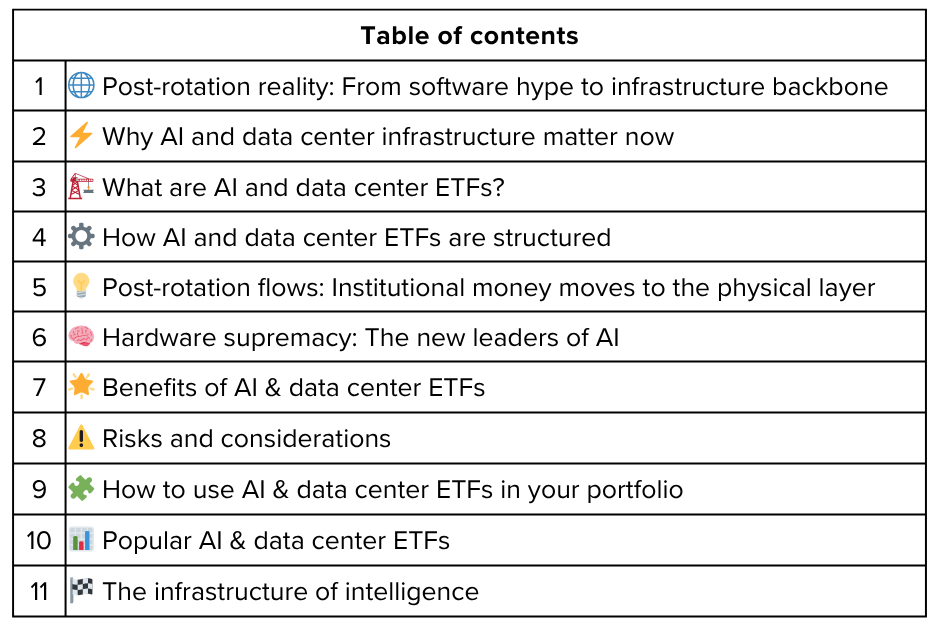

This article explores the new post-rotation market flows driving capital into data infrastructure, the rise of hardware supremacy in the AI race, and how investors can use specialized ETFs to gain exposure to this foundation of the digital economy.

🔔 Don’t miss out!

Add winvestacrisps@substack.com to your email list so our updates never land in spam

Keep reading with a 7-day free trial

Subscribe to Winvesta Crisps to keep reading this post and get 7 days of free access to the full post archives.