🧾 Will Intuit Be The Perfect Match For Mailchimp?

Chewy tumbles on weak earnings; Macquarie downgrades AMC.

Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Wednesday's Close) 4,524.09 +1.41 (0.03%)

NASDAQ (Wednesday's Close) 15,309.38 +50.15 (0.33%)

FTSE 100 (4:30 PM IST) 7,144.01 -5.83 (0.08%)

NIFTY 50 (Today's Close) 17,234.15 +157.90 (0.92%)

USDINR (Today's Close) 73.06 (1 Year -2.78%)

🔥 Top Movers

AMBA +27.41%

PVH +15.07%

TUYA +14.96%

RNA -19.09%

CENH -14.57%

FULC -9.66%

🧾 Intuit: The Perfect Match For Mailchimp?

Intuit Inc. (INTU), the parent of popular brands like QuickBooks and TurboTax looking to acquire email marketing firm Mailchimp for over $10B. Intuit already has an armada of market-leading products geared towards small businesses. Mailchimp might well be another feather in its multi-hued cap! (Tweet This)

Portfolio Of Market Leaders

Intuit was founded in 1983 with the conviction that computers will replace paper-based personal accounting. Its first product, Quicken, was coded in Microsoft's BASIC programming language for the IBM PC and Apple II.

It used the proceeds from its 1993 IPO to acquire tax-preparation software company Chipsoft for $225M, which paved the way for TurboTax to become the powerhouse tax software that it has become. Microsoft tried acquiring Intuit in 1994 for $2B, but the DoJ objected, and the deal fell apart.

Intuit dusted it off and kept going. Its accounting software QuickBooks became synonymous with accounting software for SMEs, individuals, and tax professionals. It has ensured the product suite is updated to ensure ease of use for customers by integrating with apps such as PayPal, Shopify, and Square. QuickBooks currently has an 80% market share in the US.

TurboTax helps consumers prepare and file state and federal income taxes. During the 2021 tax season, TurboTax's market share had risen to 73% from 63% in 2019. Last year, it acquired Credit Karma, a platform that provides customers with free credit score tracking for $8.1B. The deal added over 110M members of Credit Karma to Intuit's platforms.

Intuit's revenue and free cash flow have grown at a 5-year CAGR of 17% and 23%, respectively. Away from the hoopla around FAANG stocks and the like, Intuit has quietly gone about its business and delivered handsome returns to its shareholders. The stock has risen 5x over the last five years.

Mailchimp: The Gorilla In The Room

Mailchimp rose like a Phoenix from the ashes of the dot-com bust in 2001. It is a leading marketing automation platform for SMEs. Its software enables businesses to send bespoke emails to their customers to maximize the impact of the message at opportune moments.

In its two-decade-long history, Mailchimp has never raised any venture capital funding! The company is already profitable, generating $300M EBITDA in 2020 with revenue of $750M and a customer base of 140M.

Mailchimp has put itself on the block for about a month and has elicited interest from PE funds and tech companies alike. While no official announcement was forthcoming from either Mailchimp or Intuit, the synergies between them, given the focus on SMEs, are too obvious to ignore.

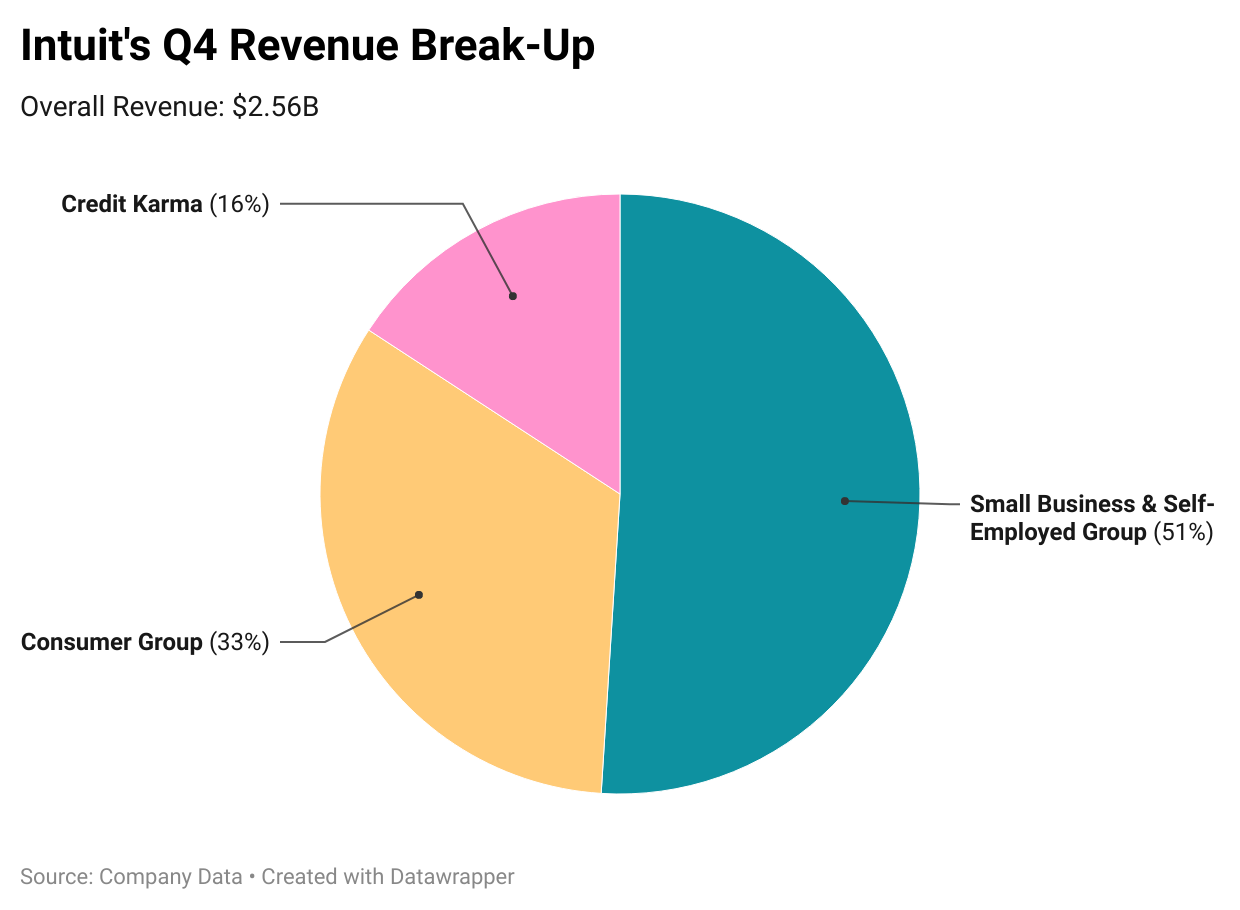

If Intuit can successfully woo Mailchimp, it’ll be the company’s largest acquisition to date. The Q4 results that were released last week were a demonstration of sorts that Mailchimp will be in good hands with Intuit. Credit Karma contributed to nearly one-fifth of the top line.

Key Stats From Intuit's Q4:

Revenue: $2.56B Vs $2.32B expected

EPS: $1.97 Vs $1.59 expected

For the full fiscal 2022, the company expects ~16% Y-o-Y revenue growth and ~15% Y-o-Y EPS growth.

If the deal with Mailchimp does go through, these forecasts may become more of a foregone conclusion. Intuit simply has to manage its industry-leading product portfolio to continue what it does best: enabling shareholders to use its accounting software to calculate the profits they’ve earned from their Intuit holdings!

Market Reaction

INTU ended at $563.13, down 0.53%. Shares are up over 50% this year.

Company Snapshot 📈

INTU $563.13 -2.98 (0.53%)

Analyst Ratings (25 Analysts) BUY 80% HOLD 16% SELL 4%

Newsworthy 📰

Earnings: Chewy shares tumble after pet retailer's earnings and forecast disappoint (CHWY -9.93%)

Hurdles: Tesla's Roadster shipment to be delayed to 2023, says Musk (TSLA -0.22%)

Bearish: Macquarie downgrades AMC on poor box office, predicts 80% stock decline (AMC -7.30%)

Later Today 🕒

Broadcom Inc. Earnings (AVGO)

DocuSign Inc. Earnings (DOCU)

Hormel Foods Corp Earnings (HRL)

Cooper Companies Inc. Earnings (COO)

Hewlett Packard Enterprise Co. Earnings (HPQ)

Guidewire Software Inc. Earnings (GWRE)

Pagerduty Inc. Earnings (PD)

6:00 PM IST: Initial Jobless Claims

7:30 PM IST: Factory Orders

Fun Fact of The Day 🌞

The retail price for the iPad would be $1,140 if it were built by American workers instead of Chinese

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today.