🏍 Will Harley-Davidson Recover From The Tariff Woes?

Oreo to get costlier; Bed Bath and Beyond's inexplicable surge.

Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Tuesday's Close) 4,630.65 +16.98 (0.37%)

NASDAQ (Tuesday's Close) 15,649.60 +53.69 (0.34%)

FTSE 100 (4:30 PM IST) 7,256.33 -18.48 (0.25%)

NIFTY 50 (Today's Close) 17,829.20 -59.75 (0.33%)

USDINR (Today's Close) 74.50 (1 Year -0.76%)

🔥 Top Movers

CAR +108.31%

ROG +29.62%

SAVA +25.94%

CHGG -48.82%

PNTG -23.28%

HSC -20.17%

🏍 Harley-Davidson: Green Light At Last?

Shareholders of Harley-Davidson (HOG) hogged the company's shares on Monday. Why? The Trump-era trade dispute between the US and Europe finally seems to have ended. But for that, the company was on the hook to pay heavy tariffs that would have impacted its financial performance. (Tweet This)

Tit For Tat

Back on March 1, 2018, then President Trump announced import tariffs of 25% tariff on steel and a 10% tariff on aluminum. The order to this effect was signed a week later.

The EU, Canada, Mexico, Australia, Argentina, Brazil, and South Korea were temporary exemptions. However, Canada, Mexico, and the EU were brought under the tariff jurisdiction in an announcement on May 31, 2018.

These tariffs were imposed based on a rarely used measure by which the US Secretary of Commerce decides if a particular article being imported into the US threatens or impairs US national security. This trigger was never used since the World Trade Organization (WTO) came into effect in 1995.

The announcement of tariffs had an immediate impact. General Motors announced the closure of plants in Maryland, Michigan, Ohio, and Ontario. It also cut 14K jobs, citing heavy tariffs. China dragged the US to the WTO in April 2018 while the EU opened a similar case in June.

The EU went all out, saying the imposition of duties goes against "all logic and history." After lodging a case at the WTO, the EU imposed retaliatory tariffs on up to $7.8B worth of US exports. Products targeted by the EU included Bourbon Whiskey, Peanut Butter, and Orange Juice.

Monkey Off The Back

Milwaukee-based Harley-Davidson had been grappling with a decline in sales in recent years. It eliminated 700 global jobs as part of a comprehensive restructuring plan. The imposition of retaliatory tariffs by the EU only made matters worse.

An order passed by the Economic Ministry of Belgium made all Harley-Davidson products subject to a 56% import tariff starting June this year. This was significantly higher than the 31% imposed by the EU in 2018. Harley forecast incremental adverse tariff effects worth $200M to $225M in 2022.

The US and the EU finally waved the white flag at each other, agreeing to "pause their steel and aluminum trade dispute." Both sides also agreed to launch cooperation on a Global Arrangement on Sustainable Steel & Aluminium.

The US said that it would not apply metal tariffs, and the EU will also suspend its tariffs on American goods. European Commission President Ursula von der Leyen said that this was a "major step forward" in the partnership between the two sides.

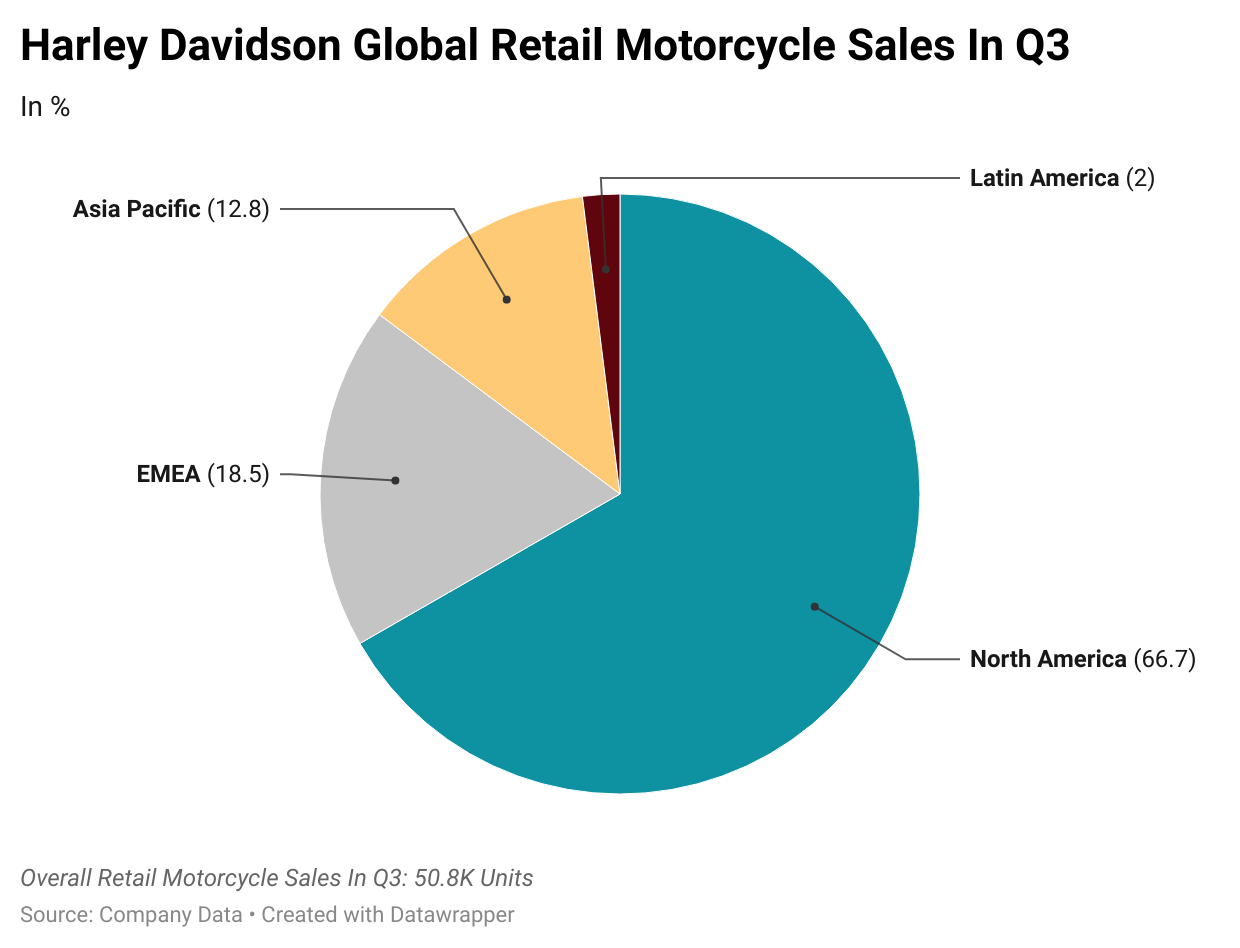

EU is the second-largest market for Harley-Davidson after the US. The company managed to sell 18.5% out of the worldwide total of 50.8K motorcycles in Europe during Q3. Financially too, things appear to be on the mend as the company beat both revenue and EPS estimates.

Key Stats From Q3:

Revenue: $1.16B Vs $1.15B expected

EPS: $1.18 Vs $0.78 expected

For the full fiscal 2021, the company expects the motorcycle segment to grow 30-35%, while the operating income of its financial services segment is expected to grow ~100%, from the earlier projection of ~80%.

The removal of tariffs certainly comes as welcome news for Harley-Davidson. Shareholders, too, would want to Vrooom ahead and want to turn around a year that has otherwise remained in neutral!

Market Reaction

HOG ended at $38.44, down 3.42% after Monday's 8% jump.

Company Snapshot 📈

HOG $38.44 -1.36 (3.42%)

Analyst Ratings (17 Analysts) BUY 41% HOLD 47% SELL 12%

Newsworthy 📰

Hike: Mondelez to raise price of Oreo cookies, Ritz crackers by 7% in 2022 (MDLZ +2.35%)

Short Squeeze: Bed Bath & Beyond shares soar over 50% in after-hours trading (BBBY +67.46%)

Navigating: Lyft surges as company charts a path out of the pandemic (LYFT +12.86%)

Later Today 🕒

Qualcomm Inc. Earnings (QCOM)

CVS Health Corp. Earnings (CVS)

Booking Holdings Inc. Earnings (BKNG)

Equinix Inc. Earnings (EQIX)

Humana Inc. Earnings (HUM)

Emerson Electric Co. Earnings (EMR)

Progressive Corp. Earnings (PGR)

Metlife Inc. Earnings (MET)

Marriott International Inc. Earnings (MAR)

Roku Inc. Earnings (ROKU)

Electronic Arts Inc. Earnings (EA)

HubSpot Inc. Earnings (HUBS)

Sun Life Financial Inc. Earnings (SLF)

Etsy Inc. Earnings (ETSY)

Discovery Communications Inc. Earnings (DISCA)

Marathon Oil Corporation Earnings (MRO)

Godaddy Inc. Earnings (GDDY)

Hyatt Hotels Corporation Earnings (H)

Today's Market Terminology: Dividend Yield

A dividend yield shows how much a company pays out as dividend every year as compared to the stock price

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today. *Capital is at risk.