🔌 Why Is Plug Power Running On Low Battery?

Tech shares routed; Engine No. 1 backs GM.

Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Monday's Close) 4,300.46 -56.58 (1.30%)

NASDAQ (Monday's Close) 14,255.48 -311.21 (2.14%)

FTSE 100 (4:30 PM IST) 7,056.28 +45.27 (0.65%)

NIFTY 50 (Today's Close) 17,822.30 +131.05 (0.74%)

USDINR (Today's Close) 74.52 (1 Year -0.87%)

🔥 Top Movers

PVAC +10.68%

NOG +10.55%

TGP +9.56%

RGNX -19.74%

AMTX -15.13%

OMER -14.75%

🔌 Plug Power: Battery Low?

Hydrogen fuel cell systems developer Plug Power Inc. (PLUG) will be bringing the largest green hydrogen production plant online on the West Coast by 2024. It's also currently building more plants elsewhere in the country. So why are the shares languishing after a euphoric start to the year? (Tweet This)

Take A Tumble

Plug Power shares were priced at $3 apiece at the start of 2020. By the end of the year, the stock price had already appreciated 10x to ~$30 apiece. As 2021 began came the meme stocks mania, and within no time, Plug Power shares hit a peak of $75 on January 26th.

The company formed a joint venture with Renault to build hydrogen-fuelled delivery vans in Europe. In addition, with clients such as Amazon and Walmart and the promise of green and sustainable products, Plug Power had a great ride while it lasted.

Then came the tumble. A lawsuit against the company and its senior executives accused it of misleading investors and some accounting errors. Nasdaq issued a notice to the company asking it to reissue financial statements for fiscal 2018 and 2019.

Shares fell to around $20, down 70% from their peak by May. They've been languishing in the $20-$30 range ever since.

In June, GM teamed up with Wabtec to supply electric batteries and hydrogen fuel cell systems for Wabtec's train locomotives. Scheduled to be delivered in 2023, these will pit GM directly against Plug Power. This increased competition from an automotive incumbent has made investors look askance about Plug Power's prospects.

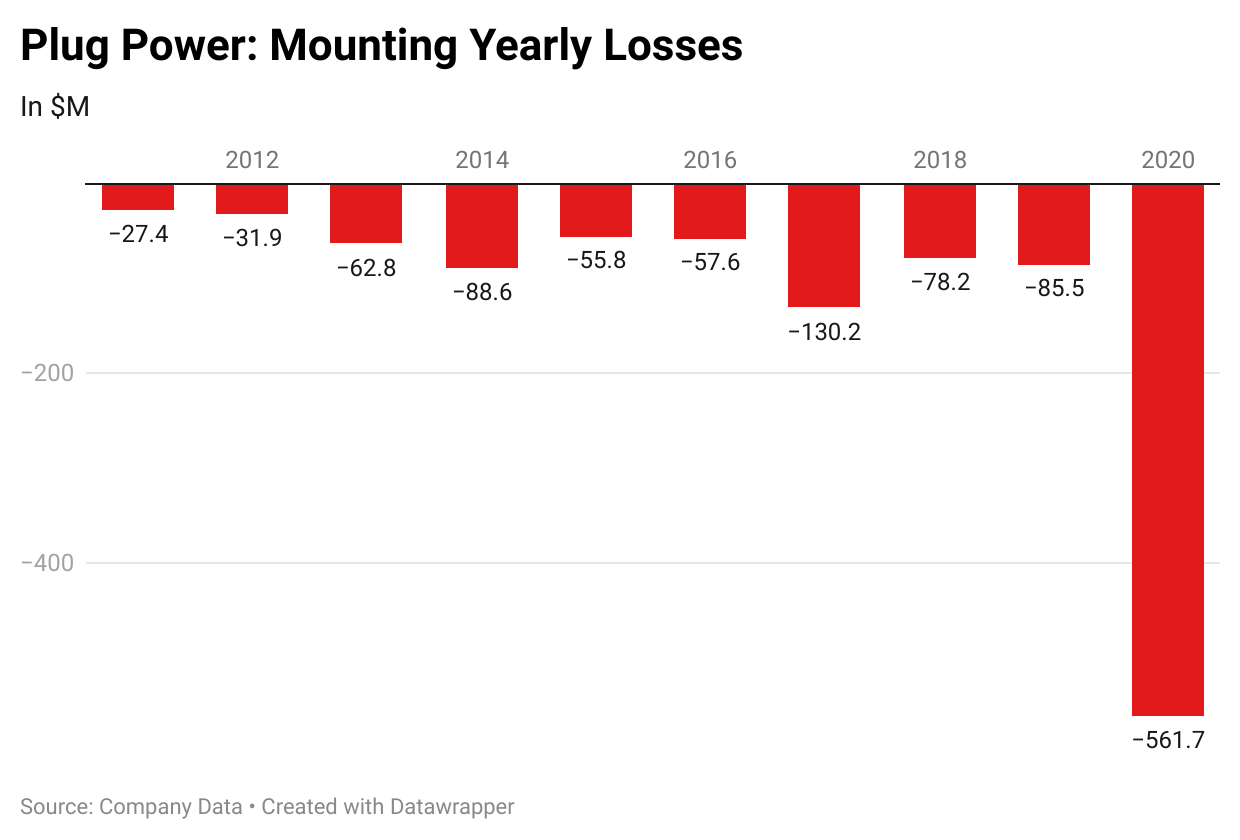

The Loss Abyss

Not one to cower, Plug Power is continuing to plan for expanding its Hydrogen production capacity. The company announced a state-of-the-art renewable energy-powered production facility in California that will produce 30 MT of green Hydrogen per day.

The facility will also house a new wastewater treatment facility that will provide recycled water to Mendota, an increasingly water-stressed agricultural hub in the vicinity. Elsewhere in the country, Plug Power is already building production facilities across Tennessee, New York, Georgia, and Pennsylvania.

While these efforts may bring in more revenues and profits a few years down the line, the current results are far from recharging investors’ batteries! While revenues rose 83% Y-o-Y to $124.6M in Q2, net loss widened 10X to $99.6M from $9.4M during the same period last year. In the first six months of the year, the company burned $246.6M in cash.

Plug Power was banking on the infrastructure bill proposed by the Biden administration to boost its business given its credentials as a green Hydrogen producer. However, that bill is now sitting in limbo in Congress, and that has poured cold water on the $7.5B that would have been provided in support of adopting zero and low-emission vehicles.

Consequently, despite all its green credentials, Plug Power finds itself in a limbo - mounting losses, increasing Capex (which will at some point mean larger production capacity), and cash that’s burning faster than Hydrogen.

Plug Power bravely marches on with its expansion plans hoping that the government will come through sooner than later. One can only hope that happens before the investors decide to pull the plug!

Market Reaction

PLUG ended at $24.32, down 4.89%. Shares are down 24% this year.

Company Snapshot 📈

PLUG $24.32 -1.25 (4.89%)

Analyst Ratings (24 Analysts) BUY 70% HOLD 30% SELL 0%

Newsworthy 📰

Standstill: Facebook says root cause of outage was faulty configuration change (FB -4.89%)

Green Light: Upstart activist Engine No. 1 takes stake in GM, supports EV transition plan (GM +1.60%)

Penalty: Tesla ordered to pay over $130M to former Black worker over racism (TSLA +0.81%)

Later Today 🕒

PepsiCo Inc. Earnings (PEP)

6:00 PM IST: Trade Deficit

7:15 PM IST: Markit Services PMI

Today's Market Terminology: Liquidation

Liquidation is the process of accounting by which a company is brought to an end. The assets and properties of the company are redistributed among stakeholders

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today.