🔏 What Is DocuSign's Growth Signaling?

Tesla cancels Plaid Plus. AMSC rips 37%.

Hey Global Investor, here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Friday's Close) 4,229.89 +37.04 (0.88%)

NASDAQ (Friday's Close) 13,814.49 +199.98 (1.47%)

FTSE 100 (4:30 PM IST) 7,089.84 +20.80 (0.29%)

NIFTY 50 (Today's Close) 15,746.25 +76.00 (0.48%)

USDINR (Today's Close) 72.81 (1 Year -3.56%)

🔥 Top Movers

AMSC +37.46%

DOCU +19.76%

AMC +17.67%

PD -12.97%

BB -12.72%

PSTH -11.94%

🔏 DocuSign: The Sign Of Times?

Electronic Signature solutions provider DocuSign (DOCU) had its best trading day in nine months after it beat estimates by a distance in Q1. Their guidance too was higher than projections. At this rate, the company seems incapable of a misstep! (Tweet This)

The Rise Of eSignatures

Imagine that you run a business. You are on the lookout for potential clients. You manage to secure a large deal. But the client is based out of a different state. You travel back and forth for negotiations, meetings, and finally, to sign deal documents. Game, set, and match.

Only, you had to get this done in the middle of a pandemic and lockdowns. Enter DocuSign, a company founded in California, nearly two decades ago. DocuSign has been under the radar for most of this period until it was thrust into the limelight in the last 18 months and how!

eSignatures or digital signatures have been around for quite a while. But the growing demand for businesses to go paperless has forced them to rethink their internal processes including all contract management. As the pioneer in this area, DocuSign has been enabling that transformation.

From 54K customers at the end of FY13, the company had a total of 988K customers in Q1 of FY22. That is a Compounded Annual Growth Rate (CAGR) of 42%. Over 225K companies across 188 countries are now clients of the company. Needless to say, the company is laughing all the way to the bank.

1M Customers And Counting

DocuSign's quarterly results trounced expectations as travel restrictions continued to be enforced. Companies are adapting e-contracts and e-signatures as the principal way of conducting business, as yours truly can attest to, based on how the employment contract was managed 100% digitally.

Key Stats for Q1:

Revenue: $469.1M Vs $436.1M estimated

EPS: $0.44 Vs $0.28 estimated.

For the ongoing quarter, the company expects revenue of $482M (Vs. analyst projection of $473.7M) Full-year revenue is expected to top $2B for the first time. DocuSign is on a relentless customer signing spree. It recently added its millionth customer.

The geographic diversity of clients is top-of-the-mind for the company. As of last quarter, the international business contributed 21% to the total revenue - an 84% rise Y-o-Y. In terms of revenue, the company has effectively doubled in revenue over the last two years.

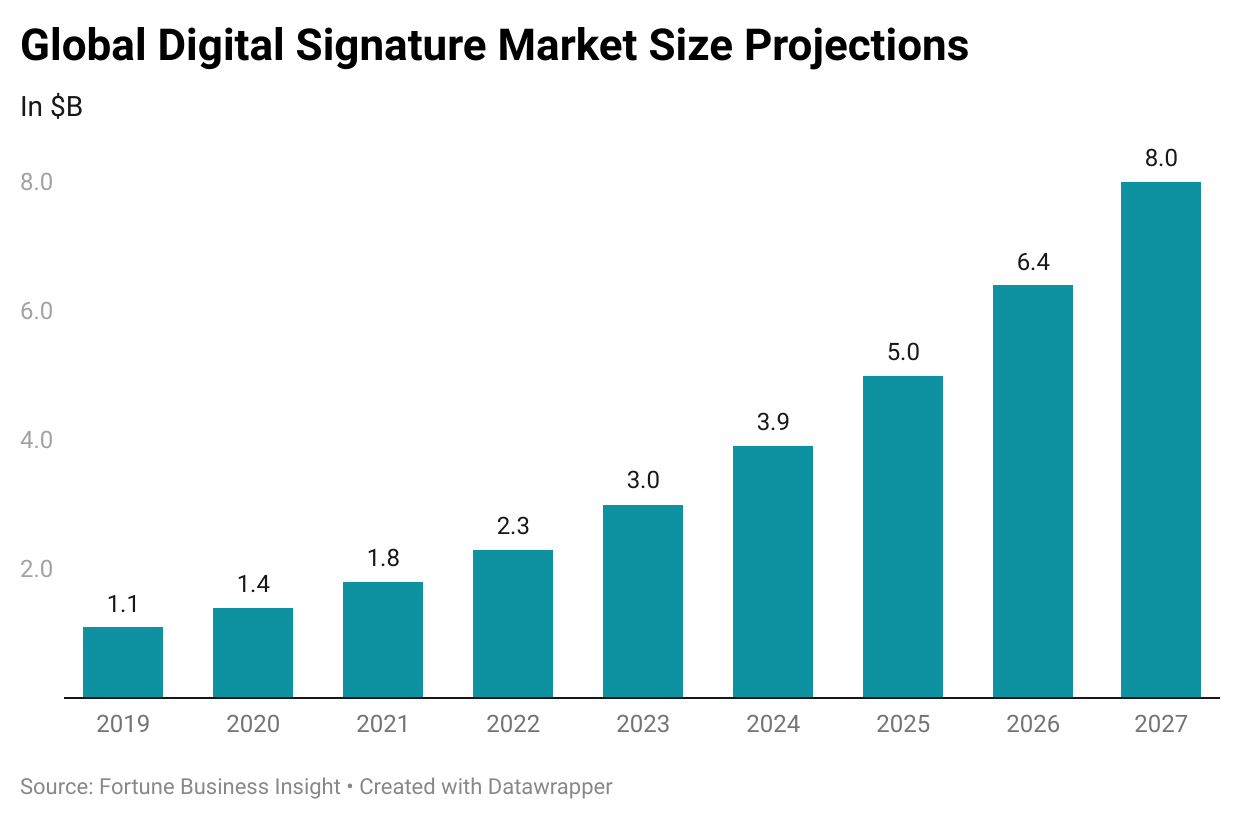

Even as vaccinations across the world pick up pace and travel restrictions ease, the expectation is that businesses will continue to move towards a future that minimizes usage of paper. The global eSignatures market is expected to grow at a CAGR of 28.9% until 2027 to $8B.

DocuSign looks well placed to maintain its growth momentum for the foreseeable future. It seems along with DocuSign, its investors are also laughing all the way to the bank. DocuSign shares have returned 6x in the three years since going public.

Market Reaction

DOCU ended the day at $233.24, up 19.76%.

Company Snapshot 📈

DOCU $233.24 +38.49 (19.76%)

Analyst Ratings (18 Analysts) BUY 83% HOLD 17% SELL 0%

Newsworthy 📰

U-Turn: Elon Musk says Tesla cancels the longest-range Model S Plaid+ (TSLA +4.58%)

Conditions: United Airlines will require new employees to show proof of Covid vaccination (UAL -1.39%)

Tapering Estimates: Zoom got workers through a pandemic. Now it needs a second act (ZM +5.33%)

Later Today 🕒

Marvel Technology Inc. Earnings (MRVL)

Vail Resorts Inc. Earnings (MTN)

UnitedHealth Group Inc. Earnings (UNH)

12:30 AM IST: Consumer Credit Data

Fun Fact of The Day 🌞

All employees at Amazon spend two days every two years working at the company’s customer service desk. This includes CEO Jeff Bezos.

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today.