💳 What Does The Swiping Bonanza Mean For Visa?

Amazon shares falls most since 2016.

Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Friday’s Close) 4,131.93 -155.57 (3.63%)

NASDAQ (Friday's Close) 12,334.64 -536.89 (4.17%)

FTSE 100 (5 PM IST) 7,544.55 +35.36 (0.47%)

NIFTY 50 (Today's Close) 17,069.10 -33.45 (0.20%)

USDINR (Today's Close) 76.51 (1 Year +3.26%)

🔥 Top Movers

VAXX +84.22%

BIOX +21.97%

CLW +20.62%

ACCD -49.87%

VERI -21.69%

IRMD -20.08%

💳 Visa: Swiping Bonanza?

The world's largest payments processor, Visa Inc. (V), threw slowdown fears out of the window with a strong quarterly performance. Credit-card spending was well above pre-pandemic levels despite the disruptions. It’s also planning to hike its rates soon. What will that mean for consumers?

Swipe Left and Right…

The US GDP had contracted 1.4% in the first quarter of the new year. Last month, economists predicted a 27.5% chance of a recession within the next year, which stood at 20% in March. Whatever the experts may believe, consumers have either turned a blind eye or a deaf ear to all of these predictions. And how?

The latest consumer spending data in the US showed that household spending rose 1.1% in March as spending on services like travel, dining, and goods like gasoline and food increased. The savings rate fell to the lowest in nine years, with some citizens tapping their savings to mitigate the rising costs.

This robust spending benefitted credit card companies like Visa, which managed to comfortably beat estimates in Q2, courtesy of strong growth in payment volumes, processed transactions, and cross-border volumes.

Key Highlights From Q2 FY2022:

Revenue: $7.2B Vs $6.9B expected

Earnings per Share: $1.79 Vs $1.65 expected

For the quarter, revenue was up 25% Y-o-Y (revenue grew in excess of 20% for the fourth straight quarter). Payments volume, on which the company's revenues are calculated, rose 17% from last year to $2.77T. Processed transactions during the quarter rose 19% Y-o-Y to 44.8B, although the number is lower than those in Q4 2021 and Q1 2022.

Cross-border volumes were up 38% from last year. Operating expenses partly offset the growth, which rose 11% Y-o-Y to $2.4B due to increased employee compensation and marketing.

How does this compare to the pre-pandemic period? Compared to the same quarter in 2019, payment volumes were up 135%, and volumes in the US were up 144%. In 2019, cash formed 59% of total payments, which fell to 46% this quarter. Travel demand shot through the roof.

Visa exited Russia after the country invaded Ukraine. This will impact revenue by 4%. The company has also offered to relocate all of its 210 employees based in Russia. Although Russians can continue to use Visa's branded cards to pay, the company no longer generates revenue as the cards don't rely on US systems to generate payments.

The management remains confident of making up for this downfall by growing elsewhere.

…Swipe Up & Down!

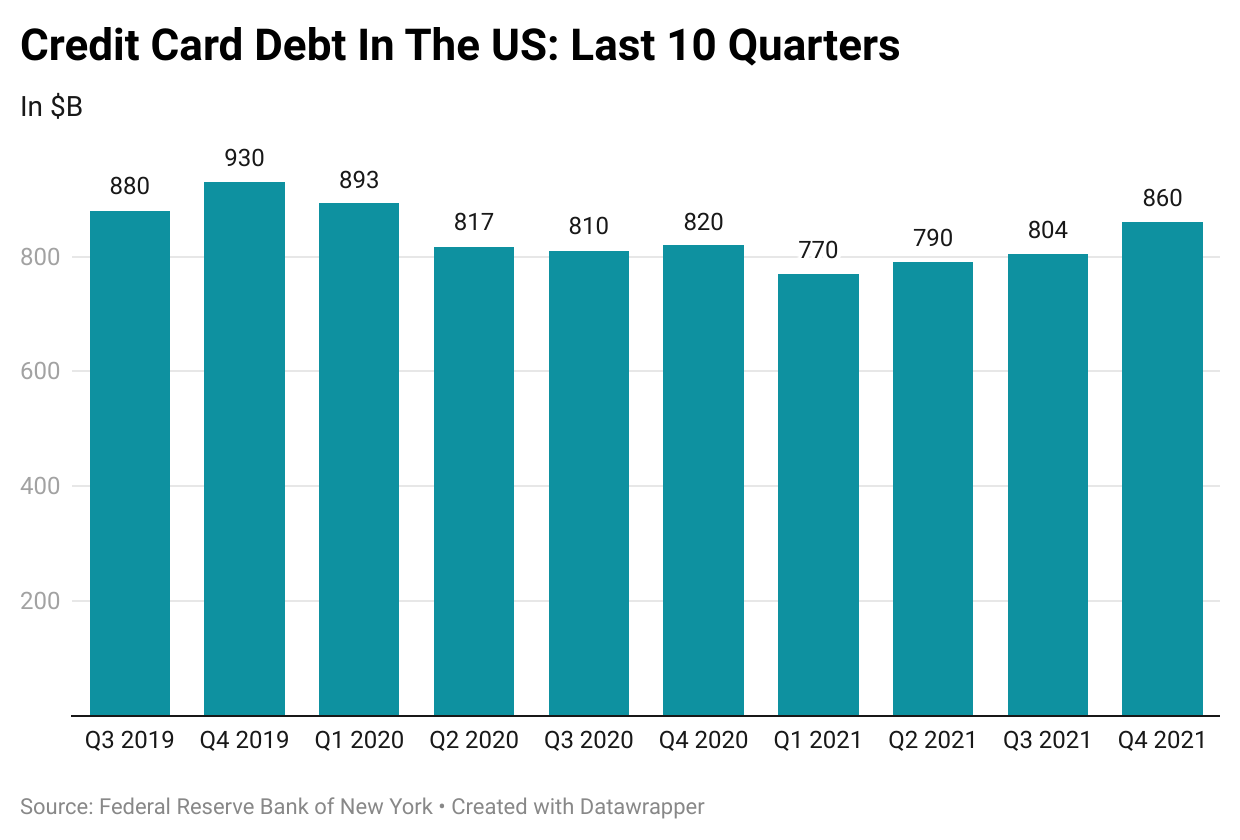

US online retail sales are set to hit $1T for the first time this year. With rising prices, the reliance on credit cards has only increased. Overall credit card balance rose by $52B in Q4 2021, the highest quarterly increase since data began to be tracked 22 years ago. If the Federal Reserve hikes interest rates by 50 basis points, that alone will add another $3.3B in interest payments this year.

So what do Visa and MasterCard decide? They will increase their credit-card swipe fees. These fees eventually get passed on to consumers as vendors hike their prices to cover these costs. The fees, which average 2.22% of transaction amounts for Visa & Mastercard, are the highest operating costs for most vendors after labor.

The hike in swipe fees was already deferred twice due to the pandemic and protests from retailers. A bipartisan group of four US Congress members has demanded that Visa and Mastercard not proceed with these hikes as they’ll enrich the companies by an additional $1.2B while putting the financial burden on vulnerable Americans.

To placate these elected representatives, Visa cut its rates for small businesses by 10% for more than 90% of the small businesses or those with $250K or less in credit card volumes. This is expected to benefit more than 838K small businesses in the US. This argument, however, cut no ice with the lawmakers.

Higher fees have been a perennial issue for Visa. It has been under litigation with Walmart over the last decade. Amazon has also threatened to stop accepting Visa Credit Cards issued in the UK due to high fees. A disaster for Visa was averted at the last minute after Amazon relented and paused a planned lockout of British Visa cards for Amazon purchases.

Investors cheered Visa's strong results, and shares rose 8% on Thursday before dropping 3.5% on Friday. The company wants to be everywhere you want to be, but so will the fees it charges its customers. So will customers balk at some point? Or will investors make merry as the customers become more inured? The swipe, it seems, has all the answers!

Market Reaction

V ended at $213.13, down 3.41%.

Company Snapshot 📈

V $213.13 -7.53 (3.41%)

Analyst Ratings (37 Analysts) BUY 89% HOLD 11% SELL 0%

Newsworthy 📰

Energy Boost: Exxon Mobil's first quarter profit rises even after $3.4B hit from Russia (XOM -2.24%)

Multifold Jump: Chevron's profit quadruples in the first quarter as higher oil & gas prices boost operations (CVX -3.16%)

Shocker: Amazon stock falls the most since July 2006 as loss rattles investors (AMZN -14.05%)

Later Today 🕒

The Clorox Co. Earnings (CLX)

Expedia Group Inc. Earnings (EXPE)

MGM Resorts International Earnings (MGM)

Apollo Global Management Inc. Earnings (APO)

Avis Budget Group Inc. Earnings (CAR)

Chegg Inc. Earnings (CHGG)

Coterra Energy Inc. Earnings (CTRA)

Devon Energy Corp. Earnings (DVN)

Moody's Corp. Earnings (MCO)

The Mosaic Company Earnings (MOS)

NXP Semiconductors NV Earnings (NXPI)

Spirit Airlines Inc. Earnings (SAVE)

The Timken Co. Earnings (TKR)

Trivago NV Earnings (TRVG)

Today's Fun Fact

88% of Millionaires in the US are Self-Made Entrepreneurs

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today.

Disclaimer: All content provided by Winvesta India Technologies Ltd. is for informational and educational purposes only and is not meant to represent trade or investment recommendations. Remember, capital is at risk. Terms & Conditions apply. See https://winvesta.in for details.

good app