🤔 Is US Steel Thinking Right?

Shell exits Permian; Robinhood tests crypto.

Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Monday's Close) 4,357.73 -75.26 (1.70%)

NASDAQ (Monday's Close) 14,713.90 -330.06 (2.19%)

FTSE 100 (4:30 PM IST) 6,986.30 +82.39 (1.19%)

NIFTY 50 (Today's Close) 17,562.00 +165.10 (0.95%)

USDINR (Today's Close) 73.67 (1 Year -1.81%)

🔥 Top Movers

AVIR +10.33%

BRKS +8.83%

ATRO +8.33%

PTGX -26.13%

NTP -23.58%

BTX -17.07%

🤔 US Steel: What’s The “X” Factor?

America’s second-largest steel producer - US Steel Corporation (X), announced a $3B investment to build a new steel plant. Ostensibly, this is to address the tight supply scenario in-country. But the question is, whether this is too little too late for US Steel, and has it missed the "super-cycle" bus? (Tweet This)

Commodity Craze

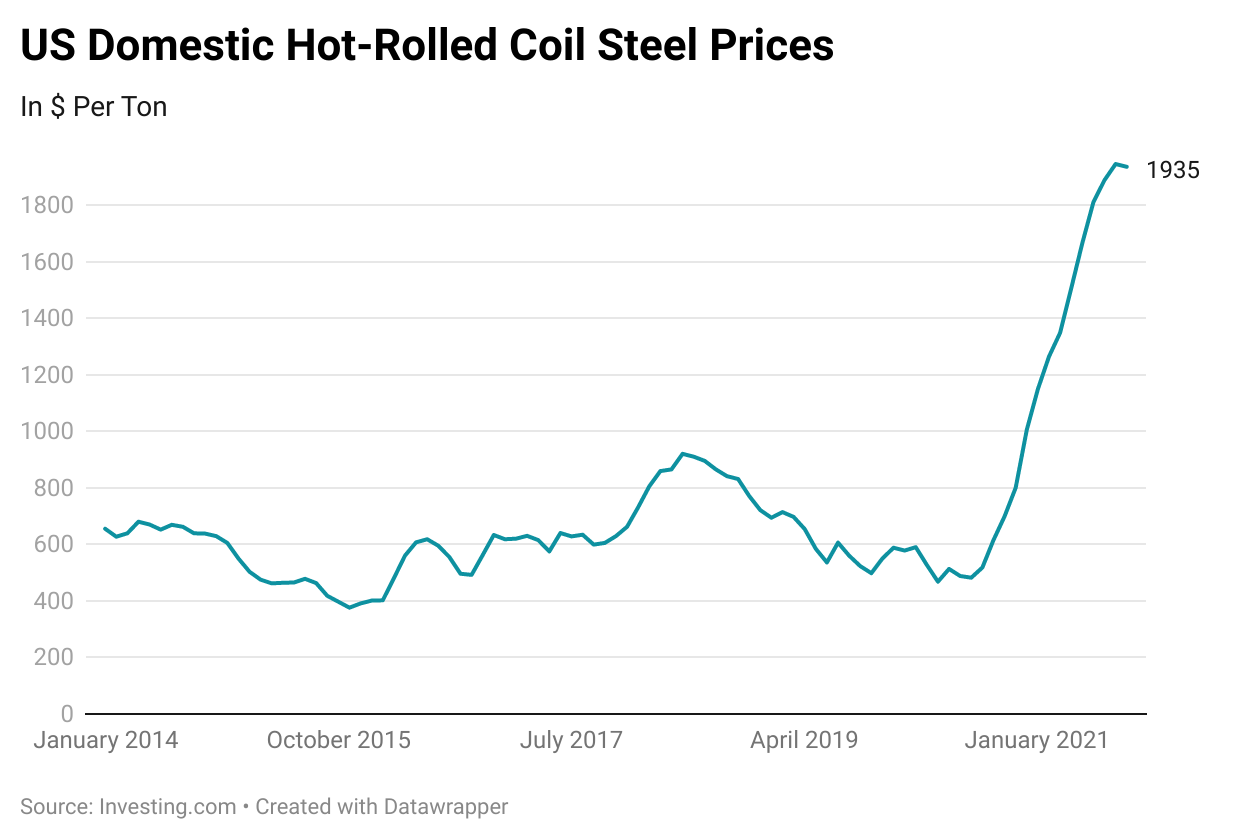

Steel is a crucial input into pretty much everything we take for granted: Refrigerators, ACs, automobiles, physical infrastructure… the list is endless. Prices were trading in a normal range in the pre-covid era, with demand-supply on an even keel. Then came the pandemic.

Fearful of a deep recession or, worse, even a depression, steel mills across the world shut down production during the early phase of the pandemic. The fears were grossly unfounded. Instead, the steel mills were caught entirely off guard by the high steel demand to their consternation.

Expectations of demand destruction gave way to unprecedented demand from every corner. Steel prices shot through the roof, industry players added capacity, and made acquisitions to no avail. To add fuel to the fire, China boosted its infrastructure spending while cutting down on metal production.

Hot-rolled steel price hit an all-time high of $1,945 per ton in August. That is a 270% jump compared to the price in March 2020. Shares of US Steel also made merry during that period, rising nearly 5x from the March low of ~$5.

Consolidation in the US steel sector meant two major players were vying for the top spot. One is our protagonist for today. The other is Cleveland-Cliffs, which acquired AK Steel for $1.1B and most of ArcelorMittal’s steel assets for $1.4B - both deals got done last year.

Steely Resolve

As they’re called, commodity supercycles are a period of continuous increase in commodity prices and signal economic growth. The most recent supercycle lasted four years between 2004-2007 - one of the best four-year periods in global GDP growth since World War II. During this period, global GDP grew at a CAGR of 5%, and prices of steel and other metals also crept up in tandem.

While the jury is still out on whether we’re currently in the middle of another supercycle, US Steel Corp seems to be waking up to the reality that steel prices are high enough to warrant new capacity to be coming online for the domestic market.

And so, the company announced a $3B steel plant that is to be funded by existing cash and free cash flow. The plant will have two state-of-the-art Electric Arc Furnaces (EAF). These are long-lead-time projects. Construction will begin in the first half of 2022, and production will commence in 2024.

Investors aren’t super convinced regarding the timing of the announcement, and questions abound: Why wasn’t this decision made for 1-½ years while prices have been on the upswing? By the time the plant comes online, what if prices revert to the mean? What if other players add new capacity in the interim? What might China do that may upend these plans? Is this too little too late?

Questions have been flying in all directions. The market isn’t convinced US Steel should take up an expansion by burning $3B in cash in the face of uncertainty regarding steel prices. And thus, the shares of US Steel have been pummeled ever since the announcement came out last Thursday.

Whether management will heed the signal that the market is sending or whether they have the steely resolve to see the project through is anyone’s guess. If they move forward and the calculus doesn’t work out, the 174% gain in the company’s stock price over the past year would be for nothing!

Market Reaction

X ended at $21.84, down 6.51%. Shares are down 14% in the last two sessions.

Company Snapshot 📈

X $21.84 -1.52 (6.51%)

Analyst Ratings (11 Analysts) BUY 46% HOLD 54% SELL 0%

Newsworthy 📰

Goodbye: Shell exits Permian with $9.5B Texas shale sale to ConocoPhillips (RDS.A +1.90%)

Trial: Robinhood testing crypto wallet, cryptocurrency transfer features (HOOD -3.96%)

Avenues: Peloton looks to commercial customers like hotel chains for new growth (PTON -2.60%)

Later Today 🕒

Adobe Inc. Earnings (ADBE)

FedEx Corp. Earnings (FDX)

AutoZone Inc. Earnings (AZO)

Neogen Corporation Earnings (NEOG)

Stitch Fix Inc. Earnings (SFIX)

6:00 PM IST: Current Account

Today's Market Terminology: Consolidation

Consolidation is the term for a stock that is neither continuing nor reversing a larger price trend. Consolidating stocks usually trade within a limited price range

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today.