Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Friday's Close) 4,662.85 +3.82 (0.08%)

NASDAQ (Friday's Close) 14,893.75 +86.94 (0.59%)

FTSE 100 (5 PM IST) 7,557.63 -53.60 (0.70%)

NIFTY 50 (Today's Close) 18,113.05 -195.05 (1.07%)

USDINR (Today's Close) 74.57 (1 Year +1.94%)

🔥 Top Movers

MLCO +16.60%

LVS +14.15%

ONTO +11.35%

FTCI -15.62%

RVLV -10.10%

CVAC -9.43%

Winvesta Insights: Episode 2

What do charts indicate for 2022? Hear all about it on the 2nd episode of Winvesta Insights, with Gaurav Bissa.

Listen to it here.

💾 TSMC: King Of Chips?

The world's most valuable semiconductor company. The first from Taiwan to list on the NYSE. Marquee set customers that include Apple, NVIDIA, Broadcom, and ARM. Taiwan Semiconductor Manufacturing Company (TSM) is in a rarefied group nowadays. Where does it go from here? (Tweet This)

Chips Ahoy!

TSMC has a global capacity of 13M 300 mm-equivalent wafers per year and manufactures chips with process nodes ranging from 2 microns to 5 nanometres. The company accounts for almost 5% of the total energy consumption of Taiwan, even higher than the capital city of Taipei!

The ubiquitous chip crunch has had its impact: delivery time has risen by six days to 25.8 weeks in December, compared to November. It’s the longest wait time since data is being tracked from 2017. Carmakers have lost $200B worth of sales in the quarter ending September. Apple lost $6B in sales due to component shortages. That number will only get worse in the holiday quarter.

This mayhem notwithstanding, TSMC has become the preferred chip manufacturer for tech and auto companies alike. With this great demand comes tremendous pressure to maintain its state-of-the-art facilities. TSM spent $17B in 2020 and $30B last year to withstand the ever-increasing chip demand.

Last April, it earmarked $100B over the next three years to increase capacity and support the manufacturing and R&D of advanced semiconductor technologies. New plants in Japan and Arizona are in the works. Setting up a facility in Europe is under discussion. In addition, TSM is working with suppliers such as Applied Materials to develop an advanced 3-nanometer processor.

Sky High Prospects!

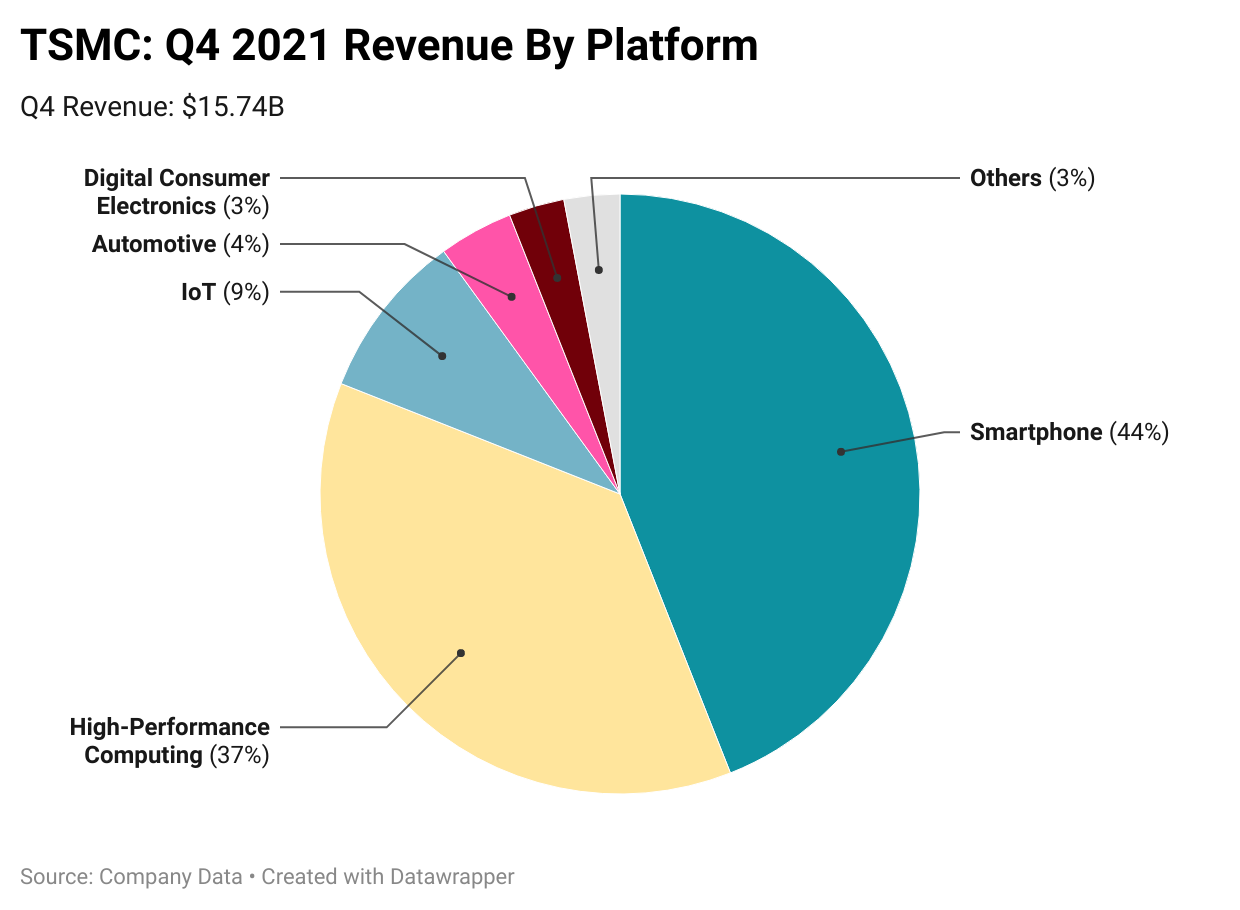

The incessant demand for chips and the shortage of raw materials meant TSM was operating at full capacity all of Q4. Needless to say, the company's financial performance surpassed all expectations.

Key Stats from Q4:

Revenue: $15.74B Vs $15.4B expected

EPS: $1.15 Vs $1.11 expected

Net Profit: $6B, up 16.4% Y-o-Y

TSM management expects capacity to remain tight this year and demand to sustain over the long term. However, this doesn't bode well for the many companies clamoring for chips. For Q1 2022, TSMC has projected revenue of ~$16.9B (Vs. $12.92B in the year-ago period). The gross margin is expected to be 53+%, compared to the previous forecast of 50+%.

So what happens when all these investments result in an oversupply of chips and demand falls? TSM remains unfazed. If anything, the company is banking on the increasing "silicon content" in tech gadgets and the EV mania to help it weather any kind of correction. In fact, the company raised its revenue CAGR targets over the next few years to 15%-20% from the earlier 10%-15%.

Just how desperate are companies for a piece of the chip pie? Enough that they're willing to prepay to stand in line when the chips roll off the assembly line. In 2021, prepayments amounted to $6.7B for TSM. Apple accounts for 25% of TSM's foundry revenue.

TSM is on track to spend ~$42B in 2022 to expand and upgrade capacity. That number is 40+% higher than the amount Intel expends to spend.

TSM is leaving no stone unturned to ensure it continues to blaze the trail, which used to be the domain of an also-ran like Intel. There's no doubt, the company is thoroughly enjoying its newfound power, is soaking it all in, and fortifying for the future. Shareholders are cheering the prospects, and why not? Semiconductor chips seem to have become the perennial "essential commodity!"

Market Reaction

TSM ended at $140.66, up 1.06%.

Company Snapshot 📈

TSM $140.66 +1.47 (1.06%)

Analyst Ratings (13 Analysts) BUY 85% HOLD 15% SELL 0%

Newsworthy 📰

Reach: Starbucks expands delivery services in China with Meituan tie-up (SBUX -2.23%)

Hike: Peloton is about to tack on hundreds of dollars in fees to its bike & treadmill, citing inflation (PTON -2.55%)

Caution: United Airlines warns 5G plans would impact 1.25M passengers a year (UAL -2.97%)

Later Today 🕒

Bank of America Corp. Earnings (BAC)

Charles Schwab Earnings (SCHW)

Goldman Sachs Earnings (GS)

PNC Financial Services Group Earnings (PNC)

Truist Financial Corp. Earnings (TFC)

Bank of New York Mellon Corp. Earnings (BK)

JB Hunt Transport Service Inc. Earnings (JBHT)

Signature Bank Earnings (SBNY)

Concentrix Corp. Earnings (CNXC)

Pinnacle Financial Partners Inc. Earnings (PNFP)

Interactive Brokers Group Inc. Earnings (IBKR)

Hancock Whitney Corp. Earnings (HWC)

Old National Bancorp Earnings (ONB)

Fulton Financial Corp. Earnings (FULT)

First Midwest Bancorp Inc. Earnings (FMBI)

Today's Market Terminology: Capital Infusion

Capital Infusion refers to the process whereby funds are injected into startups or ailing companies by an investor with a financial interest in the company. It can also be done from one unit of a company to another

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today. *Capital is at risk.