🧪 Is The Quidel-Ortho Deal Timing Questionable?

Meta fined; Crocs CEO defends deal.

Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Thursday's Close) 4,725.79 +29.23 (0.62%)

NASDAQ (Thursday's Close) 15,653.37 +131.48 (0.85%)

FTSE 100 (Thursday's Close) 7,372.10 -1.24 (0.01%)

NIFTY 50 (Today's Close) 17,086.25 +82.50 (0.49%)

USDINR (Today's Close) 74.97 (1 Year +1.75%)

🔥 Top Movers

SIM +22.25%

ALLK +22.22%

NKLA +17.98%

QDEL -17.35%

SCPL -12.80%

CROX -11.63%

🧪 Quidel: Questionable Timing?

Diagnostic healthcare products manufacturer Quidel Corporation (QDEL) is acquiring diagnostics company Ortho Clinical Diagnostics (OCDX). The cash and stock deal will value Ortho at $6B. However, the deal announcement sent underperforming shares of Quidel even lower. (Tweet This)

All About Diagnosing

Dr. David Katz founded Quidel in 1979. Its first products were launched in 1984. Quidel Corporation was created when it merged its operations with Monoclonal Antibodies in 1991.

Quidel's products cater to five verticals - infectious diseases and reproductive health, virology, bone and complement pathway markets, fluorescent immunoassay products, and molecular diagnostics products. Product lines QuickVue, Thyretain, new Sofia, and AmpliVue, have been instrumental in diagnosing many diseases such as Influenza, Strep A, Herpes, among others.

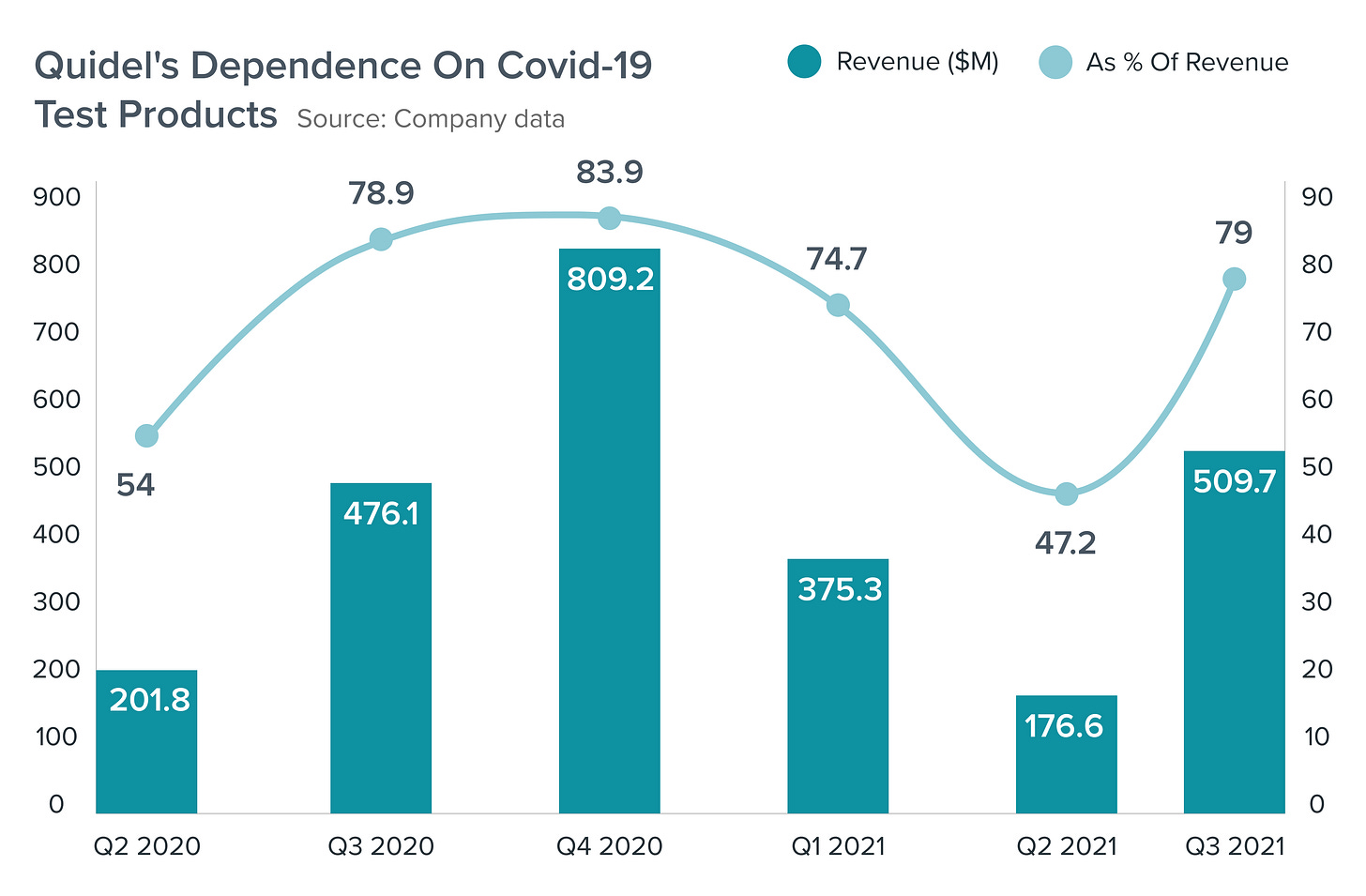

In May 2020, the USFDA issued its first Emergency Use Authorization (EUA) for Quidel's Covid-19 antigen test, a new category of tests. These diagnostic tests detect fragments of proteins found on or within the virus by testing samples collected from nasal swabs. Over the next 12 months, the Covid testing kit has become the primary contributor to the company's revenue.

For Q3 2021, the sale of Covid-19 products contributed to nearly 80% of its overall revenue. It also secured a 12-month agreement with the US government worth over $500M to supply QuickVue At-home OTC Covid-19 tests.

In today's story, the other protagonist is Ortho Clinical Diagnostics, which is into in-vitro diagnostics and diagnostic equipment for blood testing. Ortho was founded in 1939 as Ortho Products Inc. It got its current name after merging with Johnson & Johnson Clinical Diagnostics in 1997.

Ortho operates in two major segments - transfusion medicine involving screening human blood and the development & commercialization of instrument systems and reagents that screen blood for AIDS, Hepatitis, and Chagas disease.

The Carlyle Group acquired the company for $4.15B in 2014. It was taken public earlier this year, in January 2021. Ortho raised $1.3B in the IPO at $17 apiece. Shares are up 30% from its IPO price so far.

When Shareholders Aren't Convinced…

As Quidel looked to expand its reach globally, it evaluated acquisition opportunities earlier this year. The company was, in fact, in preliminary talks to acquire molecular test maker Qiagen. However, the discussions did not progress beyond the initial stage.

Last Thursday, Quidel announced the acquisition of Ortho for $6B, valuing the company at $24.68 per share, a 25% premium to its closing price on Wednesday. Quidel estimates the combined total addressable market for the companies is $50B. As of the September quarter, Quidel had cash balances worth $578.4M, and it expects that number to rise to $800M by the end of the year.

The deal will add Ortho's Covid-19 antigen and antibody tests to Quidel's portfolio, including the RT-PCR test. Just as demand seemed to be slowing down due to people getting vaccinated, the Omicron variant brought back the surge in demand for the RT-PCR test kits that pharmacy chains such as Walgreens and CVS Health couldn't cope with!

Quidel's management team is focused on the geographical footprint Ortho brings to the table with its presence in 130 countries. With estimated synergies of $90M, Quidel's CEO Doug Bryant plans to recast the combined entity as a global player with "top R&D capabilities, a more diverse product pipeline, and a broader geographical footprint."

YTD, before the deal announcement, Quidel's shares were down 12%. Shareholders didn't buy Bryant's optimism, and the shares fell a further 18% after the deal was announced. There may be a spike in sales now, but what about a few quarters hence? Bryant and the team didn't do any favors by refusing to give proper figures on the anticipated demand.

Ortho's shareholders were cheering the deal. Whatever the knee-jerk reaction may be, Quidel's team will be desperately hoping for a positive result in this test!

Market Reaction

QDEL ended at $137.39, down 17.35%. Shares are down 28% this year.

Company Snapshot 📈

QDEL $137.39 -28.85 (17.35%)

Analyst Ratings (03 Analysts) BUY 66% HOLD 34% SELL 0%

Newsworthy 📰

Guilty: Apple's App Store broke competition laws, says Dutch watchdog (AAPL +0.36%)

Penalty: Russia fines Meta Platforms 2 Billion roubles (FB +1.45%)

Concerns: Crocs CEO defends $2.5B Hey Dude acquisition as shares tumble (CROX -11.63%)

Today's Market Terminology: Accelerated Depreciation

Accelerated Depreciation is any depreciation method that produces larger deductions for depreciation in the early years of an asset's life

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today. *Capital is at risk.