🌫 Is Philip Morris Playing Russian Roulette?

Musk fears inflation headwinds for Tesla.

Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Friday's Close) 4,204.31 -55.21 (1.30%)

NASDAQ (Friday's Close) 12,843.81 -286.16 (2.18%)

FTSE 100 (5 PM IST) 7,170.77 +15.13 (0.21%)

NIFTY 50 (Today's Close) 16,871.30 +240.85 (1.45%)

USDINR (Today's Close) 76.54 (1 Year +5.45%)

🔥 Top Movers

SHLS +14.58%

AMPH +12.57%

BBAI +9.62%

POST -33.47%

YMM -26.00%

GDS -20.53%

🌫 Philip Morris: Playing Russian Roulette?

With the escalating conflict between Russia and Ukraine, companies beat a retreat by suspending their Russian operations. After maintaining the status quo for as long as feasible, the world’s largest cigarette company, Philip Morris Inc. (PM), has joined the bandwagon. What explains this behavior? (Tweet This)

Status Quo?

Accenture, Airbnb, Amazon, AMD, Apple, Mastercard, Visa are among the 300+ companies that have suspended business operations in Russia in the wake of the sanctions imposed on the country by the Western world. Even brands such as Coca-Cola, PepsiCo, Starbucks, and McDonald's eventually caved in to pressure and followed suit. Philip Morris is the latest entrant to the club.

Philip Morris' entered into a production agreement with the Soviet government back in the 1970s. The agreement saw local consumers benefit from brands like Marlboro and Apollo Soyuz for the first time. The company's first large-scale production factory in Russia came in 1993 when it acquired a controlling stake in the Krasnodartabakprom factory.

Philip Morris suspended operations in Ukraine last month - a factory that employed 1.3K people in an area that Russia has attacked. So what’s at stake here? Ukraine accounted for close to 2% of the total cigarette and heated tobacco unit shipment volume and under 2% of the total revenue. Basically, not much of an impact financially.

Russia is a different story altogether. For 2021, cigarette shipments to Russia fell to 52.5B units from 55.6B units in 2020. The percentage of total cigarette shipments fell to 8.4% from 8.8%. The company's market share in the Heated Tobacco Unit (HTU) space improved to 7.4% from 6.3% in Russia. Total HTU shipments also rose to 16.3B units from 13.6B units.

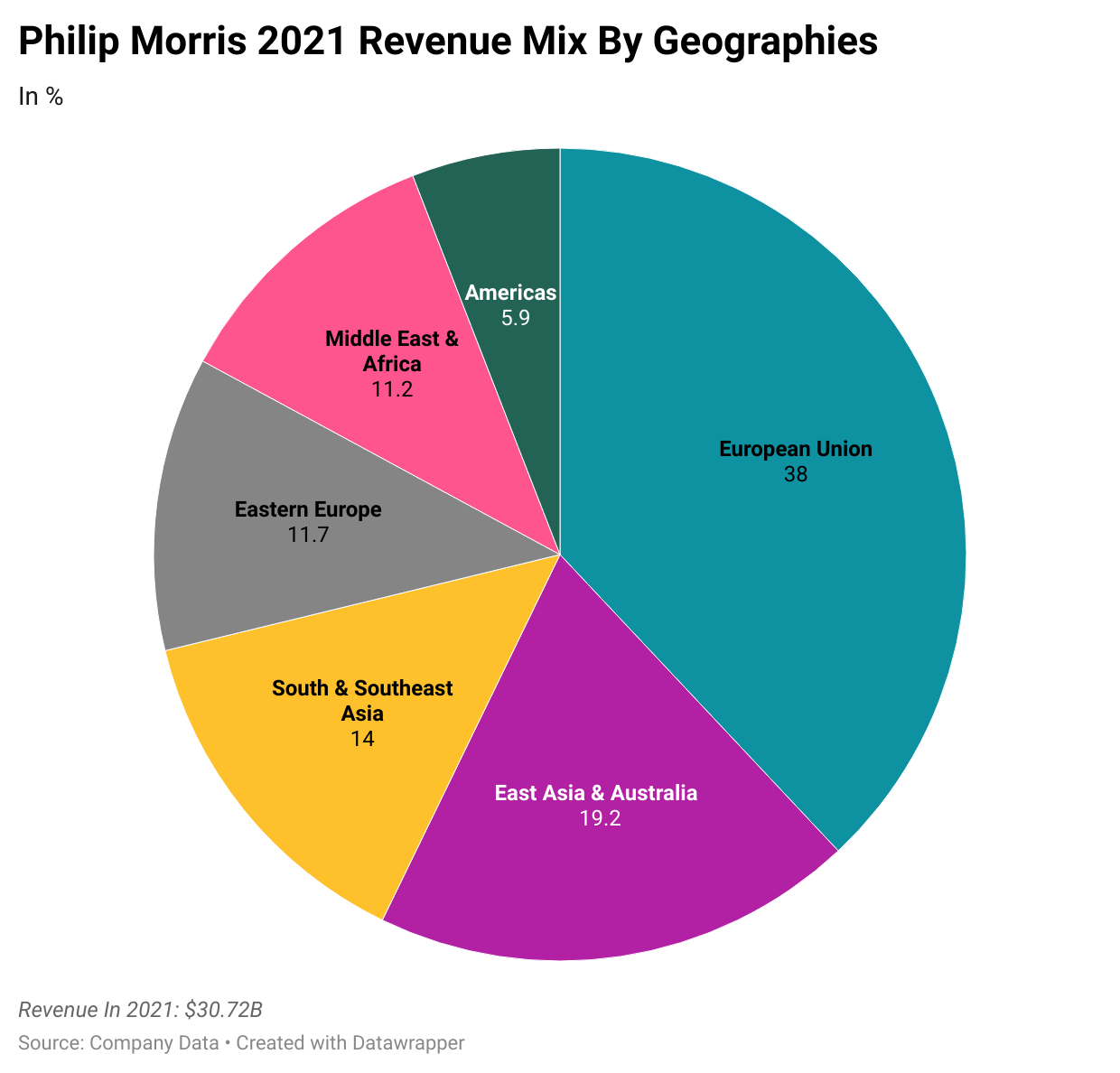

The company has over 4K employees across two factories in Krasnodar and St. Petersburg in Russia, along with 100 sales offices. In terms of the revenue, the company's exposure to Russia stands at around 8% of the overall topline or ~$2.5B, which potentially cannot be ignored. And so what did the company do? Maintain the status quo and try to stay under the radar.

Ethical Dilemmas

Only last week, Philip Morris announced the suspension of its planned investments in Russia, including all new product launches and manufacturing investments. It is also scaling down manufacturing operations in the country.

Philip Morris has been looking to reduce its reliance on the cigarette business. In 2014, the company launched the IQOS business (I Quit Ordinary Smoking). IQOS is a heated-tobacco system that produces nicotine-filled vapor without burning the tobacco leaf. It’s claimed this makes IQOS a significantly less harmful product than traditional cigarettes. Even the FDA termed IQOS as a "modified-risk" product.

Not surprisingly, IQOS is more profitable for Philip Morris than the ordinary cigarette - almost a 10% higher gross profit margin, to be precise. During the three quarters of 2021, IQOS contributed to 13% of the company's shipment volumes and nearly one-third of the revenue. It roughly has a total of 20.4M estimated IQOS users.

Philip Morris acquired the Vectura Group for $1.2B. Vectura focuses on inhalation and respiratory products. For a cigarette manufacturer to talk about respiratory health was the ultimate irony, according to activists who criticized the deal as a “sick joke.” The company was unperturbed, stating the deal as part of its strategy to develop and deliver inhaled therapeutics products in the long-term.

To fuel its “beyond nicotine” ambitions, Philip Morris also acquired OtiTopic, a US-based respiratory drug company, for an undisclosed sum. OtiTopic’s late-stage inhalable acetylsalicylic acid treatment for acute myocardial infarction is awaiting the FDA’s approval. It also acquired Fertin Pharma for $820M last September as part of a plan to offer smoke-free products such as nicotine pouches.

These overtures are unlikely to win over any of the skeptics who term these deals “eyewash.” That company had averred back in 1954 to "stop business tomorrow" if its products were harmful to consumers. In fact, the CEOs of America's seven largest tobacco companies in 1994 told the Congress, under oath, that they did not believe nicotine was addictive.

That apart, considering the fact that Russia and Ukraine make up for nearly 23% of the Philip Morris’ HTU sales and that growth in this segment is crucial for the company to meet its Next-Generation Products growth targets, the company can hardly exit Russia lock stock and barrel. That’s the reason for Philip Morris maintaining the status quo.

So will the company be able to meet its 2022 HTU guidance of shipping ~115B units? Uncertainty surrounding the war only means odds are these expectations will come under severe pressure.

Shares of Philip Morris are down 12% since the start of the month. Given the retreat from Russia, it will now have to look for alternate revenue sources to make up for the shortfall. Unfortunately, the Russian Roulette has only just begun, and there’s more yet to unfold.

Market Reaction

PM ended at $88.87, down 3.29%.

Company Snapshot 📈

PM $88.87 -3.02 (3.29%)

Analyst Ratings (18 Analysts) BUY 67% HOLD 33% SELL 0%

Newsworthy 📰

Allegations: CVS fires several employees and executives after internal sexual harassment probe (CVS -0.59%)

Warning: Musk says Tesla, SpaceX see significant inflation risks (TSLA -5.12%)

Reward: Insurer AIA launches $10B buyback on strong 2021 growth (AIA +4.31%)

Later Today 🕒

Coupa Software Inc. Earnings (COUP)

Vail Resorts Inc. Earnings (MTN)

8:30 PM IST: Inflation Expectations

Today's Market Terminology: Targeted Repurchase

A targeted repurchase is buying back a firm's stock from a potential acquirer, usually at a substantial premium to forestall a takeover attempt

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today. *Capital is at risk.