🏩 Is Hyatt's Acquisition Of ALG The Panacea It Seeks?

Lowe's confidence; Marlboro-maker buys stake in asthma firm.

Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Wednesday's Close) 4,400.27 -47.81 (1.07%)

NASDAQ (Wednesday's Close) 14,525.91 -130.27 (0.89%)

FTSE 100 (4:30 PM IST) 7,027.76 -141.56 (1.97%)

NIFTY 50 (Wednesday's Close) 16,568.85 -45.75 (0.28%)

USDINR (Wednesday's Close) 74.25 (1 Year -1.15%)

🔥 Top Movers

ALC +12.19%

NRXP +11.79%

VIR +10.54%

TUYA -18.97%

CRMT -18.60%

PCVX -14.76%

🏨 Hyatt Hotels: A For Apple; L for Leisure?

Listen to this on Winvesta Podcast

US-based hotel operator Hyatt Hotels Corp (H) has signed a deal to buy Apple Leisure Group from its private equity owners for $2.7B in cash. The deal will instantaneously expand Hyatt's European presence by 60%. Hyatt is betting on Covid-weary leisure travelers to Europe to bring in the revenue. (Tweet This)

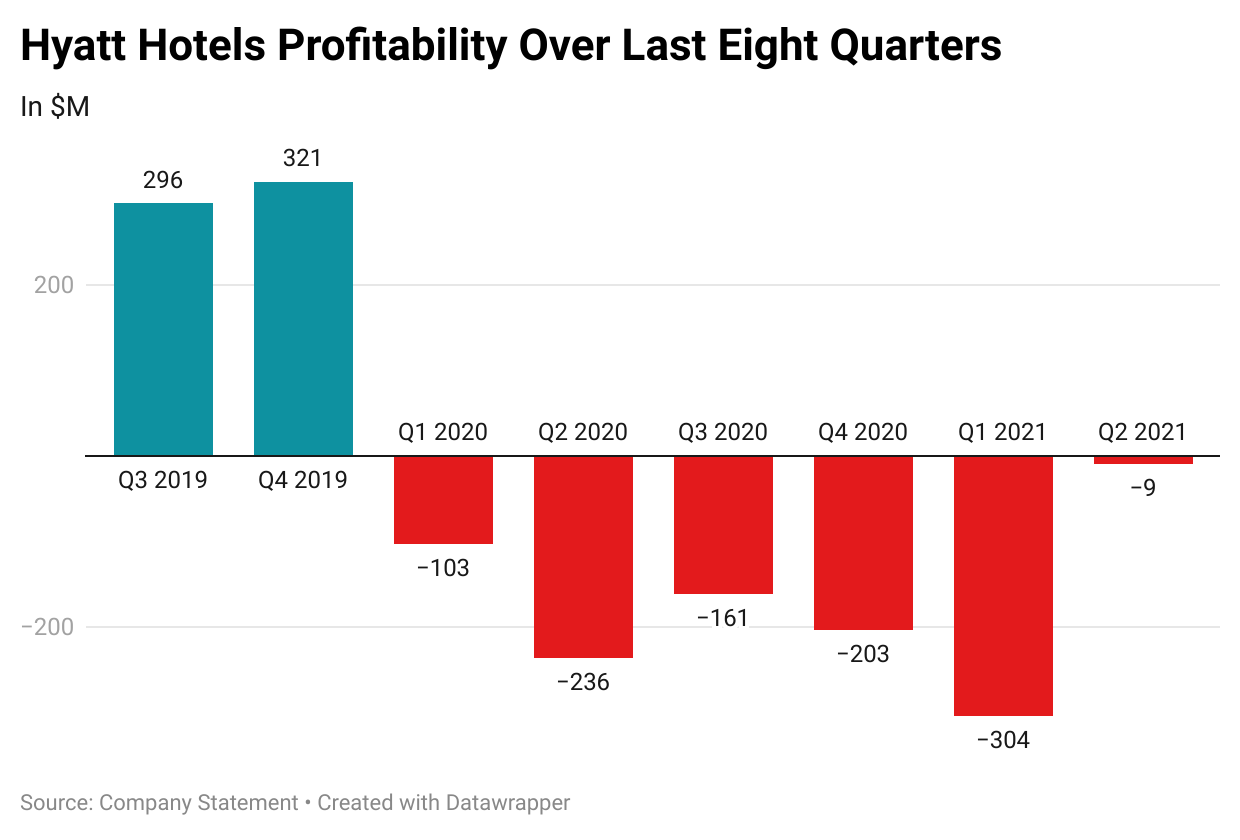

Pandemic Checks In; People Check Out

Hospitality and Aviation were the most impacted sectors when the pandemic hit in early 2020. People’s canceled travel plans meant a severe downturn in these sectors, with the global curbs on travel effectively erasing any hopes of a revival during the holiday season.

Hyatt, along with its brethren, witnessed dropping revenues while operating costs remained more or less constant. To stem the bleeding, Hyatt laid off over 1K employees globally in May last year and explored restructuring its debt.

Vaccination became the Mantra for Hyatt - and the broader industry - as they sought a return to profitability. In December, Hyatt even announced plans to grow its European portfolio by 30% through 2023. Cities such as London, Prague, Lisbon, Helsinki, Reykjavik, and Edinburgh saw the addition of new Hyatt properties.

With businesses turning to video calls rather than in-person meetings, leisure travel was the segment Hyatt was hinging its hopes on. The management also focused on Europe for its expansion as hotels there saw a lesser drop in value than the US during the pandemic. As such, Apple Leisure seemed to fit the bill quite well for Hyatt.

Becoming The Big Fish

Apple Leisure Group was acquired by private equity owners KKR & Co. and KSL Capital Partners in 2017 for an undisclosed sum. The following year, Hyatt acquired Two Roads Hospitality for ~$400M. After a 3-year hiatus, Hyatt is adding Apple Leisure to its portfolio for $2.7B.

From 9 resorts in 2007, Apple Leisure’s portfolio grew to 100 properties this year with over 33K rooms across 10 countries. 24 other deals are in the pipeline, with several hotels being currently developed.

The acquisition will see Hyatt:

Doubling its global resort footprint;

Having the largest portfolio of luxury all-inclusive resorts in the world;

Becoming the largest operator of luxury hotels in Mexico and the Caribbean; and,

Expanding its European footprint by 60%.

In addition to this, Hyatt will also foray into 11 new European markets courtesy of ALG's properties.

Hyatt expects the Apple Leisure acquisition to close by the end of the year. The company is also committed to selling real estate worth $3.5B by 2024 as it shifts to a fee-driven business model. It expects Apple Leisure’s asset-light business to propel it further in this direction.

The plans are in place. Now Hyatt just needs people to show up at its resorts! As the pace of vaccinations rises and countries begin to open their borders, the expectation is for people to spend that extra buck for personal safety instead of going for budget hotels.

Hyatt’s shares are yet to turn positive for the year. The company and its shareholders are fervently hoping this deal has everything that’ll push travelers to check into its hotels and light the fire of optimism in its languishing stock price.

Market Reaction

H ended at $70.41, down 1.39%.

Company Snapshot 📈

H $70.41 -0.99 (1.39%)

Analyst Ratings (18 Analysts) BUY 5% HOLD 90% SELL 5%

Newsworthy 📰

Upwards: Lowe's CEO says profitability will rise as retailer speeds up fridge, washing machine deliveries (LOW +9.59%)

Order: Policy groups ask Apple to drop plans to inspect iMessages, scan for abuse images (AAPL -2.55%)

Irony: Marlboro maker Philip Morris buys stake in British asthma inhaler firm (PM -7.09%)

Later Today 🕒

Applied Materials Inc. Earnings (AMAT)

Ross Stores Inc. Earnings (ROST)

Tapestry Inc. Earnings (TPR)

Kohl's Corporation Earnings (KSS)

6:00 PM IST: Initial Jobless Claims

Fun Fact of The Day 🌞

Bimbo is a brand of soft drink manufactured and marketed by Coca-Cola Inc.

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today.