🧪 Is DuPont’s Strategy On Point?

Moderna tanks; Chip sales boost Qualcomm.

Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Thursday's Close) 4,680.06 +19.49 (0.42%)

NASDAQ (Thursday's Close) 15,940.31 +128.72 (0.81%)

FTSE 100 (4:30 PM IST) 7,316.64 +36.73 (0.50%)

NIFTY 50 (Thursday's Close) 17,916.80 +87.60 (0.49%)

USDINR (Wednesday's Close) 74.50 (1 Year -0.76%)

🔥 Top Movers

SAVA +48.96%

KROS +27.69%

NKLA +21.48%

LSPD -27.90%

QRTEA -27.39%

PENN -21.08%

🧪 DuPont: Crystal Clear Strategy?

DuPont de Nemours Inc. (DD), one of the world's largest chemical companies, is acquiring engineering materials maker Rogers Corp. (ROG) for $5.2B in cash. DuPont's quarterly results also beat street estimates even as the company lowered its guidance. Shareholders didn't really mind it! (Tweet This)

Eye On The Future

In December 2015, E.I. du Pont de Nemours and Co., also known as DuPont, announced a merger of equals with Dow Chemical Company in an all-stock deal. The combined company, DowDuPont, was valued at $130B.

DowDuPont then de-merged into three independent, publicly traded companies. The agricultural business was hived into Corteva Agriscience; the materials science business became Dow, and the specialty products unit was carved into DuPont.

DuPont consists of the Nutrition & Health, Industrial Biosciences, Safety & Protection, and Electronics & Communications divisions. It also included Dow's Electronic Materials business. Today, DuPont's market cap is ~$37B.

DuPont has been eyeing the fast-growing industries such as Electric Vehicles, 5G, and Clean Energy and is trying to position itself as a supplier in this space. In fact, in July, DuPont bought Laird Performance Materials for $2.3B from PE firm Advent International. Laird specializes in advanced electronic materials for autonomous vehicles.

Here's where Rogers Corporation comes in. Founded in 1832, Rogers consists of two business segments - Advanced Electronic Solutions and Elastomeric Material Solutions - both important for EV and 5G industries and a crucial part of DuPont's strategy.

The deal values Rogers at $277 per share, which is a 33% premium to the company's closing price on Monday. The transaction is expected to be completed in Q2, 2022, subject to regulatory and shareholder approvals. Rogers will be integrated into DuPont's Electronics & Industrial business unit.

This deal also adds another feather in the cap of DuPont's CEO Ed Breen, who is credited with the mega Dow-DuPont merger and the subsequent split of the combined entity into three independent companies.

Organizing And Reorganizing

Alongside this acquisition, DuPont is jettisoning most of its Mobility and Materials business, which manufactures polymers and resins for vehicles. The company had also entered into a 50-50 JV with Japan's Teijin Films. The JV became one of the leading polyester films producers used to produce insulating material, flexible packaging, food contact packaging, etc.

DuPont's stake in the JV is also on the block. With the company singularly focusing on high-growth, high-value opportunities in sectors that have long-term growth trends, these decisions make sense.

The Mobility and Materials business is on track to generate $4.2B in sales this year. Divesting of this unit should take place by the end of 2022. Breen reiterated that DuPont is evaluating a couple of other targets as it works to maximize its capabilities.

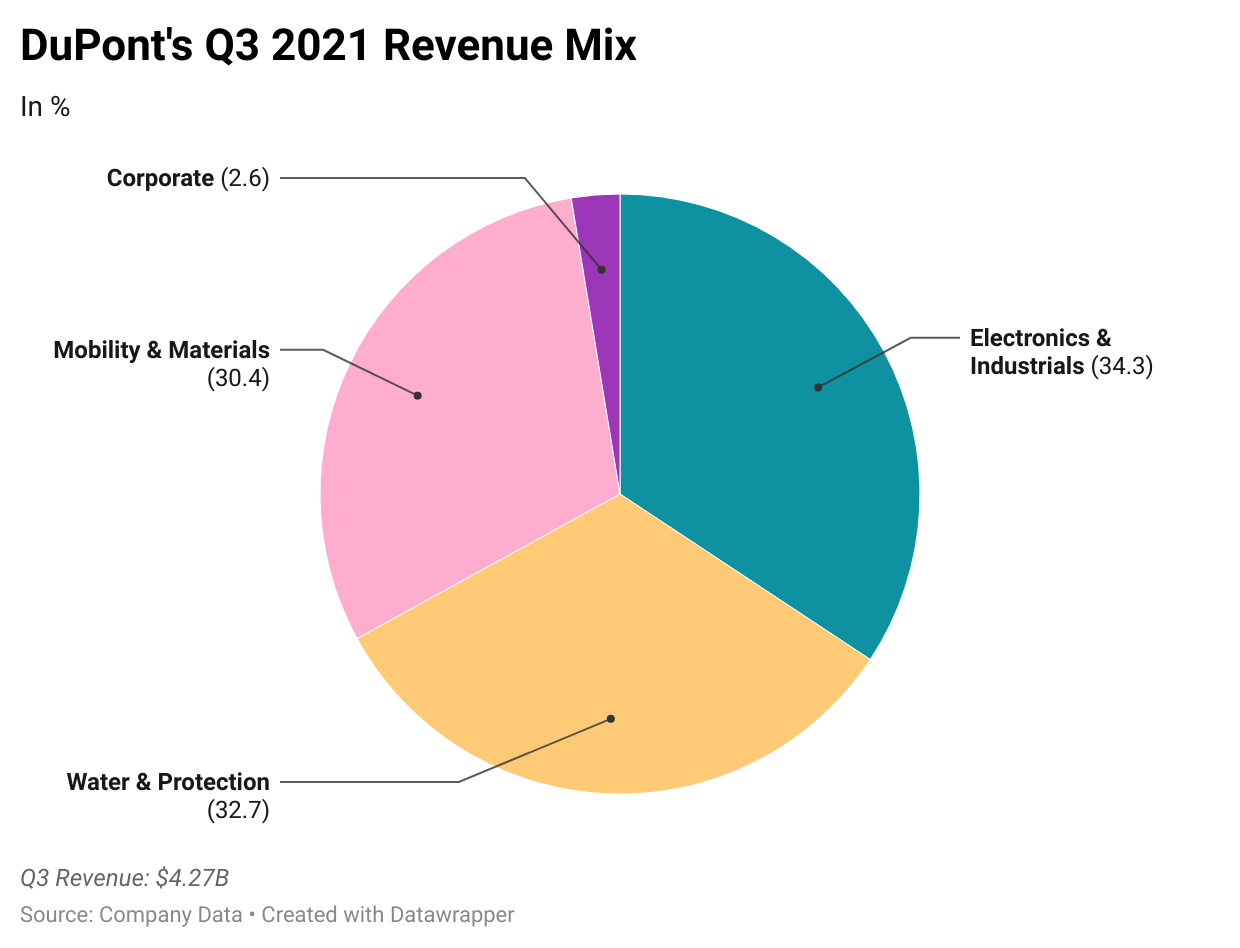

Deals apart, DuPont also declared its quarterly results this week, which beat analyst expectations.

Key Stats From Q3:

Revenue: $4.3B Vs $4.1B expected

EPS: $1.15 Vs $1.12 expected

However, the company marginally cut its full-year revenue and EPS guidance. It expects the top line to come in around ~$16.37B compared to earlier guidance of ~$16.5B. EPS expectations were cut to ~$4.20 per share from ~$4.27 per share earlier.

The culprit for the lower guidance? A slowdown in orders is tied to the global semiconductor shortage, which is expected to persist well into 2022. Shareholders didn't pay attention to the guidance and deliriously cheered the deal.

With its crystal clear strategy serving as the magical adhesive that binds all stakeholders, DuPont is setting itself up for long-term growth. Now it all boils down to execution!

Market Reaction

DD ended at $79.51, down 0.80%. This is after Wednesday's 8% surge. Shares are up 13% this year.

Company Snapshot 📈

DD $79.51 -0.64 (0.80%)

Analyst Ratings (23 Analysts) BUY 69% HOLD 31% SELL 0%

Newsworthy 📰

Downgrade: Moderna shares fall after company cuts 2021 forecast for Covid vaccine sales (MRNA -17.89%)

Boost: Qualcomm reports earnings beat led by 56% rise in smartphone chip sales (QCOM +12.73%)

Turnaround: Airbnb revenue surges as countries open up for vaccinated travelers (ABNB +3.23%)

Later Today 🕒

Berkshire Hathaway Inc. Earnings (BRK.A)

Dominion Energy Inc. Earnings (D)

Johnson Controls International Plc. Earnings (JCI)

Magna International Inc. Earnings (MGA)

Ventas Inc. Earnings (VTR)

Draftkings Inc. Earnings (DKNG)

Cardinal Health Inc. Earnings (CAH)

Goodyear Tire & Rubber Co. Earnings (GT)

AMC Networks Inc. Earnings (AMC)

Interface Inc. Earnings (TILE)

Opendoor Technologies Inc. Earnings (OPEN)

Today's Market Terminology: Board Lot

A Board Lot is a standard trading unit defined by the exchange board. A lot size usually depends on the price per share. Common board lot sizes are 50, 100, 500, and 1,000 units

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today. *Capital is at risk.