🥤 Is Coca-Cola’s Largest Deal Its Body Armor?

Unrest at Kellogg's; Hertz announces share offering.

Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Wednesday's Close) 4,660.57 +29.92 (0.65%)

NASDAQ (Wednesday's Close) 15,811.58 +161.98 (1.04%)

FTSE 100 (4:30 PM IST) 7,259.00 +10.11 (0.14%)

NIFTY 50 (Tuesday's Close) 17,829.20 -59.75 (0.33%)

USDINR (Tuesday's Close) 74.50 (1 Year -0.76%)

🔥 Top Movers

IRTC +59.01%

BXC +31.46%

VRTV +29.71%

PLTK -23.04%

ZG -22.93%

RCKY -21.96%

🥤 Coca-Cola: The Armor Of God?

Beverage maker Coca-Cola Co. (KO) announced the complete acquisition of sports drink maker Bodyarmor for $5.6B on Monday. With the deal, Coca-Cola hopes to strengthen its sports drink portfolio against market leader Gatorade. This is also Coca-Cola's biggest acquisition to date. (Tweet This)

Fizzling Of The Fizz

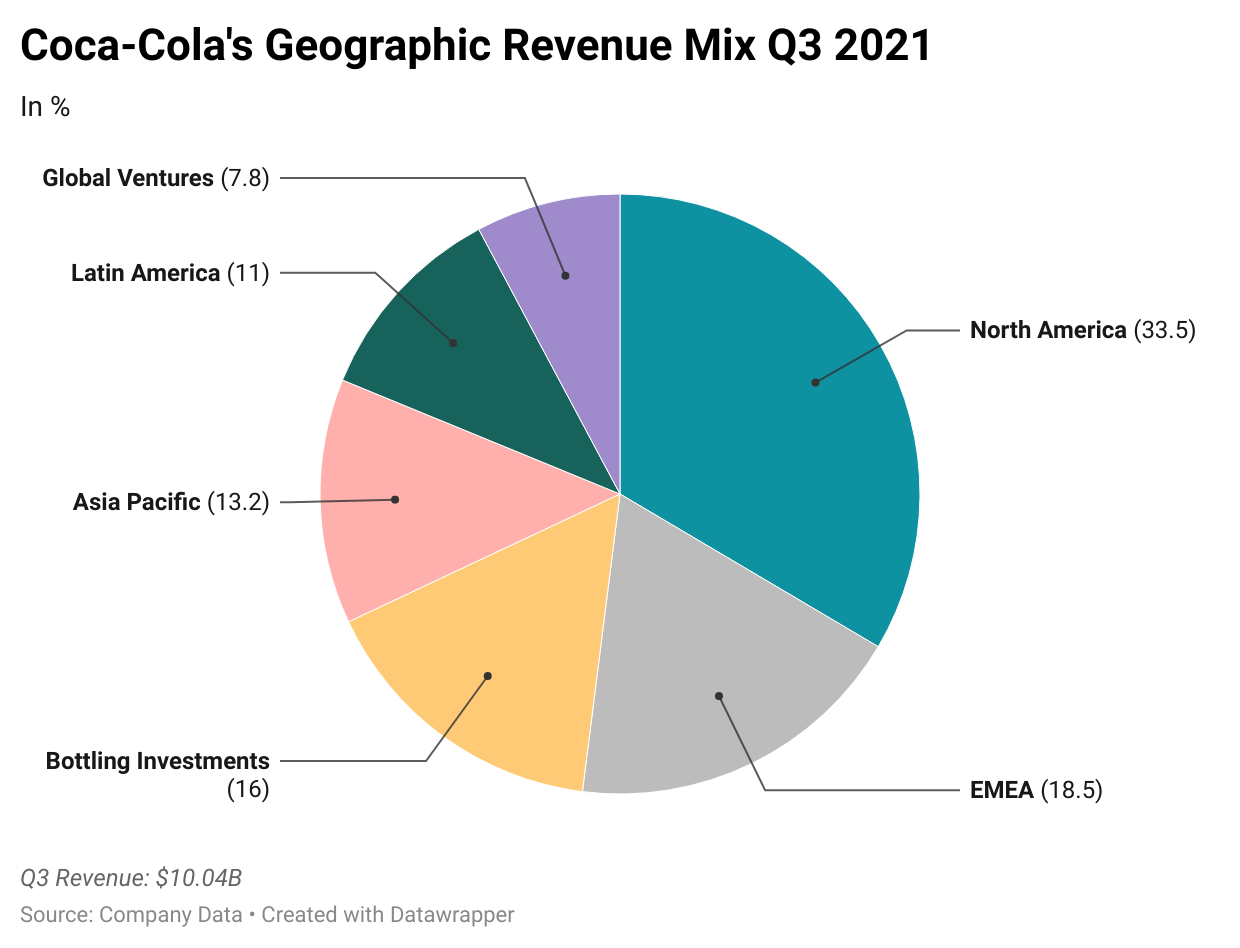

During the first phase of Covid in the US, Coca-Cola reported a 33% decline in Q2 earnings last year. Global unit case volume fell 16%. Revenue from its core business fell 26% during that period. In other words, Coca-Cola had a tough time during the pandemic.

In August 2020, the company undertook a massive restructuring exercise to cut costs. Nine new divisions replaced the 17 existing business units to eliminate duplication of resources. The company also offered voluntary layoff packages to eligible employees, expected to cost $350M to $550M.

There was also a complete review of the product portfolio to weed out non-performing products. The diet soda brand "Tab" was the first to be axed. Then came Zico Coconut Water which was sold back to its founder Mark Rampolla's PowerPlant Ventures, for an undisclosed sum.

This was followed by the elimination of Coca-Cola Life, Coca-Cola Energy, and Diet Coke Feisty Cherry. Regional brands like Northern Neck Ginger Ale and Delaware Punch also faced the music.

Coca-Cola doubled down on focusing on bigger brands and supply chain to combat further potential disruptions. It zeroed in on sparkling flavours, hydration, nutrition, juice, and other emerging categories with solid growth opportunities.

Along came Bodyarmor SuperDrink, which was founded in 2011 by Lance Collins and Mike Repole. Lance was the founder of Fuze Beverages and NOS Energy Drink. Mike had established VitaminWater and SmartWater. Bodyarmor positioned itself as an electrolyte-filled energy recovery drink for athletes.

Bodyarmor hit the jackpot when Basketball superstar, late Kobe Bryant, invested $6M in the company and joined its board of directors in 2014. That was enough for the company to get on the radar of Coca-Cola, which was desperate to find an answer to Gatorade. In 2018, Coca-Cola acquired a 15% stake in Bodyarmor, making it the second-largest shareholder.

Fortifying Itself With The Armor

Now that Coke cleared the clutter in its product portfolio, it was ready to take the next step. In February this year, Coke filed a pre-acquisition filing with the Federal Trade Commission, stating that it intends to buy a controlling stake in Bodyarmor later this year. That came to fruition this week.

Coca-Cola paid $5.6B in cash for the remaining 85% stake, making it the company's largest acquisition to date. The deal values Bodyarmor at $6.6B. Until then, Coke's largest acquisition was that of Costa Coffee, for which it paid $5.1B in 2018. Kobe Bryant's estate will receive ~$400M from its stake sale.

Bodyarmor has annual retail sales of $1.4B with a 50% growth rate, giving Coke some much-needed heft in the energy drinks market. The combined entity will have only 23% of the sports drink market, well behind Gatorade's 68% after this deal. As part of the deal, Bodyarmor co-founder Mike Repole will assist Coke with its still beverages portfolio.

Shares of Coca-Cola have risen 6.7% this year and have underperformed its arch-rival Pepsi (which rose 14%). Shareholders are hopeful this deal infuses Coca-Cola with the fizz it desperately needs both in its product portfolio as well as its financial performance. Say "Yes!" to effervescence!!

Market Reaction

KO ended at $56.29, up 0.34%. Shares are up 6.7% this year.

Company Snapshot 📈

KO $56.29 +0.19 (0.34%)

Analyst Ratings (28 Analysts) BUY 57% HOLD 43% SELL 0%

Newsworthy 📰

Unrest: Kellogg's US cereal plant workers reject revised offer (K +1.30%)

Funds: Hertz announces 37.1M share offering by stockholders (HTZZ -9.30%)

Demand: CVS Health beats on earnings, gets lift from Covid vaccines and prescription volumes (CVS +5.69%)

Later Today 🕒

Moderna Inc. Earnings (MRNA)

Novavax Inc. Earnings (NVAX)

Square Inc. Earnings (SQ)

Airbnb Inc. Earnings (ABNB)

Uber Inc. Earnings (UBER)

Pinterest Inc. Earnings (PINS)

Peloton Interactive Earnings (PTON)

Duke Energy Corp. Earnings (DUK)

Cigna Corp. Earnings (CI)

Becton Dickinson & Co. Earnings (BDX)

Regeneron Pharmaceuticals Inc. Earnings (REGN)

Fidelity National Information Services Inc. Earnings (FIS)

Air Products & Chemicals Inc. Earnings (APD)

Southern Co. Earnings (SO)

Cloudflare Inc. Earnings (NET)

Fortinet Inc. Earnings (FTNT)

American International Group Inc. Earnings (AIG)

Monster Beverage Corp. Earnings (MNST)

Microchip Technology Inc. Earnings (MCHP)

Liberty Broadband Corp. Earnings (LBRDA)

Expedia Group Inc. Earnings (EXPE)

Kellog Co. Earnings (K)

Dropbox Inc. Earnings (DBX)

Today's Market Terminology: Moving Average

It refers to the average price per unit of an equity share with respect to a specific period of time. Some popular time frames used to study the moving average of a stock include 50- and 200-day moving averages

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today. *Capital is at risk.