🛍️ Is Brookfield Set To Grow Through Insurance?

AMC's deal with Warner Bros.; MCD under antitrust probe.

Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Monday's Close) 4,432.35 -4.17 (0.09%)

NASDAQ (Monday's Close) 14,860.18 +24.42 (0.16%)

FTSE 100 (5 PM IST) 7,131.42 -1.53 (0.02%)

NIFTY 50 (Today's Close) 16,280.10 +21.85 (0.13%)

USDINR (Today's Close) 74.36 (1 Year -0.96%)

🔥 Top Movers

GNOG +50.77%

CRTX +47.32%

VRTV +19.21%

AXSM -46.50%

BLUE -27.45%

EPIX -16.61%

📄 Brookfield: Ensuring Growth Through Insurance?

Listen to this on Winvesta Podcast

Brookfield Asset Management's (BAM) reinsurance unit is buying American National Group Inc. (ANAT) for $5.1B in cash. That's a 10% premium to Friday's $190 per share closing price for American National. Does this signal a return to normalcy for the insurance sector that’s been clobbered by the pandemic? (Tweet This)

Spreading The Insurance Cover

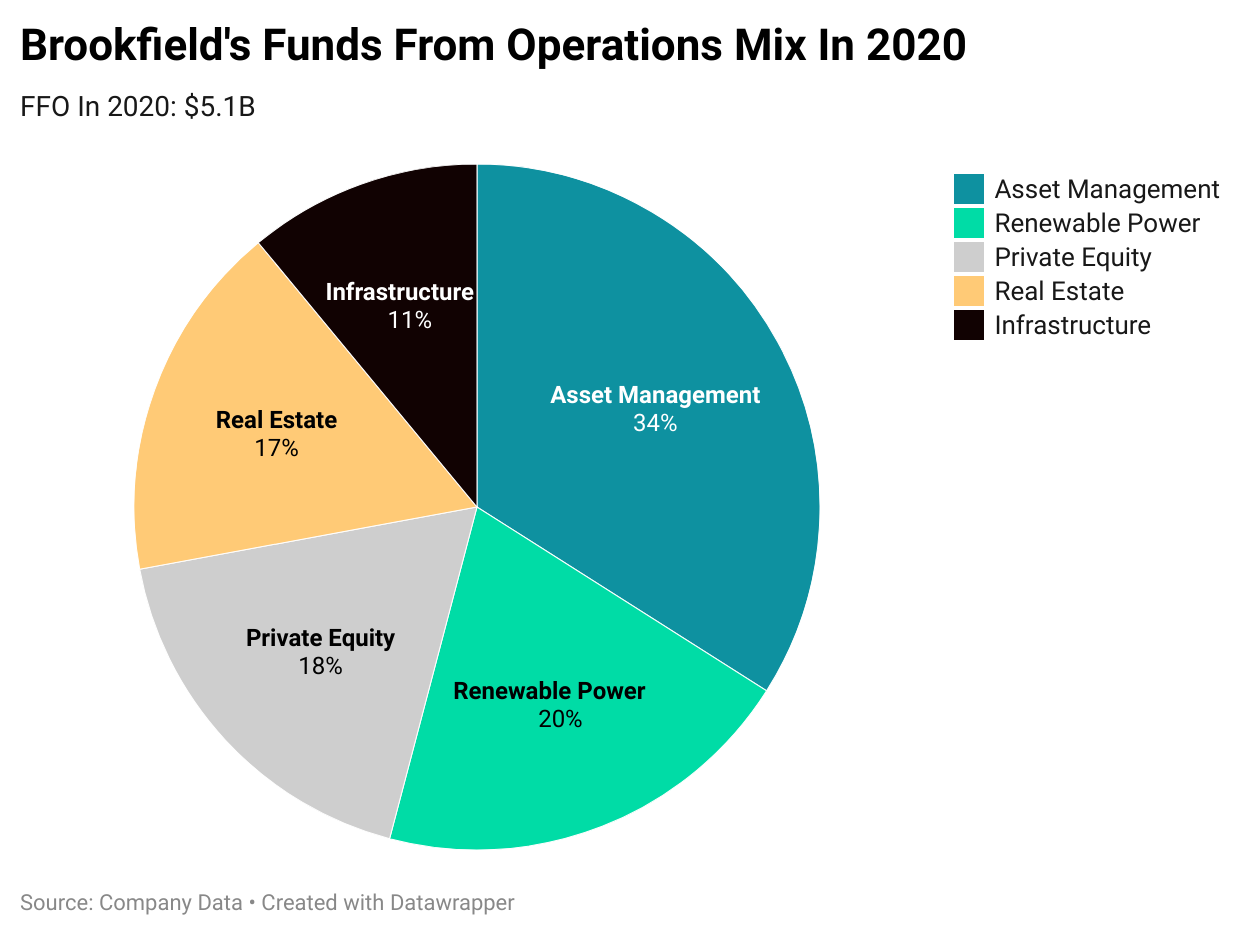

Brookfield is one of the largest alternative asset managers globally, with over $600B in assets under management. With operations in over 30 countries worldwide, its business interests run the gamut from Asset Management, Real Estate, and Renewable Power to Infrastructure and Private Equity.

Last fall, Brookfield created a strategic partnership with American Equity Life to acquire a 19.9% stake in AEL in two tranches. The first tranche of 9.9% had valued the company at $37 per share and hasn’t yet received regulatory approval. But business doesn’t stop.

Realizing the potential for growth in the insurance business, Brookfield spun off Brookfield Asset Management Reinsurance Partners Ltd. (BAMR) just a couple of months back. Brookfield expects its insurance business to be a $100B - $200B opportunity over the next few years.

The other protagonist in today’s story: American National, founded in 1905. The company deals with life insurance and property and casualty insurance that insures homes, cars, boats, motorcycles, etc. Nearly half of its $3.8B revenue came from property and casualty insurance. American National has over $100B worth of insurance policies in force.

Growing Private Equity Interest

American National was evaluating putting itself up for sale back in May. Since then, shareholders have pushed up the price by almost 55% in anticipation of a hefty payday. Those expectations were met when Brookfield swooped in with a 10% premium to Friday’s close. The deal is expected to close in the first half of 2022, subject to meeting the closing conditions and regulatory clearances.

Private equity interest in the insurance sector has been decidedly on the rise. Last month, Blackstone acquired a 9.9% stake in AIG’s life and retirement business for $2.2B. Blackstone will also manage $50B or nearly 25% of the life and retirement business' investment portfolio. This number will increase to $92.5B through 2027.

These deals are to be seen in the context of these companies emerging from a debilitating pandemic. American National reported a net profit of $170M in Q1 2021 (Vs. net loss of $220.4M Y-o-Y). Similarly, AIG registered a net profit of $91M (Vs. loss of $7.9B last year).

This seems to be a win-win for all the parties involved. Brookfield gets to expand its insurance business. American National's shareholders get a price they’re happy about. However, the specter of Aon is a warning for the players not to take things for granted since anything is possible!

Market Reaction

BAM ended at $57.05, up 0.60%; BAMR ended at $57.98, up 0.89% while ANAT ended at $188, up 8.8%.

Company Snapshot 📈

BAM $57.05 +0.34 (0.60%)

Analyst Ratings (12 Analysts) BUY 75% HOLD 25% SELL 0%

Newsworthy 📰

Solo: AMC reaches deal with Warner Bros. for 45 days theatrical exclusivity in 2022 (AMC +5.33%)

Investigation: McDonald's faces Italian antitrust probe into franchise terms (MCD -0.69%)

Acquisition: DraftKings to buy Golden Nugget online for $1.56B, as gaming's M&A streak continues (DKNG +1.49%)

Later Today 🕒

Coinbase Global Inc. Earnings (COIN)

Sysco Corp. Earnings (SYY)

McAfee Corp. Earnings (MCFE)

6:00 PM IST: Productivity & Unit Labour Cost

Fun Fact of The Day 🌞

If you pronounce the name of products wrong in an Apple store, employees are not allowed to correct you

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today.