🛢 Is Baker Hughes’ Price Baking In Performance?

Visa shares surge on strong results.

Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Wednesday’s Close) 4,183.96 +8.96 (0.21%)

NASDAQ (Wednesday's Close) 12,488.93 -1.81 (0.01%)

FTSE 100 (5:30 PM IST) 7,498.86 +73.25 (0.99%)

NIFTY 50 (Today's Close) 17,245.05 +206.65 (1.21%)

USDINR (Today's Close) 76.62 (1 Year +2.74%)

🔥 Top Movers

AMR +13.59%

ALKS +11.94%

ZNTL +11.67%

NCR -23.24%

FFIV -12.84%

SPOT -12.44%

🛢 Baker Hughes: Great Expectations?

Oilfield services and equipment firm Baker Hughes Co. (BKR) missed street expectations. Poor revenue growth at a time when oil prices rallied left investors sulking. With supply-side challenges compounded due to the Russia-Ukraine conflict, is the company now on a slippery slope?

No Boil Despite Oil

Oil has touched the Nadir and the Zenith in the past couple of years. From negative price per barrel at the height of the pandemic to multi-year highs, it has been a swift, volatile, and unpredictable journey. When Russia invaded Ukraine, supply fears pushed Brent Crude past the $130 per barrel mark. A slight cool-off notwithstanding, prices remain comfortably on the high side.

Baker Hughes is the second-largest oilfield contractor globally after Schlumberger and provides services to oil & gas companies pertaining to drilling, production, and reservoir consulting. It also offers a range of industrial services to the downstream chemicals, processing, and pipeline markets and has offices worldwide.

The company merged its oil & gas business with GE in 2017, just as oil prices crashed. Under the burden of its debt, GE started selling its stake in Baker Hughes right when oil prices started shooting up. Having started with a 63% stake in Baker Hughes, GE currently owns ~25% of the company.

There was an allegation back in 2019 - which ultimately was unfounded - that GE had hidden losses to the tune of $38B and used Baker Hughes as one of the vehicles. The findings were termed "bigger than Enron." Baker Hughes denied it all, and eventually, the issue died its natural death.

With oil prices riding high and oil companies large and small reporting large profits, expectations from Baker Hughes were high as well. As a result, its shares surged to a 52-week high last month in anticipation of a blowout quarter. That was not to be, however!

Drilling Underperformance

Baker Hughes’ performance left a lot to be desired as both EPS and revenue missed expectations.

Key Highlights From Q1:

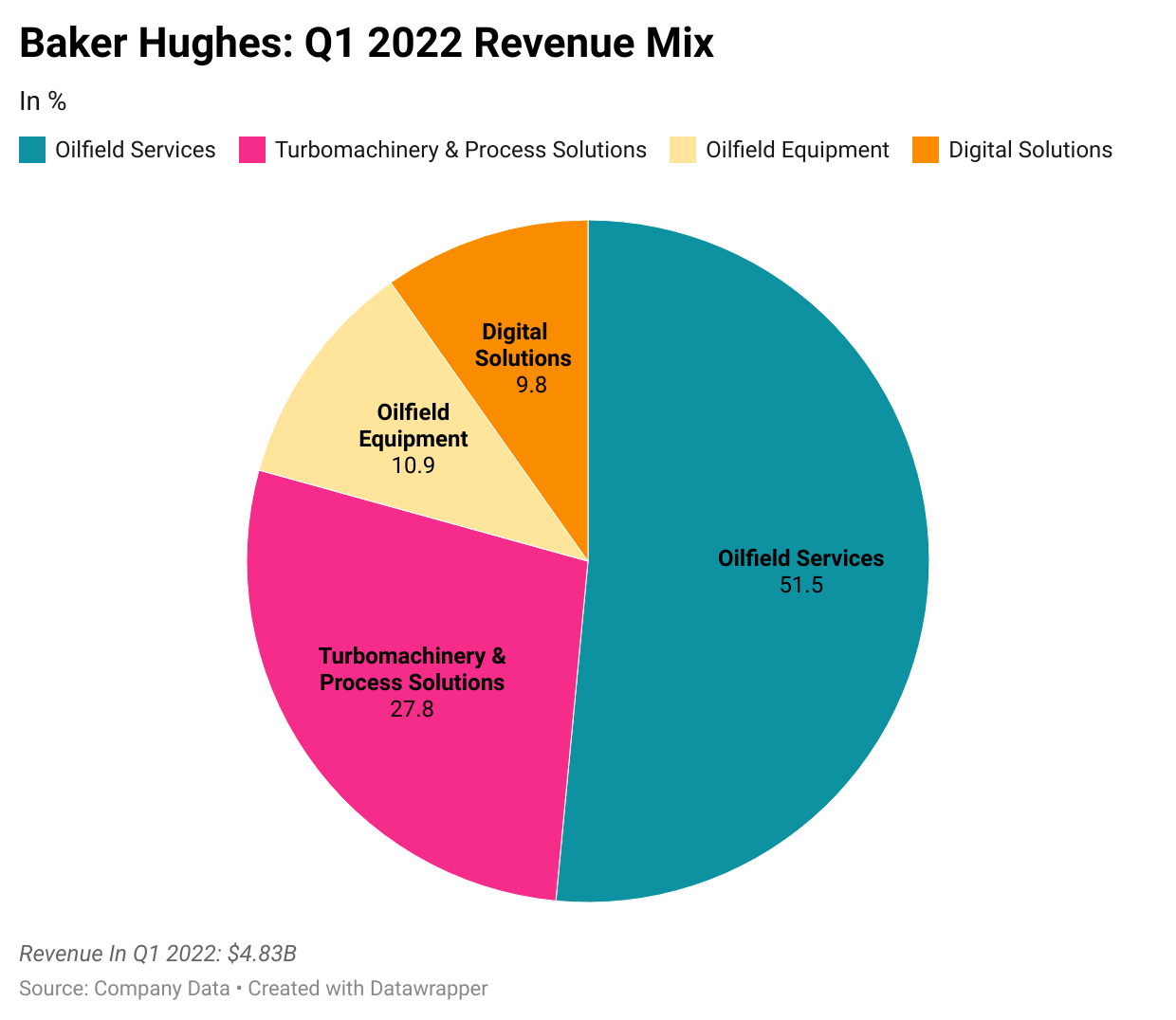

Revenue: $4.83B Vs $5.02B expected

Earnings Per Share: $0.08 Vs $0.19 expected

Net Profit: $72M Vs Net Loss of $452M Y-o-Y

Not only did revenue fall well below estimates, but it also grew at a paltry 1% Y-o-Y and was down 12% compared to Q4 2021. The company pointed to lower volumes in all the businesses and the struggle in moving people and equipment to Russia, which counts as one of the biggest oil-producing nations globally.

Unlike peers like Halliburton, which stopped all existing projects in Russia, Baker Hughes continues to operate in the country and has only put an end to future investments. For the quarter, Russia represented 4% of the overall topline. Even as it struggles with importing technology into Russia due to sanctions, Baker Hughes hopes to bag newer LNG projects in Europe.

Last week, the company acquired Mosaic Materials to enhance its carbon dioxide capture utilization and storage business as it looks to position itself as a leader in LNG and new energy.

Baker Hughes' oilfield equipment business was the biggest underperformer during the quarter. Segment revenue dropped 16% Y-o-Y alongside an operating loss of $8M (compared to a $4M profit in the year before quarter). The business received orders worth $6.84B during the quarter, up only 3% Y-o-Y despite the skyrocketing oil prices.

On the contrary, peers such as Halliburton offered a rosy outlook for the next few years, with a plan to increase North American spending by 35% (as against 25% earlier). Halliburton’s net profit also doubled from the year-ago period.

It’s becoming clearer that the company’s reliance on Russia, concomitant operational challenges, and supply-side issues were more problematic than expected. It wasn’t a surprise then that investors balked, and the shares suffered their worst day in two years. Baker Hughes finds itself on a slippery slope and needs to get its act together soon. There’s no use crying over spilled oil!

Market Reaction

BKR ended at $31.28, down 0.22%.

Company Snapshot 📈

BKR $31.28 -0.07 (0.22%)

Analyst Ratings (28 Analysts) BUY 75% HOLD 25% SELL 0%

Newsworthy 📰

Deep In The Red: Boeing lost $1.1B on Trump Air Force One contract; CEO regrets deal (BA -7.53%)

Revival?: Facebook revenue slows, but user gains fuel stock (FB +18.37%) (Afterhours)

Swiping On: Visa soars as cardholders spend despite Omicron's surge (V +6.47%)

Later Today 🕒

Apple Inc. Earnings (AAPL)

Amazon.com Inc. Earnings (AMZN)

Twitter Inc. Earnings (TWTR)

Comcast Corp. Earnings (CMCSA)

Mastercard Inc. Earnings (MA)

Intel Corporation Earnings (INTC)

Domino's Pizza Inc. Earnings (DPZ)

McDonald's Corp. Earnings (MCD)

Eli Lilly and Co. Earnings (LLY)

Robinhood Markets Inc. Earnings (HOOD)

Roku Inc. Earnings (ROKU)

Southwest Airlines Co. Earnings (LUV)

Sanofi Earnings (SNY)

Caterpillar Inc. Earnings (CAT)

Arthur J. Gallagher & Co. Earnings (AJG)

The Carlyle Group Inc. Earnings (CG)

Curevac N.V. Earnings (CVAC)

First Solar Inc. Earnings (FSLR)

Five9 Inc. Earnings (FIVN)

Gilead Sciences Inc. Earnings (GILD)

Goodyear Tire & Rubber Co. Earnings (GT)

The Hershey Co. Earnings (HSY)

International Paper Co. Earnings (IP)

Linde Plc. Earnings (LIN)

Merck & Co. Inc. Earnings (MRK)

Pitney Bowes Inc. Earnings (PBI)

Sirius XM Holdings Inc. Earnings (SIRI)

T. Rowe Price Group Inc. Earnings (TROW)

Thermo Fisher Scientific Inc. Earnings (TMO)

United States Steel Corp. Earnings (X)

Western Union Co. Earnings (WU)

Willis Towers Watson Plc. Earnings (WTW)

6:00 PM IST: Initial Jobless Claims

6:00 PM IST: Real GDP Data

Today's Fun Fact

Small businesses generate 13 times more patents per employee than large patenting companies

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today.

Disclaimer: All content provided by Winvesta India Technologies Ltd. is for informational and educational purposes only and is not meant to represent trade or investment recommendations. Remember, capital is at risk. Terms & Conditions apply. See https://winvesta.in for details.