🔵 IBM: Can Big Blue End Investors’ Blues?

Moderna's Omicron vaccine; Peloton sues Lululemon.

Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Friday's Close) 4,594.62 -106.84 (2.27%)

NASDAQ (Friday's Close) 15,491.66 -353.57 (2.23%)

FTSE 100 (5 PM IST) 7,130.42 +86.39 (1.23%)

NIFTY 50 (Today's Close) 17,053.95 +27.50 (0.16%)

USDINR (Today's Close) 75.06 (1 Year +0.13%)

🔥 Top Movers

CARS +21.07%

MRNA +20.57%

BNTX +14.19%

CPE -16.47%

PDD -15.86%

LPI -15.48%

UPI Is here!

For the first time ever, Indians can invest in US stocks using UPI. $0 fixed fee. 30-second process. Only with #Winvesta. (Tweet This)

Experience it today, and be a part of creating history.

Learn more

*For a limited time. Capital is at risk.

🔵 IBM: Where Is The Dancing Elephant?

If you had purchased IBM's (IBM) stock in 2016, you wouldn't be a happy camper. Far from it. The last five years have seen the stock go down 25%. In desperate need of a strategy, the company executed a major shift a few weeks back. Will the move be the first step towards a complete transformation? (Tweet This)

Intricate Steps In The Dance

When Louis Gerstner became chairman of IBM in 1993, visionary that he was, he wanted to leverage the inchoate Internet and make that the backbone of IBM's operations. The IBM Internet division was created soon after and was led by Irving Wladawsky-Berger.

Over the next six years, the internet division became the market leader in providing services that transformed business. This was at the height of the dot com bubble. IBM's market value soared to $168B from a paltry $29B when Gerstner had just come onboard.

However, it's been a downward trend in IBM's once famed internet business, and the unit has been a drag on its financials. As the division lost its sheen, IBM looked to spin it off so the business would focus on managing and modernizing client-owned infrastructure. In fact, the spin-off was announced in October 2020.

In the meantime, the company instead bet on the fast-growing cloud computing sector and took a punt on it by acquiring Red Hat for $34B in October 2018. By enabling companies to move their infrastructure to the cloud, Red Hat would drive a high-margin business for IBM. That was the plan.

However, integrating a young company with a flamboyant culture into a stodgy and bureaucratic IBM was easier said than done. Things came to a head when Red Hat's President Jim Whitehurst quit in July this year. Despite Red Hat growing in double digits in the last seven quarters, IBM reported a revenue decline in six of the seven quarters.

The digital transformation services sector is set to become a $500B market by 2024. The spin-off was also expected to ease some strain from IBM's balance sheet. IBM's shares surged when the spin-off was announced. But things are not as rosy as they were projected to be.

Waking Up A Snoring Elephant

The spun-off entity was named Kyndryl. By ring-fencing the IT infrastructure entity's brand and business away from IBM, the company was hoping to change the perception about its own business and make it more cloud-centric.

Kyndryl finally started trading on Wall Street earlier this month (November 3rd, to be precise). Shareholders of IBM received one share of Kyndryl for every five IBM shares. Kyndryl continued to provide technical support to over 4.5K clients in 115 countries globally.

On debut, Kyndryl's shares fell nearly 7% to close at $26.38 apiece and slipped further during after-hours trading. The company reported its first quarterly results last week. Revenue was down 5% Y-o-Y at $4.6B with net loss at $692M, almost triple the $238M loss for the same period last year.

During Q3, the company also signed contracts worth $2.8B; the only drawback was that all contracts worth $100M and more were from existing clients, and no new clients came on board. As a result, Kyndryl's shares have almost halved since their debut on Wall Street.

Even so, the company is focused on the positive. For Q3, its "work under contract" or order backlog stood at $51.1B. In addition, 53% of that amount is likely to be recognized as revenue over the next two years, while 36% will be done over the next three to five years. Kyndryl also announced an expansion in its partnership with Microsoft and VMware.

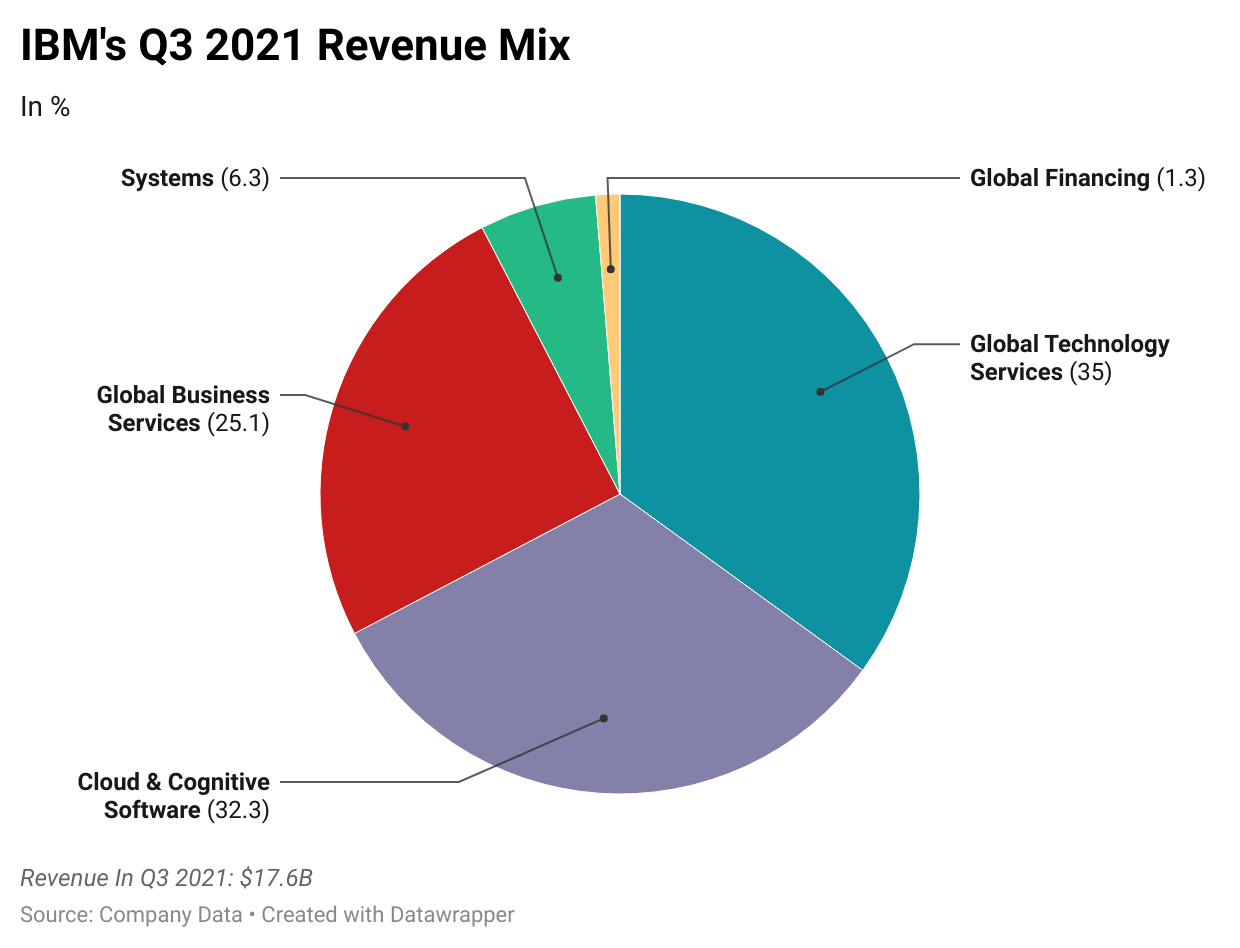

Kyndryl notwithstanding, IBM continues to suffer from poor financial performance. IBM's Q3 revenue of $17.62B (Vs. analyst expectations of $17.77B). Net income too fell 33% Y-o-Y. The company didn't provide any forward guidance. It has received several new processing chips in the recent past from suppliers, but that hasn't yet translated to revenue on its income statement.

So is everything hunky-dory? Far from it. On the cloud front, it faces formidable incumbents such as Amazon, Microsoft, and Google. So getting Kyndryl out of its books hasn't changed its performance measurably. The elephant is still somnolent. But that hasn't stopped investors in Big Blue to keep looking out for that elusive green!

Market Reaction

IBM ended at $115.81, down 0.77%. Shares are down 2.2% this year.

Company Snapshot 📈

IBM $115.81 -0.90 (0.47%)

Analyst Ratings (17 Analysts) BUY 29% HOLD 65% SELL 6%

Newsworthy 📰

Timeline: Moderna says an omicron variant vaccine could be ready in early 2022 (MRNA +20.57%)

Case: Peloton has sued Lululemon in feud over cycle maker's new apparel line (PTON +5.67%)

Offer: AMC, Sony offering NFTs to people who purchase advance Spider-Man tickets (AMC -3.34%)

Later Today 🕒

Frontline Ltd. Earnings (FRO)

Stonex Group Inc. Earnings (SNEX)

Navigator Holdings Ltd. Earnings (NVGS)

8:30 PM IST: Pending Home Sales

Today's Market Terminology: Delta

Delta is the ratio that compares the change in the price of the underlying asset to the corresponding change in the price of a derivatives. It is also known as hedge ratio and ranges from 0 to 1

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today. *Capital is at risk.