☁️ How Strong Is Microsoft’s Castle On A Cloud?

Starbucks hikes pay; Kraft Heinz optimistic for the year.

Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Wednesday's Close) 4,551.68 -23.11 (0.51%)

NASDAQ (Wednesday's Close) 15,235.84 +0.12 (0.001%)

FTSE 100 (4:30 PM IST) 7,241.29 -11.98 (0.17%)

NIFTY 50 (Today's Close) 17,857.25 -353.70 (1.94%)

USDINR (Today's Close) 74.90 (1 Year -0.26%)

🔥 Top Movers

ENPH +24.65%

SLAB +18.86%

NRIX +17.33%

PHAT -20.23%

AGYS -19.94%

ROL -10.81%

☁️ Microsoft: Castle On A Cloud?

That’s our ode to Les Miserables. Microsoft (MSFT) crushed analyst expectations in Q1 of the fiscal year 2022, with its fastest revenue growth since 2018. The net profit of over $20B in Q1 is comfortably higher than the market value of many companies! The juggernaut continues to roll on. (Tweet This)

The Ever Bigger Boat

Even larger amounts of data and mind-bogglingly complex data computing techniques have meant data storage methods have had to evolve at a breakneck pace. Cloud Computing seemed to be the easy answer as companies worked to decouple their technology needs from the limited resources they had at their disposal.

The cloud provides remote data storage, leverages the internet to support access to shared resources, software, and information. Indeed, cloud computing seems to be the veritable panacea that enables companies to become more secure, cost-efficient, and agile.

Have you ever heard of the Zettabyte? That’s 1, followed by 21 zeros. In an era where we have barely made sense of one Terabyte of hard drive space, imagine a Gigabyte of Terabytes. That’s one Zettabyte. By 2025, over 100 Zettabytes of data will be stored in the cloud.

The pandemic served to accelerate companies’ transition to the cloud as they struggled to get employees to work remotely, share documents on the web, and access data from anywhere. This anywhere-anytime data access has allowed companies to scale without incurring capex.

By 2024, it is expected that 45% of IT spending on system infrastructure, infrastructure software, application software, and business process outsourcing will permanently shift from traditional solutions to the cloud. The big three cloud providers - Amazon, Microsoft, and Google - are the direct beneficiaries of this shift.

When A Billion Is A Rounding Error

Microsoft continued to ride the cloud wave and trounced all expectations.

Key Stats From Q1:

Revenue: $45.3B Vs $43.97B expected

EPS: $2.27 Vs $2.07 expected

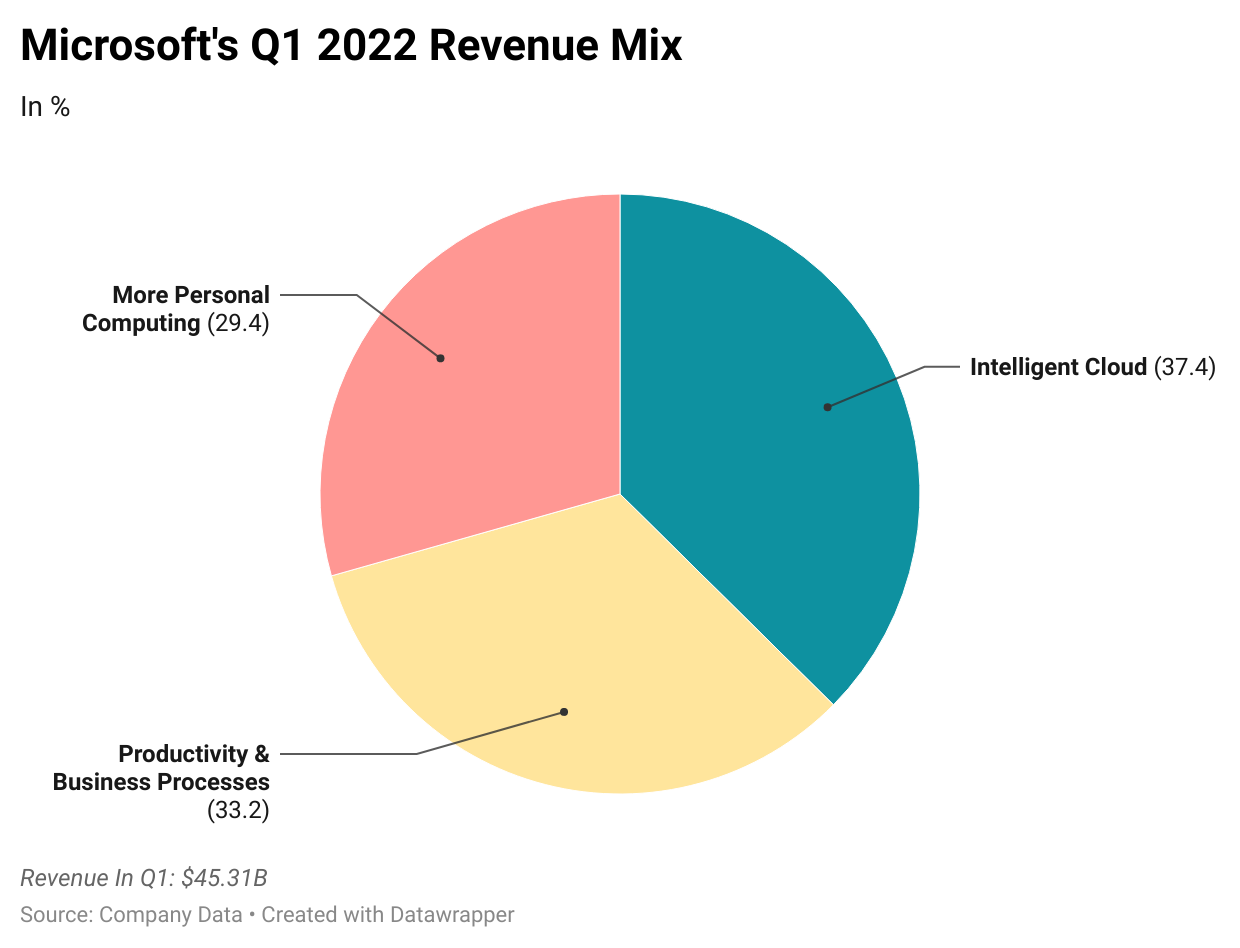

Microsoft's Azure and other cloud services grew 50% Y-o-Y in Q1. Barring Xbox Content and Services, all other segments saw double-digit growth during the quarter. Microsoft's Intelligent Cloud segment recorded revenue of $16.96B, up 31% Y-o-Y and higher than the consensus estimates of $16.51B.

Supply chain issues and chip shortages impacted the production of the Xbox gaming consoles and Surface laptops. Even so, sales of gaming consoles and accessories rose 166% Y-o-Y. However, sales of Surface devices fell 17% in Q1. This figure is expected to slide further in the current quarter.

In Q2, the company expects to surpass $50B in revenue - a first in its history. Despite these stellar results, Microsoft has issued a warning for the unlikeliest of businesses – Advertising! The company has warned that big customers may tighten their advertisement purse strings on its Bing platform until supply chain issues are resolved.

Suffice it to say, this warning didn't even register in the minds of investors. They made merry as Microsoft shares surged and its market cap of $2.42T came within a hair's breadth of Apple's $2.46T, a difference of just $40B. The Windows now seems open for Microsoft to take back the mantle that it had recently relinquished since mid-2020.

Market Reaction

MSFT ended at $323.17, up 4.21%. Shares are up ~50% this year.

Company Snapshot 📈

MSFT $323.17 +13.06 (4.21%)

Analyst Ratings (38 Analysts) BUY 92% HOLD 08% SELL 0%

Newsworthy 📰

Luring: Starbucks to hike US employee pay to attract workers during labour crunch (SBUX -1.23%)

Technology: McDonald's enters into a strategic partnership with IBM to automate drive-thru lanes (MCD +2.67%)

Confidence: Kraft Heinz sees stronger earnings for the year thanks to higher prices (KHC -0.11%)

Later Today 🕒

Apple Inc. Earnings (AAPL)

Amazon Inc. Earnings (AMZN)

MasterCard Inc. Earnings (MA)

Comcast Corp. Earnings (CMCSA)

Merck Co. Earnings (MRK)

Shopify Inc. Earnings (SHOP)

American Tower Corp. Earnings (AMT)

Caterpillar Inc. Earnings (CAT)

T. Rowe Price Group Inc. Earnings (TROW)

Hershey Co. Earnings (HSY)

Arthur J Gallagher & Co. Earnings (AJG)

Willis Towers Watson Plc Earnings (WLTW)

6:00 PM IST: Initial Jobless Claims

Today's Market Terminology: Delta

A delta relates to the ratio of change in the price of a derivative in response to change in the price of the underlying asset. A higher delta suggests higher sensitivity to the price changes of the underlying asset

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today. *Capital is at risk.