🚗 General Motors: Charging Up For Change?

EBAY to sell South Korean unit, technical glitches with Southwest Airlines.

Hey Global Investor, here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Tuesday's Close) 4,246.59 -8.56 (0.20%)

NASDAQ (Tuesday's Close) 14,072.86 -101.29 (0.71%)

FTSE 100 (5:30 PM IST) 7,175.98 +3.50 (0.05%)

NIFTY 50 (Today's Close) 15,767.55 -101.70 (0.64%)

USDINR (Today's Close) 73.32 (1 Year -2.83%)

🔥 Top Movers

GOEV +16.81%

GSHD +12.22%

RIDE +11.34%

SAGE -19.30%

AVXL -17.39%

VRM -11.46%

🚗 General Motors: Charging Up For Change?

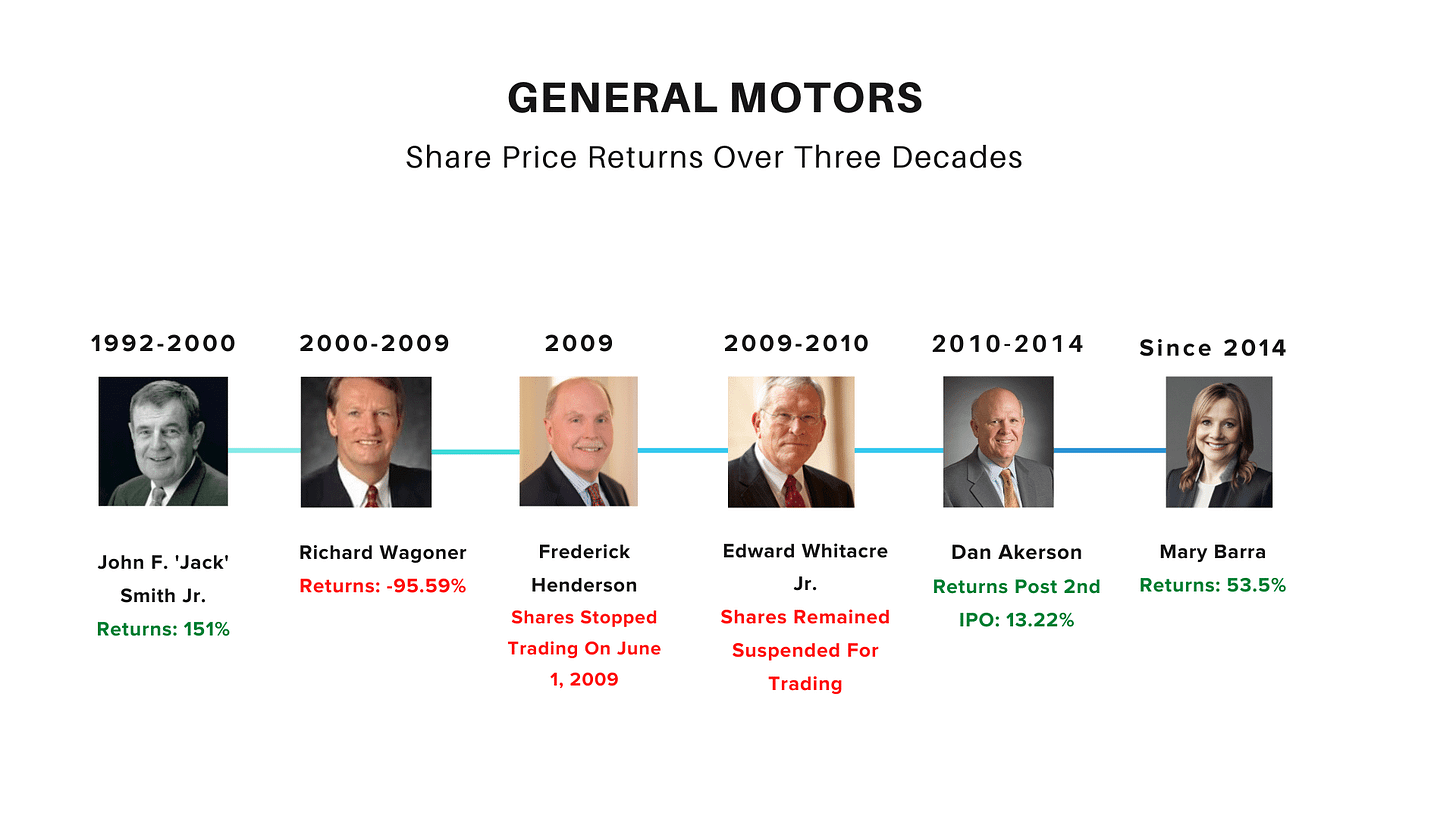

General Motors (GM) is transforming itself as it prepares for an all-electric future. In the works are numerous partnerships, strategic investments, and greenfield manufacturing plants. GM seems to have shifted gears as it works on shedding its legacy image. (Tweet This)

The EV Push

In 2019, GM announced its highly anticipated EV foray: 1M EVs in the US and China by 2025; 30 all-electric vehicle models globally by 2025. GM had also announced a $20B capex plan in March 2020, just days before the pandemic struck.

Covid-19 and concomitant global lockdown notwithstanding, GM managed to sell 2.55M vehicles in the US last year. EVs accounted for a paltry 0.007% of this number. In response, GM announced in November that it’s increasing EV-related capex to $27B over the next five years instead of the earlier $20B.

The company has pledged to phase out all gasoline and diesel-powered vehicles globally by 2035 and become carbon neutral by 2040. It also aims to take advantage of US President Joe Biden's proposed $174B spending plan to boost EVs and charging, including $100B in new EV rebates.

Across The Electric Value Chain

It was reported yesterday that the company is now boosting its $27B outlay to $35B. GM also announced the building of two battery plants - each costing over $2B. These are in addition to the plants the company is already building in Ohio and in Tennessee.

GM is also branching out beyond automotive. It signed a non-binding MoU with Wabtec Corp. to develop and commercialize the FLXdrive electric locomotives. These locomotives will use a combined 18K battery cells that include GM's Ultium battery and Hydrotec Hydrogen fuel cell systems.

In order to have a presence across the EV value chain, GM has partnered with EVgo to add another 2.7K renewable energy-powered fast chargers to its nationwide charging network by 2025. This will more than triple EVgo's existing network of over 800 charging stations.

In addition to this, GM is the majority owner of autonomous EV startup Cruise. Cruise has recently secured a $5B line of credit from GM’s financing arm as it gets ready to launch self-driving robotaxies. Production of these Origin shuttles is expected to start in 2023. Cruise has already secured a permit from the California Public Utilities Commission in this regard.

By 2025, global EV sales are likely to top 12.2M, indicating a CAGR of ~52%. It looks like the company is getting its ducks in a row up and down the electric-powered value chain while other competitors in the space seem to be fixated on just the electric vehicle.

Market Reaction

GM ended the day at $60.81, up 0.03%.

Company Snapshot 📈

GM $60.81 +0.02 (0.03%)

Analyst Ratings (22 Analysts) BUY 91% HOLD 09% SELL 00%

Newsworthy 📰

Asset Sale: EBay to sell South Korean unit for about $3.6B to Shinsegae, Naver (EBAY +0.11)

Glitch: Southwest Airlines cancels 500 flights after second technology issue in two days (LUV -0.28%)

Reversal: Roblox reports decline in users and their spending (RBLX -8.13%)

Later Today 🕒

Lennar Corporation Earnings (LEN)

The Honest Company Inc. Earnings (HNST)

Twilio Inc. Annual General Meeting (TWLO)

6:00 PM IST: Building Permits & Import price index

11:30 PM IST: Federal Reserve Announcement

12:00 AM IST: Jerome Powell Press Conference

Fun Fact of The Day 🌞

Candy Crush brings in a reported $633K a day in revenue.

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today.