🔚 Did NVIDIA’s ARM Deal Ever Have Legs?

Peloton co-founder steps down.

Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Tuesday's Close) 4,521.54 +37.67 (0.84%)

NASDAQ (Tuesday's Close) 14,194.46 +178.79 (1.28%)

FTSE 100 (5 PM IST) 7,611.60 +44.53 (0.59%)

NIFTY 50 (Today's Close) 17,463.80 +197.05 (1.14%)

USDINR (Today's Close) 74.81 (1 Year +2.59%)

🔥 Top Movers

TDC +26.34%

PTON +25.28%

ATOM +23.91%

SLQT -47.32%

PLSE -34.44%

KPTI -20.02%

🔚 NVIDIA: The Severed ARM?

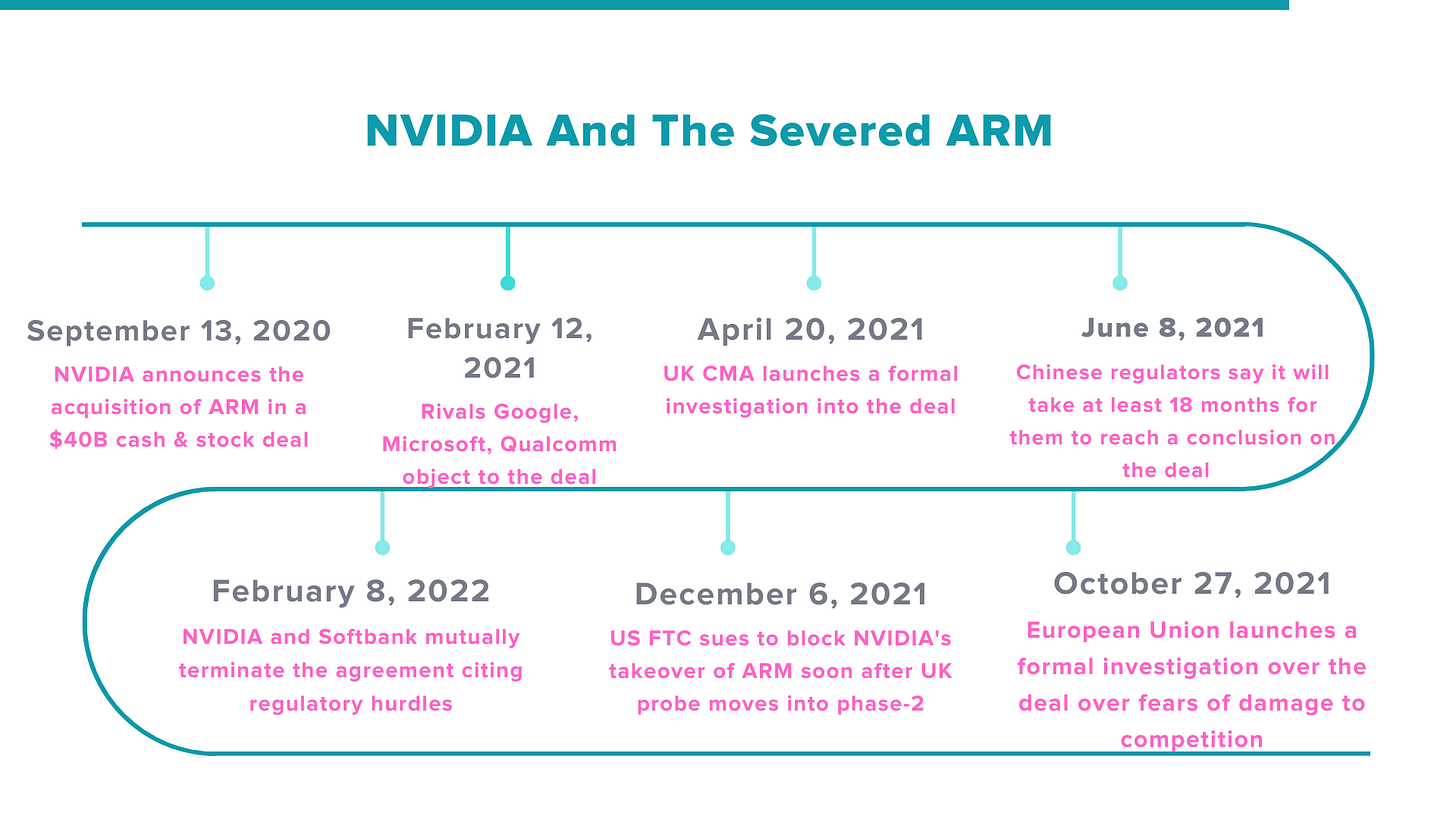

17 months of negotiations, representations, and discussions with regulators have come to naught. NVIDIA (NVDA) and SoftBank finally saw the writing on the wall and have terminated NVIDIA's proposed acquisition of ARM Holdings. ARM is preparing to go public. NVIDIA is licking its wounds. (Tweet This)

Too Big A Bite To Chew

ARM's chip design is at the heart of 95% of the world's smartphones. Softbank, led by the mercurial Masayoshi Son, raised many eyebrows when acquiring ARM for $32B in 2016.

Once the acquisition was completed, Softbank pushed ARM outside its core expertise, making the company invest heavily in AI-driven IoT products and having it add to the headcount. After March 2017, ARM managed to earn a profit for the first time in the quarter ending June last year.

Softbank took the credit for itself - that its earlier investment was finally delivering the goods. And still, Son was angling for a suitor that would take ARM into its arms and make it a profitable transaction for the Japanese giant. The pressure was building on Son since some of the other high-profile investments, such as WeWork and Indian hospitality company OYO, were misfiring.

NVIDIA saw ARM as an opportunity to expand its presence into mobile, given that NVIDIA’s chips were in more heavy-duty applications such as PCs and video game consoles. Additionally, ARM’s licenses would enable NVIDIA to generate revenue (and profits) from day one. And thus, in September 2020, NVIDIA jumped all in with a $40B check for ARM.

The deal included $1.5B in equity to ARM’s employees, $5B in performance-based payouts, $12B in cash, and $21.5B in NVIDIA stock. Some of its fiercest competitors - Qualcomm, Google, and Microsoft saw red when the deal was announced. They complained to the regulators that NVIDIA would become a veritable monopoly if ARM were subsumed.

Regulators were anyway going to have to approve the deal. With these complaints, they swung into action. In dealing with the UK, China, EU, and the US regulatory bodies, NVIDIA, ARM, and Softbank had their hands full. The protagonists were still hopeful the deal would close by March 2022. With NVIDIA’s shares rising in the meantime, the ARM deal would have been worth closer to $60B.

The Deal That Never Was

Beyond financial gain, ARM would also have instantly delivered to NVIDIA access to 13M additional developers and access to data center chip technology that would pit it against Intel’s x86 architecture.

NVIDIA was also quick to reassure its competition that ARM’s technology will continue to be available fairly, reasonably, and non-discriminatory. That was not enough to placate the likes of Microsoft and Qualcomm, who were vocal about the unfair advantage NVIDIA would have if ARM’s technology were to be owned wholly by it.

In November last year, the UK regulator saw serious concerns in the Phase 1 probe and extended their review to a Phase 2 probe. The FTC sued to block the transaction on antitrust grounds in the US. The European Commission asked for more time. Inexplicably, NVIDIA waited a full nine months after announcing the deal to file its application with Chinese authorities.

Chinese authorities promptly told NVIDIA it would take 18 months for them to opine on the deal. And that’s when the dominoes started falling. The writing was on the wall, and it was only a matter of time before NVIDIA would be forced to throw in the towel.

That happened yesterday. NVIDIA CEO Jensen Huang cited significant regulatory challenges that would preclude this deal from consummating and that NVIDIA will support ARM as a "proud licensee." ARM is now expected to go public before March 31, 2023.

In the aftermath of this announcement, ARM’s CEO Simon Segars, who was an advocate for this deal, was replaced by Reed Haas, who was the president of ARM's IP Products Group until now. NVIDIA will pay Softbank a $1.25B break-up fee for canceling the transaction. For the nine months ending December 2021, ARM's net sales surged 40% Y-o-Y to $2B.

The winner in all of this saga is Qualcomm. How? That's a story for another day. For now, NVIDIA is licking its wounds. ARM shakes off the ordeal and gets ready for its IPO. Softbank still has to earn a reasonable return on its investment, and who knows how the IPO markets will perform a year from now? Stay tuned right here as things unravel, er, unfold!

Market Reaction

NVDA ended at $251.08, up 1.54%.

Company Snapshot 📈

NVDA $251.08 +3.80 (1.54%)

Analyst Ratings (44 Analysts) BUY 80% HOLD 18% SELL 2%

Newsworthy 📰

Twist: Facebook market cap falls below $600B - which could actually help it dodge new antitrust scrutiny (FB -2.10%)

Change: Peloton posts loss, slashes its full-year revenue outlook as founder steps down as CEO (PTON +25.28%)

Defiance: Chipotle profits beat expectations despite higher costs, Omicron (CMG +6.62%)

Later Today 🕒

Walt Disney Co. Earnings (DIS)

Uber Technologies Inc. Earnings (UBER)

CVS Health Corp. Earnings (CVS)

Glaxosmithkline Plc Earnings (GSK)

Aegon NV Earnings (AEG)

Mattel Inc. Earnings (MAT)

CleanSpark Inc. Earnings (CLSK)

Manulife Financial Corp Earnings (MFC)

MGM Resorts International Earnings (MGM)

Sun Life Financial Inc. Earnings (SLF)

Teva Pharmaceuticals Industries Earnings (TEVA)

Twilio Inc. Earnings (TWLO)

Udemy Inc. Earnings (UDMY)

Zynga Inc. Earnings (ZNGA)

Today's Market Terminology: Bidding Buyer

A bidding buyer in the context of equities is a non-aggressive buyer who prefers to await a natural seller in the hope of paying a lower price

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today. *Capital is at risk.