📚 Can Udemy Grow Profitably?

No Tesla-Hertz deal yet; DuPont near an acquisition.

Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Monday's Close) 4,613.67 +8.29 (0.18%)

NASDAQ (Monday's Close) 15,595.92 +97.53 (0.63%)

FTSE 100 (4:30 PM IST) 7,251.70 -36.92 (0.51%)

NIFTY 50 (Today's Close) 17,888.95 -40.70 (0.23%)

USDINR (Today's Close) 74.73 (1 Year -0.46%)

🔥 Top Movers

ANIP +49.52%

VUZI +32.27%

CMTL +26.10%

BTBT -17.19%

MRTX -13.57%

INVZ -9.14%

📚 Udemy: Denying Profitability?

EdTech company Udemy Inc. (UDMY) made a tepid debut on the Nasdaq last week, with shares ending 5% below its IPO price. At the end of day one, the company was valued at $3.8B. That suggests there's a lot to be desired regarding Udemy's financials and other aspects. (Tweet This)

Not Taking "No" For An Answer!

In 2007, Eren Bali and Oktay Caglar built software for a live virtual classroom in Turkey. Along with Gagan Biyani, they took the idea to Silicon Valley in 2010. They were rejected by the VCs not once, not twice, but 30 times. Undaunted, the three continued to develop the product and launched Udemy (a portmanteau of you + academy) in May 2010.

Within a few months, the company had nearly 10K registered users trying to learn over 2K courses created by 1K instructors. By August, the company managed to raise $1M in venture funding. As a sign of Udemy's growing stature, in June 2015, it raised Series D funding of $65M. Last November, it raised $50M at a valuation of $3.25B.

In April 2013, Udemy launched its iOS app, followed by the Android version in January 2014. Udemy expanded its iOS platform to include Apple TV in July 2016. In January last year, the Udemy mobile app became India's top-grossing android app.

Udemy's business model is pretty straightforward. There is no fee charged for creating or hosting a course on Udemy's platform. Whenever a student purchases a course is when Udemy makes money.

Fees generated through Udemy's browser-based portal are shared 50-50 between the company and the instructor. For sales made through the apps, the company charges a 30% fee. Courses on Udemy's platform range between $4.99-$12. It is also testing a subscription-based model priced between $20-$30 per month, which will allow users unlimited access to over 5K courses.

Can Online Learning Be Profitable?

As of June this year, Udemy had 44M+ students, 183K+ courses with 65K instructors teaching in 75 languages. It counts among its corporate clients, giants such as Citigroup, Jaguar Land Rover, PayPal, and Box Inc. Udemy now has hubs in Denver, Dublin, Turkey, Brazil, and Gurugram in India.

All that said, the company has yet to become profitable. During the pandemic, Udemy saw a surge in customers who signed up for various courses as people lined up to upskill themselves. Even so, the company's losses widened to $77.6M in 2020, compared to a loss of $69.7M in 2019.

For the first six months of the year, Udemy reported revenue worth $251M Vs. $201M during the same period last year. Net losses too narrowed to $29M from $52M Y-o-Y. Put another way, for every dollar of revenue that it earns, Udemy spends $1.20. The company's CEO attributed these skewed numbers to its aggressive expansion policy.

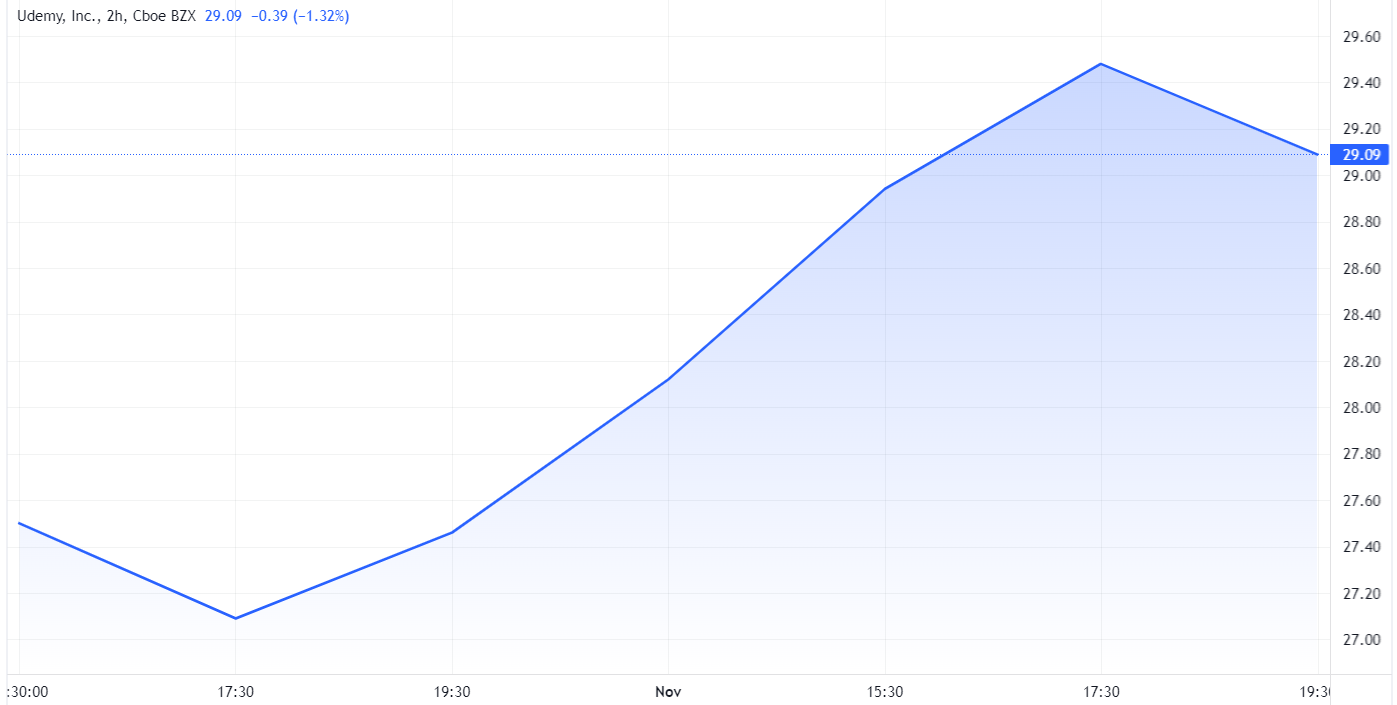

Udemy listed on Wall Street at $29 per share and ended the day at $27.50. It raised $421M in its IPO, selling 14.5M shares. Udemy's biggest investor currently is Insight Partners, which along with its affiliates, owns over 30% of the company post listing. Other major shareholders include MIH Edtech investments - a unit of Prosus NV and Norwest Venture Partners.

Udemy has joined a small list of companies with $200M or more in market cap whose shares closed below the offer price on day one. Out of the ~200 listings this year, including blank check companies, there have only been 34 such instances, with Udemy being the 25th worse.

Current and future shareholders would surely want to educate themselves a little more about the company before enrolling themselves for the long haul. Courses anyone?

Market Reaction

UDMY ended at $29.22, up 6.25%.

Company Snapshot 📈

UDMY $29.22 +1.72 (6.25%)

Newsworthy 📰

Not Yet: Elon Musk says Tesla has not signed contract with Hertz yet (TSLA +8.49%)

A Step Closer: DuPont nears $5B deal to buy engineering materials maker Rogers (DD +2.34%)

Pressure: Facebook whistleblower Haugen urges Zuckerberg to step down (FB +1.98%)

Later Today 🕒

Pfizer Inc. Earnings (PFE)

T-Mobile US Inc. Earnings (TMUS)

Amgen Inc. Earnings (AMGN)

ConocoPhilips Earnings (COP)

Mondelez International Inc. Earnings (MDLZ)

Eaton Corporation Plc. Earnings (ETN)

Activision Blizzard Inc. Earnings (ATVI)

Vertex Pharmaceuticals Inc. Earnings (VRTX)

KKR & Co. Inc. Earnings (KKR)

Match Group Inc. Earnings (MTCH)

Prudential Financial Inc. Earnings (PRU)

Marathon Petroleum Corp. Earnings (MPC)

Global Payments Inc. Earnings (GPN)

Rockwell Automation Inc. Earnings (ROK)

DuPont de Nemours Earnings (DD)

Cummins Inc. Earnings (CMI)

American Water Works Co. Earnings (AWK)

Gartner Inc. Earnings (IT)

Waters Corporation Earnings (WAT)

Today's Market Terminology: Debentures

Debentures are a form of fixed-income instruments which is not backed by security of any physical assets or collateral of the issuer

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today. *Capital is at risk.