🛒 Can P&G “Tide” Over Cost Pressures?

Covid cases on Royal Caribbean; Zoom's $85M settlement.

Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Friday's Close) 4,395.26 -23.89 (0.54%)

NASDAQ (Friday's Close) 14,672.68 -105.59 (0.71%)

FTSE 100 (5 PM IST) 7,081.03 +48.73 (0.69%)

NIFTY 50 (Today's Close) 15,885.15 +122.1 (0.77%)

USDINR (Today's Close) 74.36 (1 Year -1.01%)

🔥 Top Movers

TEAM +21.86%

SIMO +16.63%

POWI +14.09%

SAVA -32.72%

TBIO -22.38%

ANVS -20.85%

🛒 Procter & Gamble: “Tide” Over Cost Pressures?

Listen to this on Winvesta Podcast

Consumer goods giant Procter & Gamble (PG) beat analyst expectations in Q4 on Friday. The results were largely driven by consumers purchasing a larger percentage of premium health and personal care products. So is the going good for P&G? The results inevitably came with the statutory warning, "Conditions Apply." (Tweet This)

What Women (And Men) Want?

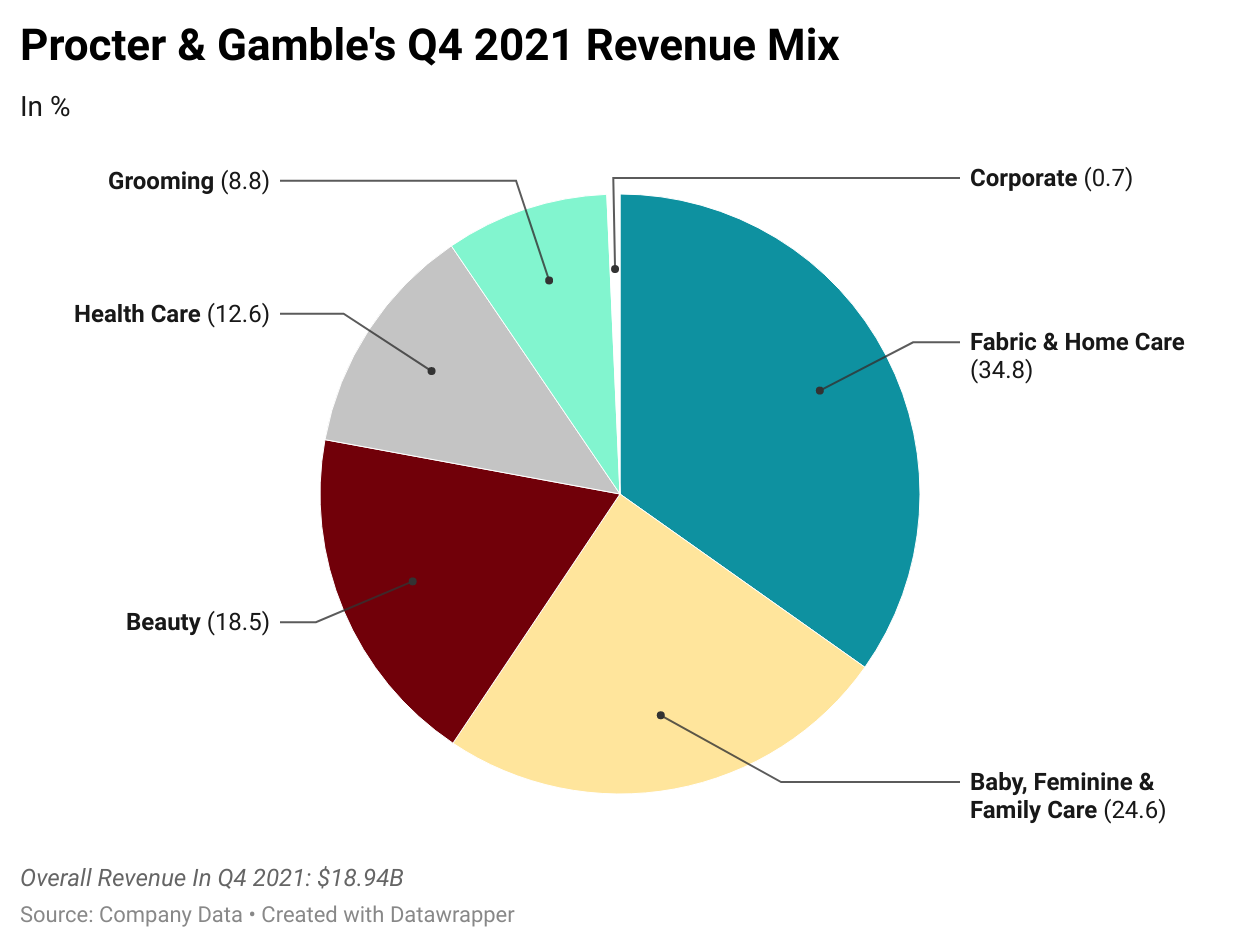

P&G’s Q4 results were ahead of expectations. This, in spite of its largest business - Fabric & Home Care which contributes more than a third of the overall revenue - witnessing a less-than-inspiring 2% organic sales growth Y-o-Y. Why? It seems people have been spending less and less on home cleaning supplies after having over-purchased during the pandemic.

Key Stats From Q4:

Revenue: $18.95B Vs $18.41B expected

EPS: $1.13 Vs $1.08 expected

Guidance For the Fiscal Year 2022:

Organic sales growth in the 2-4% range

6-9% EPS growth over $5.50 EPS in FY2021

$8B in dividends; share repurchase between $7-$9B

Healthcare was P&G’s best-performing segment during the quarter with organic sales growth of 14% Y-o-Y. This was the segment’s first double-digit growth in two years. Oral care contributed significantly to these results following price increases and a lower base.

P&G’s second-largest business by revenue - the Baby, Feminine, and Family Care business which contributes almost a quarter of the top line - was the one drag. It actually saw a decline in organic sales Y-o-Y.

For that matter, this segment has not seen double-digit organic sales growth in the last three years. This lackluster performance correlates with a fall in the US birth rate and the concomitant impact on the sale of diapers, and other baby products.

Input Cost Worries

The key raw material that goes into P&G’s products is polypropylene, pulp, and resins, each of which has registered a price increase anywhere from 25% to 70% Y-o-Y. This increase in input cost means pressure on profits throughout fiscal 2022 as well.

The after-tax hit for P&G purely on these input costs this year will be ~$1.9B. The company expects to pass these price hikes through to the customer starting this fall. Price hikes will vary across brands but are not expected to cross into double-digits.

So is this just a P&G issue? The answer is an emphatic “No.” Unilever, for instance, is contending with its toughest inflationary pressure in a decade. Kimberly-Clark, a perennial US competitor has already hiked prices on various items.

There’s some more disconcerting news at the ground level. A shortage of drivers has been plaguing the company and has been causing supply disruptions. It’s expected this alone will cost the company upwards of $100M this year.

Reaction from the investors has been tepid on account of news pertaining increased input costs, and driver unavailability. As a result, shares are up only 2% this year compared to a corresponding 19% increase in the S&P 500.

So far, there have only been “Whispers” about P&G's underperformance this year. But does the company have it in itself to “Tide” over the underperformance so that the stock goes “Ariel?” If not, there’s not much “Pamper”ing the company can expect from its shareholders.

Market Reaction

PG ended at $142.23, up 1.97%.

Company Snapshot 📈

PG $142.23 +2.75 (1.97%)

Analyst Ratings (21 Analysts) BUY 48% HOLD 47% SELL 5%

Newsworthy 📰

Spread: Royal Caribbean shares fall as six covid cases discovered on board a ship (RCL -3.94%)

Acquisition: Square to buy Australia's Afterpay in $29B deal as 'buy now, pay later' trend takes off (SQ -3.14%)

Peace: Zoom reaches $85M settlement over user privacy, 'Zoombombing' (ZM -2.05%)

Later Today 🕒

Global Payments Inc. Earnings (GPN)

NXP Semiconductors NV Earnings (NXPI)

Simon Property Group Inc. Earnings (SPG)

American Water Works Company Inc. Earnings (AWK)

Solaredge Technologies Inc. Earnings (SEDG)

7:15 PM IST: Markit Manufacturing PMI

7:30 PM IST: ISM Manufacturing Index

Fun Fact of The Day 🌞

Dunkin' Donuts in South Korea started spraying coffee aroma into public buses every time their jingle played. Coffee sales rose 29%.

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today.