🥩 Can KFC Resurrect Beyond Meat?

FedEx warns of shipment delays.

Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Friday's Close) 4,677.03 -19.02 (0.41%)

NASDAQ (Friday's Close) 14,935.90 -144.96 (0.96%)

FTSE 100 (5 PM IST) 7,473.50 -11.78 (0.16%)

NIFTY 50 (Today's Close) 18,003.30 +190.60 (1.07%)

USDINR (Today's Close) 74.05 (1 Year +0.89%)

🔥 Top Movers

DISCA +16.87%

PHVS +15.57%

FC +10.44%

PRVA -13.45%

EAR -12.50%

RPTX -11.62%

🥩 Beyond Meat: Chicken Out Of The Kitchen?

Shares of Beyond Meat (BYND) were languishing near their 52-week low after their poor Q3 results and post-earnings commentary. But with KFC restaurants adding Beyond Meat’s plant-based chicken to its menu, albeit for a limited time, can the latter heave a sigh of relief? (Tweet This)

“Yum!” my Plant-Based Chicken!

Yum! Brands has been trying to figure out menu changes in its subsidiary restaurants for a while now to cater to the growing veganism trend in the US. It was an opportunity to bring back customers that are being alienated and also to stand tall in the face of stiff competition.

Back in August 2019, Yum! and Beyond Meat tested plant-based chicken at a restaurant in Atlanta. Customers couldn’t have enough of it, and the entire supply was sold out in five hours. The product was also tested at KFC outlets in Nashville, TN, Charlotte, VA, and Southern California.

This was the background for Yum! and Beyond Meat to sign a formal partnership agreement last February, to supply exclusive menu items to the former’s constituent restaurant chains - KFC, Taco Bell, and Pizza Hut over the next several years. The financial terms of the agreement are under wraps.

Ever since, KFC has been working with Beyond Meat to develop chicken substitutes. We’re not talking about the simple ground-up consistency of its ubiquitous chicken nuggets. Instead, this mimics the taste and texture of whole-muscle chicken, like chicken breast.

Finally, the results are out, and starting today, KFC introduces Beyond Meat's plant-based chicken to its menus in its 4K outlets across the US. On the face of it, this will be for a limited period of time, although the definition of "limited" remains unclear.

Beyond Meat had also struck a three-year deal with McDonald's, becoming the preferred patty supplier for its McPlant burger. The companies also decided to work together on developing new substitutes for pork, chicken, and egg. Beyond Meat’s management was quick to clarify that the financial impact of the deals, at least in 2021, was going to be "fairly modest."

Beyond Fried Chicken will be offered at KFC restaurants across the US as a combo meal or a la carte in six to 12-piece orders. The prices will start at $6.99, excluding taxes, and may vary at different locations.

Ring-Fencing The Issues

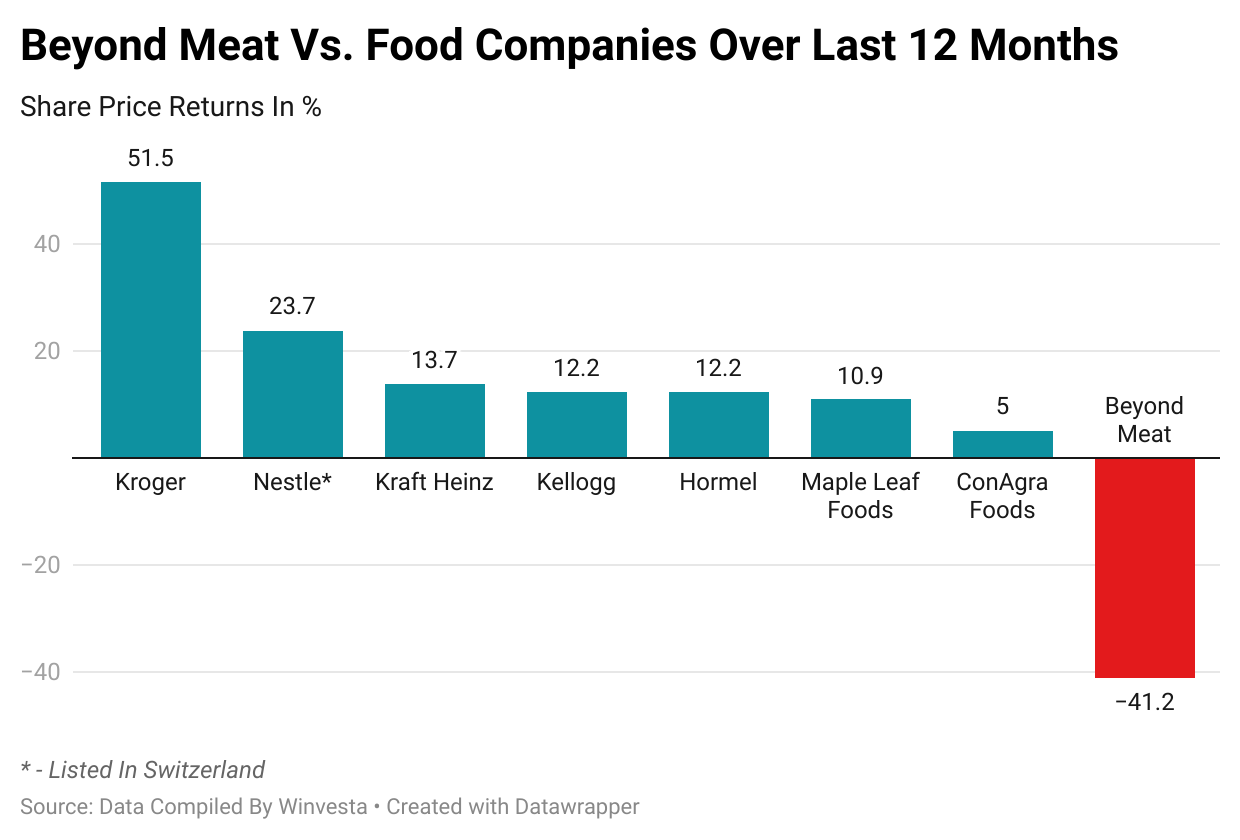

When Beyond Meat went public in 2019, it was the best listing in nearly two decades. However, shares began to crater as US sales reached saturation point. In the quarter gone by, US revenue declined 13.9% Y-o-Y. This is critical because the US accounts for most of its sales (63% in Q3).

The company also gave a dour outlook when it said that due to weak grocery demand, sales might not rebound quickly owing to higher costs and supply chain issues. That was enough for the shares to dip to a 52-week low, declining nearly 70% from their peak.

It is this grocery demand that the company hopes to recapture through the KYC deal. The company expects concomitant synergies to boost the retail business. To capitalize on the news, it has enlisted YouTube star Liza Koshy to star in the ad campaigns of this plant-based chicken.

The one reason why all of these efforts might not excite vegetarians and vegans: Beyond Fried Chicken will be made using the same equipment as KFC's traditional chicken products, there will be cross-contamination.

The uncertainties in the US notwithstanding, international business has been the saving grace for Beyond Meat. International retail outlets carrying its plant-based meat products have risen to 32K as of Q3, compared to ~150 during its IPO in 2019.

The company's presence at international foodservice outlets has grown from ~1.5K outlets during the IPO to over 26K outlets as of Q3 2021. Revenue from the international business also grew 142.5% year-on-year in Q3 to $38.9M compared to $16M.

Be that as it may, the analyst community hasn't warmed up to Beyond Meat because of its elevated valuations. The one-year forward price-to-sales ratio of 5.5x may not be easy to justify. US sales not growing is a big reason for their lack of excitement. Also, the fact that the company spent 7.8% of its net revenue on product innovation in Q3, compared to Nestle's paltry 1.9%, is also a dampener.

The KFC announcement may have triggered a U-turn for the shares of Beyond Meat from their 52-week low. However, a lot of things have to fall in place for this upward trend to be sustainable. For example, the company getting a grip on its core market (US), managing expenses better, and tackling competition will be a few items that are likely to keep investors on the edge.

Beyond Meat's shareholders have had a long period of heartburn, courtesy of its tumultuous share price. Whether KFC turns out to be the antacid they so desperately seek, only time will tell.

Market Reaction

BYND ended at $68.52, up 2.18%.

Company Snapshot 📈

BYND $68.52 +1.46 (2.18%)

Analyst Ratings (20 Analysts) BUY 10% HOLD 50% SELL 40%

Newsworthy 📰

Defence: Ousted James Hardie CEO rejects claims of concerns related to conduct (JHX -5.02%)

Fallout: FedEx warns of shipment delays as Omicron leads to staffing shortage (FDX +0.33%)

Cash: Blackstone to invest $3B in Invenergy Renewables (BX -2.11%)

Later Today 🕒

Accolade Inc. Earnings (ACCD)

Tilray Inc. Earnings (TLRY)

AZZ Inc. Earnings (AZZ)

Limoneira Co. Earnings (LMNR)

8:15 PM IST: Markit Manufacturing PMI

Today's Market Terminology: Letter of Credit

Letter of Credit is a form of guarantee of payment issued by a bank on behalf of a borrower that assures the payment of interest and repayment of principal on bond issues

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today. *Capital is at risk.