💡 Can GE Regain Its Lost Glory?

Rivian's mega debut; Good news for Lordstown.

Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Wednesday's Close) 4,646.71 -38.54 (0.82%)

NASDAQ (Wednesday's Close) 15,622.70 -263.84 (1.66%)

FTSE 100 (5 PM IST) 7,365.42 +25.60 (0.34%)

NIFTY 50 (Today's Close) 17,886.70 -130.50 (0.72%)

USDINR (Today's Close) 74.45 (1 Year -0.74%)

🔥 Top Movers

RIVN +29.14%

PDFS +26.09%

RNG +20.54%

POSH -28.98%

PRPL -24.48%

FUBO -23.12%

💡 General Electric: Regaining Lost Glory?

130 years after its founding, General Electric (GE) is splitting into three different companies. Reasons? Simplify its group structure, pare debt, and get its battered share price back on track. Will the company, started by Thomas Alva Edison, regain its lost glory? (Tweet This)

The Undoing

GE has been through possibly everything under the sun - World Wars, famines, natural calamities, and even pandemics! And came out stronger in the end. At one point, it was synonymous with American business power and was the most valuable global conglomerate.

There were some wrong bets taken, and there was some bad timing as well. The global financial crisis in 2008 exposed these lacunae in decision-making at GE. GE Capital had become an albatross around the company’s neck and dragged it deep into a debt spiral which has continued to affect the company to this day.

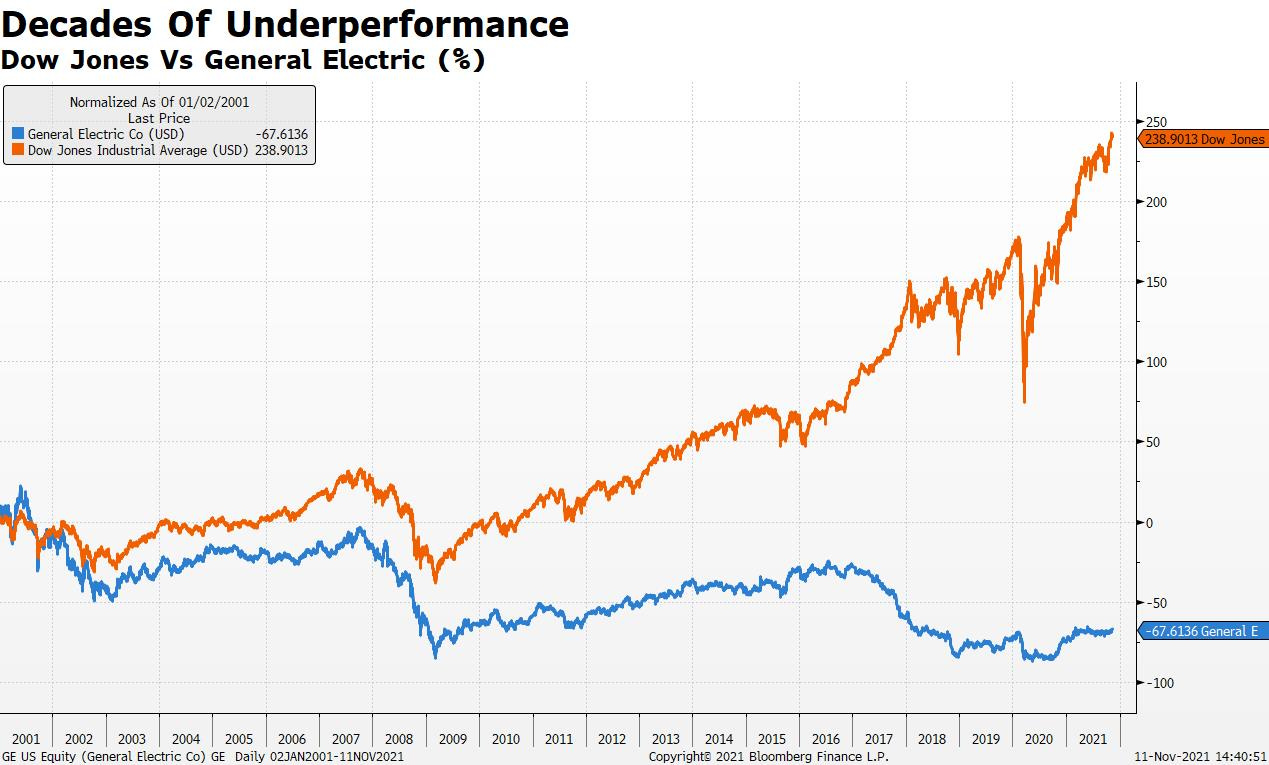

The erosion in value at GE over the next decade was such that the company was removed from the Dow Jones Industrial Average index in 2018, after a continuous run of more than a century on the blue-chip index. During that period of turbulence, GE's market value eroded by over $200B.

Larry Culp was the company’s first outsider CEO, who took over in September 2018, probably at GE’s worst phase, to put it mildly. With debt over $100B, Culp needed to reduce the strain on the balance sheet and regain shareholder confidence. GE thus embarked on a massive asset sale plan.

GE sold part of its stake in Baker Hughes for $1.75B, sold its Biopharma unit for $20B, and its aircraft leasing business for $31B. The quantum of bond purchases also increased. At the end of Q3 2021, GE’s debt stood at $62.9B, a far cry from when Culp just took charge of the day-to-day affairs.

Mea “Culp” Yeah!

On Tuesday, GE perhaps announced its most dramatic restructuring under Culp. The company will split into three independent entities focused on aviation, healthcare, and energy. The healthcare unit will be spun off by early-2023 and the energy unit by early-2024.

The energy business will be run by GE Power CEO Scott Strazik and will combine GE's renewable energy, fossil fuel, power, and digital units. The brand name GE will be retained for its aviation business. The Healthcare business will be run by incoming CEO Peter Arduini.

GE, the parent, plans to retain a 20% stake in the healthcare business, which also will be issuing debt securities to repay the existing debt of the parent. So how do things look for the beleaguered company?

With an expected $7B in free cash flow in 2023, and by selling its remaining stake in Baker Hughes, GE hopes to bring down its net debt to $35B. Culp clarified this break was not a response to investor pressure. Neither does he expect any regulatory or labour issues from this move.

This tough decision was hailed by activist investor Nelson Peltz, whose Trian Fund Management was instrumental in ousting Jeffrey Immelt back in 2015. Trian, which holds a 1.5% stake in GE, called for more dramatic action to overhaul the beleaguered company. The fund "saluted" Culp and the steps GE has been taking to shore up long-term shareholder value.

In response, the stock rose as high as 15% in pre-market trading on Tuesday. As the fine print became clearer, the realization dawned that the split would take another 2+ years to engineer. That was enough for the excitement to temper down a bit.

This is only the first salvo as GE looks to exit the conglomerate structure. There’s a long way to go before it can stake the claim for its rightful place under the sun. Whether it will ever be back to its glory days as the symbol of American capitalism is the $120B question!

Market Reaction

GE ended at $108.96, down 2.09%.

Company Snapshot 📈

GE $108.96 -2.33 (2.09%)

Analyst Ratings (21 Analysts) BUY 52% HOLD 43% SELL 5%

Newsworthy 📰

Bonanza: Rivian valued at over $100B in debut, after world's biggest IPO of 2021 (RIVN +29.14%)

Purchase: Foxconn buys Lordstown Motors' old GM factory for $230M (RIDE +21.22%)

Slide: Beyond Meat shares crater as losses mount, company issues disappointing forecast (BYND -18.61%)

Later Today 🕒

Brookfield Asset Management Inc. Earnings (BAM)

Tapestry Inc. Earnings (TPR)

Flowers Foods Inc. Earnings (FLO)

Merck Annual General Meeting (MRK)

Today's Market Terminology: Coupon Rate

A coupon payment on a bond is the annual interest payment that the bondholder receives from the bond's issue date until it matures

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today. *Capital is at risk.