🧴 Can Clorox’s Cleaning Solutions Wipe Its Woes?

Affirm plummets ⬇, Zillow soars ⬆

Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Thursday's Close) 4,504.08 −83.10 (1.81%)

NASDAQ (Thursday's Close) 14,185.64 −304.73 (2.10%)

FTSE 100 (4:30 PM IST) 7,617.71 −54.69 (0.71%)

NIFTY 50 (Today's Close) 17,374.75 −231.10 (1.31%)

USDINR (Today's Close) 75.40 (1 Year +3.89%)

🔥 Top Movers

COE +24.04%

GLSI +18.79%

GRAB +14.41%TWOU -47.86%

INFU -26.47%

QNGY -24.71%

🧴 Clorox: Where Is Catharsis?

Shares of cleaning products manufacturer Clorox (CLX) fell the most in one day in more than two decades! Yes, you read that right. This is the same company that couldn't keep up with customer demand for sanitizers and cleaning wipes at the height of the pandemic. What gives? (Tweet This)

The I-Word…

Clorox's financial year runs from July through June. In FY 2020, the company was breathless and fired all cylinders. Highest quarterly revenue, net profit, free cash flow, and gross profit margin in 10 years. For the following year, revenue grew 9% Y-o-Y. However, other business metrics declined.

Linda Rendle took over as CEO of Clorox in September 2020. She was focused on growing brands such as Burt's Bees, Formula 409, Glad, Hidden Valley, Ever Clean Pet Products. She executed her strategy by increasing advertising spending.

When the company measured what the consumers felt about the company's brands last quarter, the message was: Clorox's brands are the best in their category 75% of the time - a record high. But there was a catch. That feedback had come on the back of elevated advertising spending.

Clorox was everywhere in the NBA - it even introduced a new format at the All-Star weekend called 2022 Clorox Rising Stars. All these sponsorships meant higher costs and lower margins. And if sales didn't keep abreast of the spending, there would have been a double whammy.

And then came the I-word. The US consumer price index for November and December has been highest since 1982. High inflationary pressure, increased promotional spending, sales not keeping pace with spending increase - that's the perfect storm Clorox found itself in the middle of.

… And The Perfect Storm

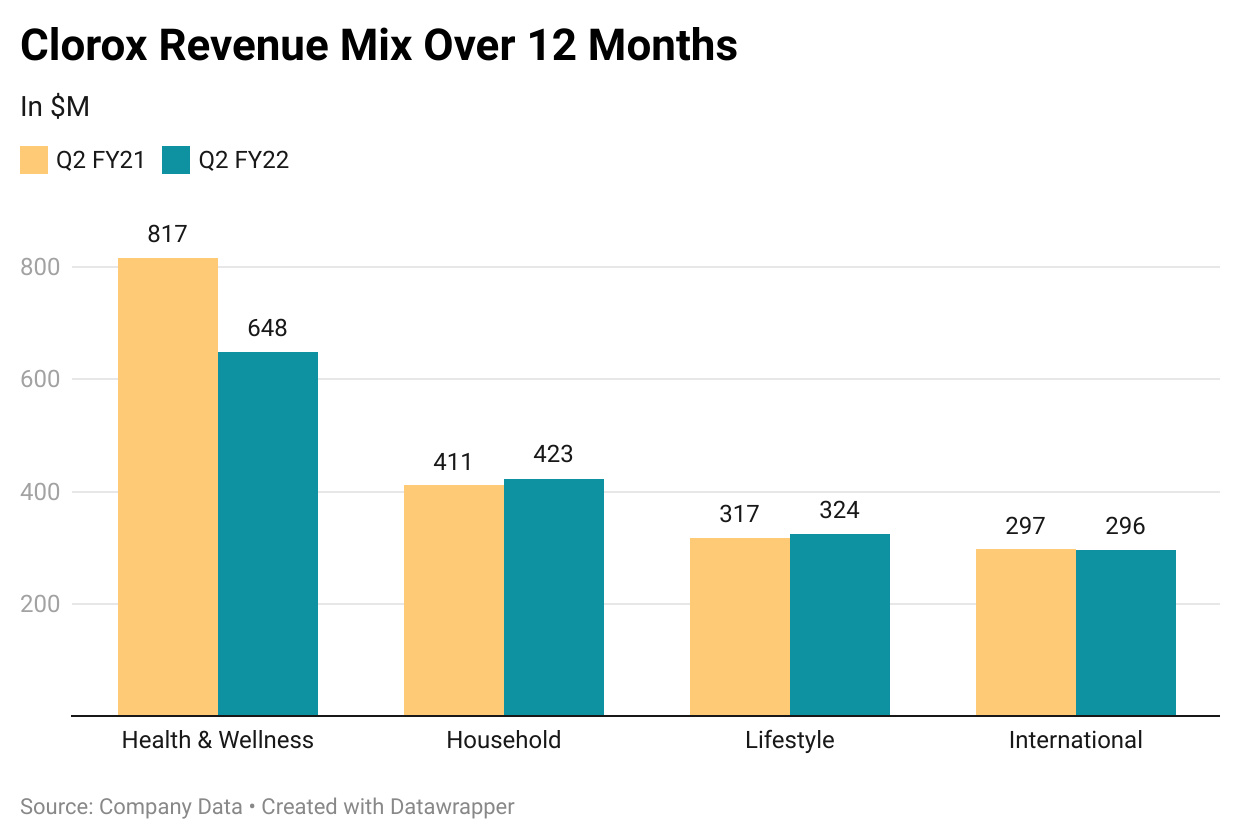

From record levels in FY20, Clorox now reported a decline in sales, saw margin compression, and guidance for the year was not soothing either.

Key Highlights From Q2 FY22:

Revenue: $1.69B Vs $1.67B expected

EPS: $0.66 Vs $0.78 expected (compared to $2.03 at the same time last year)

Organic sales down 8% Y-o-Y

Gross Margins: 33% Vs 45% Y-o-Y

The company attributed this across the board disappointment to higher manufacturing, logistics, and commodity costs. To add to the ignominy, the gross margin levels were worse than what the company had endured at the height of the Great Recession.

For FY 2022 which ends in June, Clorox expects net sales to decline ~2.5% (slightly better than the earlier projected ~4% decline). The company expects demand for its products to remain high. Even so, the company now expects to earn ~$4.37 per share (compared to earlier projection of ~$5.55 and analyst expectation of $5.37).

In delivering the bad news, the management did not hold back. The company said it will take several years for the margins to come back, and that's subject to how inflation behaves. And so how does fortune reversal look? From the highest gross margin in 10 years in FY20, Clorox now expects FY22 gross margin to be at a 10-year low, in the mid-30%.

As the pandemic peters out, there are heaps of unsold goods in warehouses owing to falling demand. Clorox today has 66 days worth of inventory in its warehouses, compared to 55 days earlier. At the pandemic's peak, the company had signed up numerous third-party manufacturers to meet demand. Now, it wants to unwind those agreements.

So, where's the bright spot? Clorox has paid and raised dividends for 45 consecutive years. But if everything else seems to be falling apart, will investors care about dividends? And will those dividends last if the situation deteriorates any further. Just ask shareholders of General Electric.

The stock came back full circle, from a 52-week high in March 2020, to a 52-week low on Friday, erasing all of the gains made during the pandemic. Linda Rendle has her task cut out if she plans to keep her job. If the battered margins and increased spending are not brought under control soon, the shareholders may very well have the last word!

Market Reaction

CLX ended at $141.38, down 1.02%. The stock is down 21.27% in the last month.

Company Snapshot 📈

CLX $141.38 -1.45 (1.02%)

Newsworthy 📰

Shaky: Affirm shares plummet 21% after company releases financial results early (AFRM -21.42%)

Open House: Zillow soars on upbeat outlook and faster-than-expected selloff of homes in portfolio (ZG +13.56% premarket)

Lift-off: Expedia optimistic about travel recovery, boosting stock despite mixed results (EXPE +4.29% premarket)

Later Today 🕒

Alliance Bernstein Holding LP Earnings (AB)

Apollo Global Management Inc. Earnings (APO)

Enbridge Inc. Earnings (ENB)

Goodyear Tire & Rubber Co. Earnings (GT)

Magna International Inc. Earnings (MGA)

Under Armour Inc. Earnings (UAA)

Today's Market Terminology: Discounted Cash Flow (DCF)

DCF or Discounted Cash Flow is a way to calculate future cash flows multiplied by discount factors in order to obtain the present values

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today. *Capital is at risk.