🧻 Can Bed Bath & Beyond Manage A Turnaround?

Domino's expects soaring costs in 2022.

Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Tuesday's Close) 4,713.07 +42.78 (0.92%)

NASDAQ (Tuesday's Close) 15,153.45 +210.62 (1.41%)

FTSE 100 (5 PM IST) 7,546.02 +54.65 (0.73%)

NIFTY 50 (Today's Close) 18,212.35 +156.60 (0.87%)

USDINR (Today's Close) 73.93 (1 Year +0.57%)

🔥 Top Movers

ACCD +27.69%

BFLY +19.46%

ILMN +16.98%

TBPH -12.88%

PACB -11.34%

ACI -9.75%

🧻 Bed Bath & Beyond: Losing Sleep Over Turnaround?

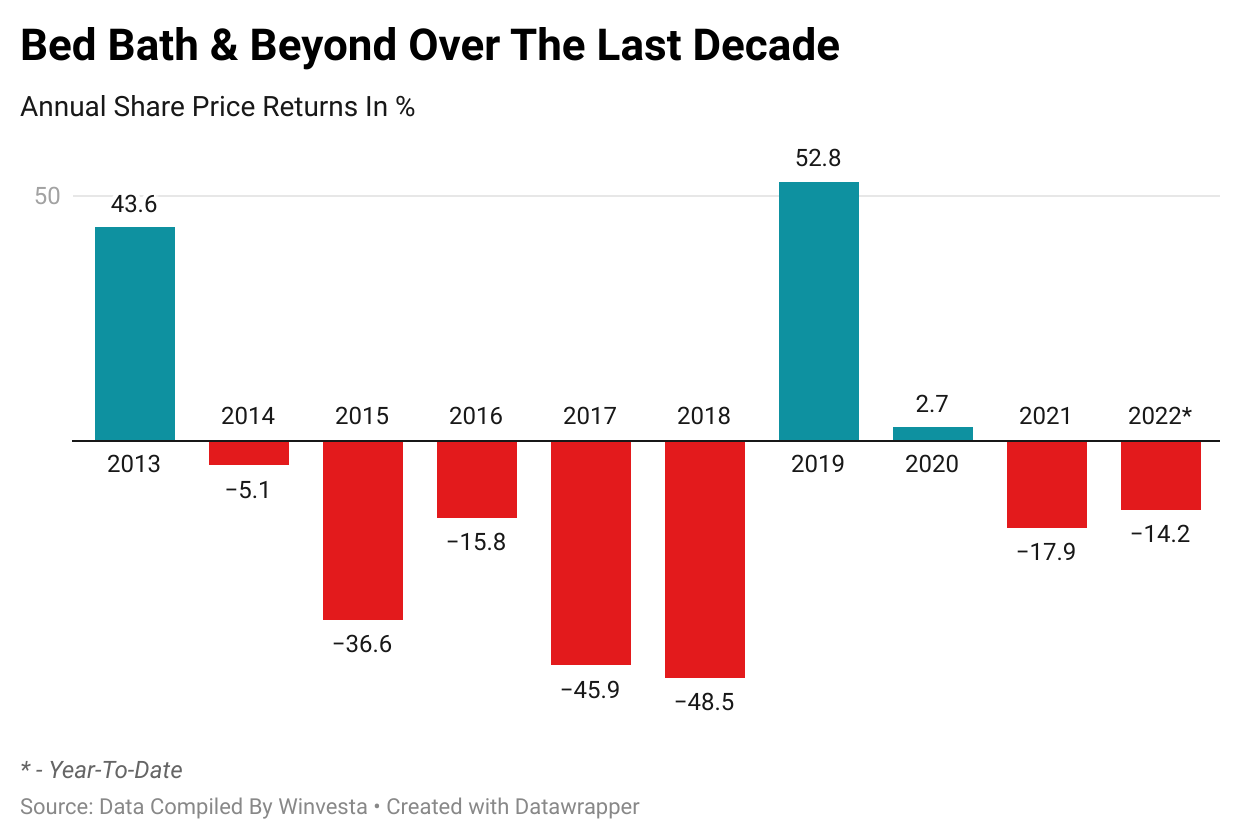

Bed Bath & Beyond's (BBBY) share price has dropped over 70% in the last five years. The turnaround plan unveiled in October 2020 hasn't done much. The cracks are well and truly open, with 37 more underperforming stores set to close across the US and sub-par earnings. (Tweet This)

The Promised Turnaround...

Shareholder activism has shaken companies such as ExxonMobil, Macy's, and Kohl's in 2021. But Bed Bath and Beyond has been at the receiving end of shareholder activism since March 2019. Its shares had rocketed 20+% in a single session when activist investors acted to replace its entire 12-member board.

This revolt was led by Legion Partners Asset Management, Macellum Advisors, and Ancora Advisors, who together held a 5% stake in the company. Unfortunately, they were unhappy the company hadn't kept pace with competition regarding online shopping.

Also at issue were underperforming assets such as Buy Buy Baby and the decor retail chain Cost Plus World Market. Bed Bath & Beyond had acquired Cost Plus in 2012 for $495M. They were also sharpening their knives against CEO Steven Temares, who was at the helm since 2003.

The management initially put up a brave face amid blistering criticism from the triumvirate but ultimately buckled under the pressure. Within two months, CEO Temares stepped down. The search for a new CEO ended six months later, when Mark Tritton, formerly Chief Merchandising Officer at Target, was appointed.

Tritton made merry changing the face of the management team, asking six incumbent C-Suite occupants to leave. Tritton's need for fresh perspectives to help the company adapt to consumers' shopping needs was cited as the rationale behind the move. These changes paved the way for the vaunted turnaround plan.

...Is Still Turning Around

The turnaround plan announced in October 2020 had a few salient features (the discerning reader will notice how it corresponds to the activist investors' wishlist).

Stores were to be decluttered and operations modernized; 200 stores were on the chopping block for closure over the next two years; the company's digital presence would be revamped, and product prices made more competitive with those of e-commerce players. Ten new private label brands were to be introduced in key merchandise categories.

The management needed this plan to turnaround Bed Bath & Beyond's fortunes. It had projected private label products to account for 30% or more of overall sales. Sales were expected to increase in single digits, and gross margins to expand to 38% from 33%. Pulling the plan off was expected to cost the company $400M annually.

The company also jettisoned Cost Plus World Market, which was lapped up by private equity fund Kingswood Capital Management for an undisclosed amount. Then came the quarterly results.

Key Highlights From Q3:

Revenue: $1.88B Vs $1.95B expected

Loss Per Share: $0.25 Vs breakeven

Net Loss: $276M Vs $75M Y-o-Y

Same-Store Sales: -7% Vs -0.9% expected

Supply chain bottlenecks introduced by the pandemic cost the company $100M. The full-year forecast has been revised downward. It now expects to have an adjusted loss of ~$0.08 on revenue of $7.9B versus the earlier forecast of EPS between ~$0.85 on revenue of $8.2B.

Last week, the company also announced plans to shut 37 more underperforming stores across 19 states in the US. This is on top of the 200 stores it had planned to close as part of the turnaround plan.

The company's shares remain among the most heavily shorted. The latest data shows 22% of its shares available for trading were sold short. With the turnaround plan stuttering, the company is finding itself among other "meme stocks." Investors certainly seem to be looking beyond Bed and Bath for signs of a meaningful turnaround that's yet to materialize.

Market Reaction

BBBY ended at $13.12, up 0.85%.

Company Snapshot 📈

BBBY $13.12 +0.11 (0.85%)

Analyst Ratings (20 Analysts) BUY 15% HOLD 45% SELL 40%

Newsworthy 📰

Stalled: Union rejects Kroger's King Soopers sweetened wage offer (KR -2.83%)

Idea: Walgreens CEO says company is looking into strategic options for UK-based Boots business (WBA +1.12%)

Estimate: Domino's Pizza forecasts soaring food costs in 2022, backs long-term outlook (DPZ -3.23%)

Later Today 🕒

Lennar Corporation Earnings (LEN)

Jefferies Financial Group Earnings (JEF)

7:00 PM IST: Consumer Price Index & Core CPI

12:30 AM IST: Federal Budget & Beige Book

Today's Market Terminology: Naked Options Strategies

This is an unhedged strategy making use of either a short call or a short put strategy. They are called naked because they do not involve an offsetting or risk-reducing position in another option of the underlying security

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today. *Capital is at risk.