💳 Can American Express Justify Its “Special” Tag?

Chevron's budget boost; Square changes name.

Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Wednesday's Close) 4,513.04 -53.96 (1.18%)

NASDAQ (Wednesday's Close) 15,254.05 -283.64 (1.83%)

FTSE 100 (5 PM IST) 7,119.50 -49.18 (0.69%)

NIFTY 50 (Today's Close) 17,401.65 +234.75 (1.37%)

USDINR (Today's Close) 75.03 (1 Year +0.08%)

🔥 Top Movers

CP +14.14%

AMBA +14.13%

REX +10.35%

NKTX -16.55%

AMC -15.82%

SPT -15.23%

💳 American Express: Buffett’s Special One?

Financial Services powerhouse American Express (AXP) has had its best year since 2017 in terms of yearly returns. Although the stock is down 20% from its peak this year, it is still up 30% YTD. The management, too, is bullish about business momentum. Will Omicron play spoilsport? (Tweet This)

170 Years And Counting

American Express began as an express mail service in New York in 1850. It resulted from the merger of express companies owned by Henry Wells, William Fargo, and John Butterfield. Wells & Fargo would also go on to start Wells Fargo two years later.

Seven years after its inception, the company introduced a money order business, directly competing with US Post Office's money orders. The company had declared its cards business would be launched on October 1, 1958.

Such was the public interest and curiosity that 250K cards were issued even before the official launch date. Two decades later, in 1977, it began trading on the New York Stock Exchange. American Express formed a joint venture with Warner Communications in 1979, which created the likes of MTV, Nickelodeon, and The Movie Channel. All the properties were sold to Viacom in 1984.

By then, the company had shifted its complete focus into the credit cards business, which caught Warren Buffett’s attention. Berkshire Hathaway acquired a stake in the company in 1994. American Express is the third-largest holding in Berkshire Hathaway's portfolio, after Apple and Bank of America. The 151M shares held by the corporation are now valued at $25.4B.

In November 2010, the company's UK division was cautioned by the Office of Fair Trading for encouraging customers to turn their unsecured credit card debts into secured debt. In October 2012, the Consumer Financial Protection Bureau (CFPB) ordered AmEx to refund $85M to approximately 250K customers for illegal card practices between 2003 and 2012.

American Express was named as one of the most valuable brands in the world by Forbes in 2017. Currently, it has close to 120M cards in circulation globally and a market capitalization of over $100B.

Pandemic Blues

American Express was severely impacted due to the onset of the pandemic in 2020, with travel, entertainment, and retail spending taking a big hit. With vaccination rates improving worldwide, and people venturing out, spending on American Express cards was up for the first time since Q3 2019 in Q3 this year.

Key Highlights From Q3:

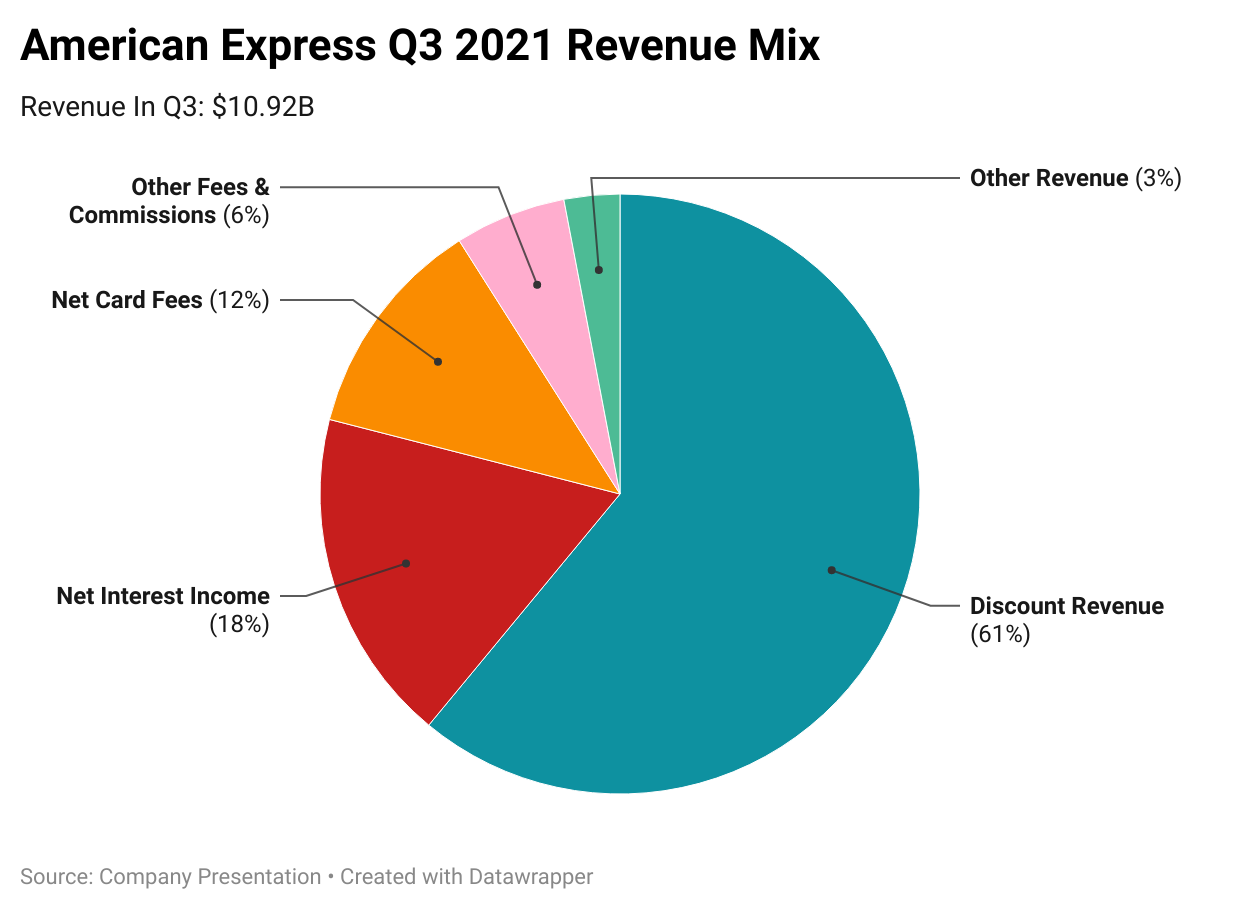

Revenue: $10.93B Vs $8.75B YoY - highest in five quarters

EPS: $2.27 Vs $1.80 expected

The return of spending was evident because the company issued over 2M credit cards in each of the three quarters so far this year. Majority of the spending came from Millennials and Gen Z users who spent 48% more on their cards than the same period last year and 38% more than Q3 2019.

Business in October and November has surpassed the whole of Q3, and this trend is expected to continue into 2022 as well. Even so, travel and entertainment spending on AmEx is still only 71% of pre-pandemic levels and is expected to rise to 80% of pre-pandemic levels in this quarter. But that was before Omicron was a thing. This new Covid-19 variant may throw a spanner in the wheel.

Warren Buffett had called American Express "special" at a summit last year. In the face of competition that’s chanting “Buy Now, Pay Later,” the company has its task cut out if it has to live up to Buffett’s tag!

Market Reaction

AXP ended at $150.06, down 1.47%, and shares are up 27% this year.

Company Snapshot 📈

AXP $150.06 -2.24 (1.47%)

Analyst Ratings (27 Analysts) BUY 48% HOLD 44% SELL 8%

Newsworthy 📰

Scrap: Facebook asks court to dismiss US FTC antitrust lawsuit for good (FB -4.27%)

Boost: Chevron raises spending budget and share buybacks (CVX +1.26%)

Rename: Jack Dorsey's Square changes corporate name to Block (SQ -6.66%)

Later Today 🕒

Marvell Technology Inc. Earnings (MRVL)

Dollar General Corp. Earnings (DG)

DocuSign Inc. Earnings (DOCU)

Kroger Earnings (KR)

Ulta Beauty Inc. Earnings (ULTA)

Asana Inc. Earnings (ASAN)

Cooper Companies Inc. Earnings (COO)

Guidewire Software Inc. Earnings (GWRE)

Smartsheet Inc. Earnings (SMAR)

7:00 PM IST: Initial Jobless Claims

Today's Market Terminology: Exceptional Item

An exceptional item is an accounting term that refers to an abnormal gain or loss that is not generated from the ordinary business operations of a company, is infrequent in nature, and is unlikely to recur in the foreseeable future

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today. *Capital is at risk.