💾 Can AMD Challenge NVIDIA For Supremacy?

Disney, Uber, AstraZeneca beat estimates and soar

Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Wednesday's Close) 4,587.18 +65.64 (1.45%)

NASDAQ (Wednesday's Close) 14,490.37 +295.92 (2.08%)

FTSE 100 (4 PM IST) 7,657.67 +14.25 (0.19%)

NIFTY 50 (Today's Close) 17,605.85 +142.05 (0.81%)

USDINR (Today's Close) 74.98 (1 Year +2.59%)

🔥 Top Movers

ECOL +67.73%

DCFC +64.57%

GRCL +34.10%NEWR -28.35%

QNST -26.85%

TCS -22.79%

💾 AMD: Micro To Mega?

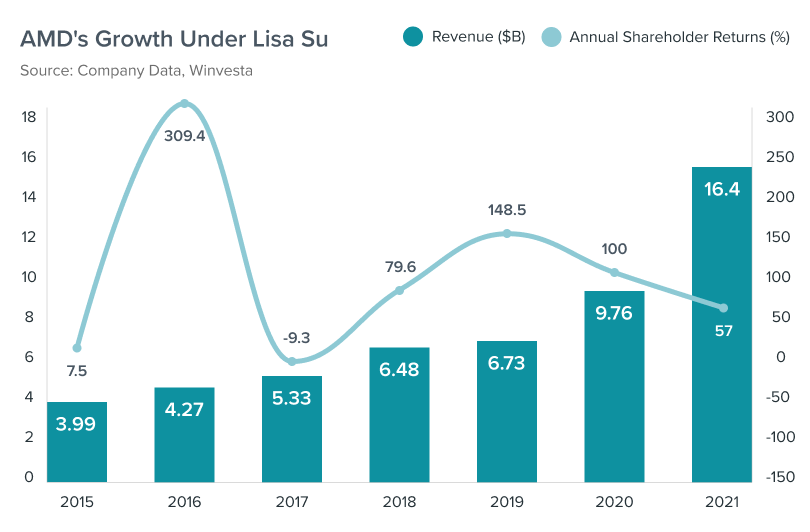

Advanced Micro Devices (AMD), under the leadership of CEO Lisa Su, stands tall amongst the semiconductor companies in the world. Lisa is now gunning for the company to scale greater heights. Q4 results and the commentary for 2022 may be just the shot in the arm AMD needed! (Tweet This)

A Dream Turnaround

AMD Ryzen, AMD EPYC, AMD Radeon, AMD Instinct - these names are ubiquitous today on laptops, gaming stations, and data centers. AMD has managed to penetrate households across the globe. Given that the company was teetering on the edge of bankruptcy just eight years ago, how far the company has come is a lesson in dreaming big and of perseverance.

In July 2006, AMD acquired graphics card manufacturing company ATI Technologies for $5.4B. It soon came to light that ATI was "grossly overvalued." To add insult to injury, the K10 Barcelona processor, launched in September 2007, had a bug in it, leading to loss of both sales as well as reputation.

Intel promptly paid Dell $723M to remain the sole provider of their CPUs and shut AMD out. When Lisa Su became AMD's CEO in October 2014, shares traded at $3. The company was bleeding money, and market share had fallen to 1%. It was just a ghost compared to Intel.

Lisa Su devised AMD's turnaround strategy based on three pillars - build great products, simplify the business, and deepen customer relationships. In addition, it signed strategic partnerships with Sony and Microsoft.

Its Ryzen line of processors and Radeon graphic cards, which also had the same performance efficiency as Intel CPUs and NVIDIA GPUs, were noticeably cheaper. It also forayed into the data center business through the launch of the server processor Epyc.

AMD turned in a net profit of $43M in 2018, the first since 2011. Revenue had crossed the $5B mark. New graphic cards were flying off the shelves thanks to crypto miners. Today, AMD's market cap is $150B. Under Su, shares have risen a staggering 4,100% in seven-and-a-half years. It also issued robust guidance going into the new year.

Clearing The Way For Xilinx

AMD reported record revenue in Q4, as it sold more chips priced at the higher end.

Key Highlights From Q4:

Revenue: $4.83B Vs $4.53B expected

EPS: $0.92 Vs $0.76 expected

The company's Enterprise, Embedded, and Semi-custom segment saw revenue of $2.2B, higher than the estimate of $2.1B. Revenue for this segment rose 74.6% Y-o-Y. AMD's other business - the Computing and Graphics segment saw revenue increase 32% to $2.6B Y-o-Y.

For the new year, AMD expects revenues of $21.5B, comfortably higher than analyst estimates of $19.27B, and a growth of 31% from 2021. It expects the current quarter to touch a record $5B in revenue, a growth of 45% Y-o-Y.

Global semiconductor shortage? No problem! The company has worked to ensure that inventory was "matched to demand." Su has also approved significant investments to ensure ongoing capacity expansion.

NVIDIA had announced the $40B acquisition of ARM in September 2020. Within a month, AMD wooed Xilinx with a $35B offer to bolster its performance computing capabilities and expand its product portfolio.

It's another thing that NVIDIA has abandoned the "once-in-a-generation" ARM deal because of regulatory backlash from China, the UK, and the US. Applied Materials also abandoned its planned $2.2B acquisition of Japan's Kokusai Electric Corp. Reason? The Chinese regulator balked.

With AMD, however, the Chinese government gave conditional approval to the deal last week. In other words, AMD and Xilinx will not be allowed to tie-in sales of products or discriminate against customers that buy one set of products but not another. AMD now expects the deal to be completed in the current quarter itself.

Today, AMD is just $50B shy of Intel in terms of market cap and growing much faster than its illustrious peer. It may still be quite a way from NVIDIA in size and growth, but Lisa Su is taking aim, one chip at a time!

Market Reaction

AMD ended at $132.85, up 3.60%.

Company Snapshot 📈

NVDA $251.08 +3.80 (1.54%)

Analyst Ratings (44 Analysts) BUY 80% HOLD 18% SELL 2%

Newsworthy 📰

Onward: Disney stock soars after record theme-park profit and streaming success produce record revenue (DIS +7.70%)

Unboosted: AstraZeneca sees higher 2022 sales, but COVID boost waning (AZN +3.51%)

Recovery: Uber posts quarterly profit as ride demand recovers, delivery remains strong (UBER +6.10%)

Later Today 🕒

Twitter Inc. Earnings (TWTR)

PepsiCo Inc. Earnings (PEP)

The Coca-Cola Company Earnings (KO)

Philip Morris International Inc. Earnings (PM)

Affirm Holdings Inc. Earnings (AFRM)

Arcelormittal SA Earnings (MT)

Astrazeneca Plc. Earnings (AZN)

Brookfield Asset Management Inc. Earnings (BAM)

Expedia Group Inc. Earnings (EXPE)

Freshworks Inc. Earnings (FRSH)

GoDaddy Inc. Earnings (GDDY)

HubSpot Inc. Earnings (HUBS)

Illumina Inc. Earnings (ILMN)

Western Union Co. Earnings (WU)

Zillow Group Inc. Earnings (ZG)

7:00 PM IST: Initial Jobless Claims

Today's Market Terminology: Maturity Spread

A maturity spread is the difference in returns between bonds of different time lenghts

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today. *Capital is at risk.