🧘♂️ Bend It Like Asana?

After beating Wall Street consensus in first earning report, Asana raised its full-year guidance.

Hey Global Investor, here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Wednesday Close) 3,672.82 −29.43 (0.79%)

NASDAQ (Wednesday Close) 12,338.95 −243.82 (1.94%)

FTSE 100 (5 PM IST) 6594.68 +31.39 (0.47%)

NIFTY 50 (Today's Close) 13,478.30 −50.80 (0.38%)

USDINR (5 PM IST) 73.69 (1 Year +4.12%)

Bend It Like Asana?

After beating Wall Street consensus in first earning report, Asana raised its full-year guidance.

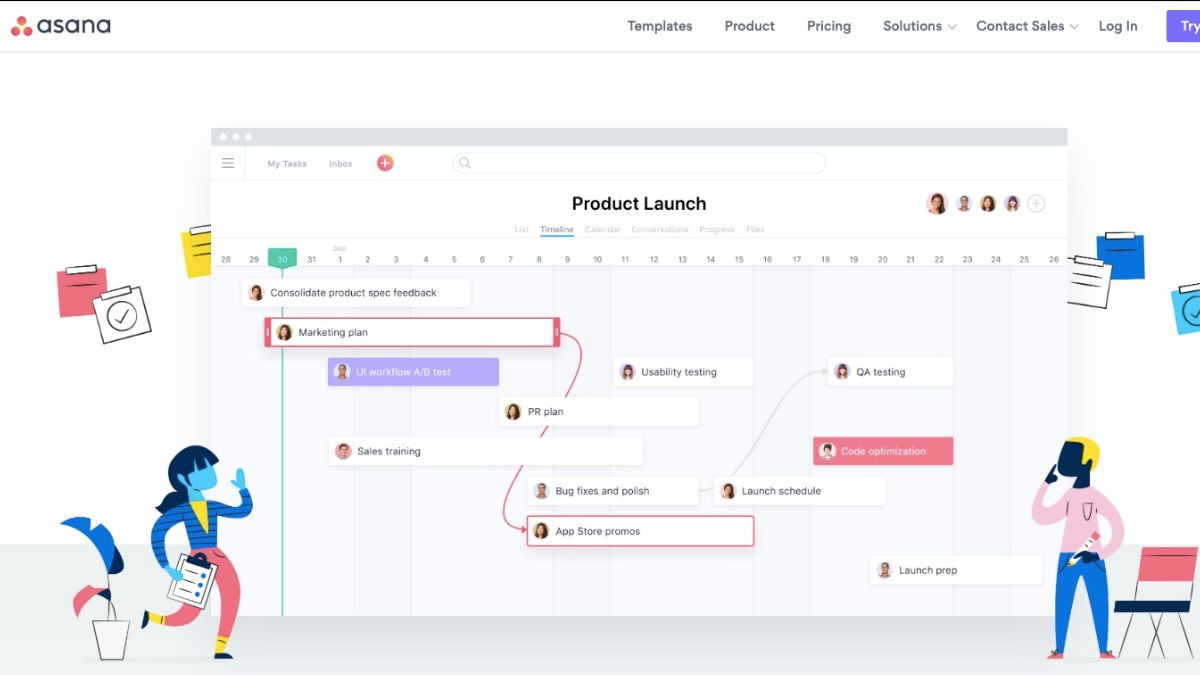

Background: Asana, the work and project management software provider, debuted on NYSE in September 2020 in a direct listing. Facebook co-founder Dustin Moskovitz and ex-Google, ex-Facebook engineer Justin Rosenstein founded Asana in 2008. The company launched its product in 2012 and, by December 2018, raced to a $1.5B valuation.

Asana introduced enhanced and new integrations with Slack, Zoom, Atlassian Jira, and Microsoft Teams to leverage the work-from-home trend. Asana also deepened its workflow and control processes.

What Happened? On Tuesday, Asana reported better than expected earnings for its first quarter as a public company (fiscal Q3).

Key numbers:

Revenue: $58.9M vs. $54.1M expected; up 55% from last year.

EPS: -$0.34 vs. -$0.37 expected.

For its Q3, Asana had more than 89,000 paying clients (net retention rate of 115%). Customers spending $5000 and $50,000 a year grew 58% and 104% Y-o-Y respectively (net retention rate of 125% and 140% in that order).

For Q4, Asana expects $63M in revenue and -$0.25 in EPS (consensus of $58.1M and -$0.31 EPS). The company also raised its full-year guidance to ~$221M and non-GAAP loss of ~$1.22 per share.

Asana expects to add new paying customers, quicker deployments, and better adoption among some of the largest enterprises in the coming months.

Market Reaction: The shares closed at $28.34, down 2.34%. In pre-market trading, the stock jumped 15.39% to $32.61.

Company Snapshot 📈

ASAN $28.34 -0.68 (-2.34%)

Newsworthy 📰

Dashing Up: DoorDash trading at steep premium to Uber and GrubHub as investors bet on growth beyond food (DASH +85.79%)

That's "Fine": General Electric agrees to pay $200 million SEC fine for misleading investors (GE +3.92%,)

Status Update: The FTC wants to break up Facebook (FB -1.93%)

Later Today 🕒

7.00 PM IST: Initial jobless claims (state program, SA)

7.00 PM IST: Continuing jobless claims (state program, SA)

7.00 PM IST: Consumer price index

Hooker Furniture Corp Earnings (HOFT)

Fun Fact of The Day 🌞

The longest chess game theoretically possible is 5,949 moves.

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today.