🚴 Are The Wheels Coming Off Peloton's Ride?

Shopify eases investor concerns.

Hey Global Investor! Here's what you need to know before the US markets open.

Market Snapshot 📈

S&P 500 (Monday's Close) 4,410.13 +12.19 (0.28%)

NASDAQ (Monday's Close) 13,855.92 +86.21 (0.63%)

FTSE 100 (5 PM IST) 7,359.27 +62.12 (0.85%)

NIFTY 50 (Today's Close) 17,277.95 +128.85 (0.75%)

USDINR (Today’s Close) 74.79 (1 Year +2.49%)

🔥 Top Movers

KSS +36.02%

GLSI +26.99%

M +18.00%CFV -29.20%

NVRO -16.72%

PLTK -11.36%

🚴 Peloton: Wheels Coming Off?

Netflix and Peloton (PTON) were the veritable poster boys of pandemic-fueled growth. Yesterday, we covered the unraveling of Netflix. Today, we focus on Peloton's woes. With reports that the company halted production due to lack of demand, shares went into a free fall. Is it a "Pause" or a "Stop?" (Tweet This)

How The Tables Turn

Until May 2021, Peloton was an investor's dream. Back-to-back quarters of $1B+ in revenue; 500% growth in share price in 2020; continued momentum in the first half of 2021; and the growing popularity of its products. It seemed to be the growth story for the ages. Demand shot through the roof, and the company found it challenging to keep up with supply.

In a hurry to keep pace with production, it acquired exercise equipment manufacturer Precor for $420M. In May, the company also announced an outlay of $400M to build its first factory in the US. It seemed the demand for its cycles and treadmills was never-ending. Turned out it was a beautiful mirage if ever there was one!

Owing to a "significant reduction" in demand, the company is now planning to halt the production of Bike in February and March. Production of the more expensive Bike+ was already halted in December and will not be restarted until June. Starting February, Tread will not be manufactured for the next six weeks.

Last May, the Consumer Product Safety Commission began to receive reports of injuries among people using the Tread+ with pets and even children being pulled under the equipment. There was even a child fatality. Peloton recalled 125K treadmills and incurred a loss of $165M. In FY 2022, Tread+ will not be manufactured at all!

John Foley didn't acknowledge production was being halted for any of its products. However, he did say the company is taking up "significant corrective actions" to improve profitability and optimize costs. Gross margin improvements, moving to a variable cost structure, and identifying reductions in operating expenses are some of the options currently on the table.

And then there's the class action lawsuit that's staring the company in its face with accusations of improperly charging sales tax for customers based in New York, Virginia and Massachusetts. The company has asked the court to dismiss the case or force the plaintiffs to settle through arbitration. Whether the court will agree isn't obvious.

Peloton expects to end the current quarter with 2.77M subscribers (Vs, forecast ~2.83M). Revenue is expected to be around $1.14B, which is within the range of expectation, and expects a loss of approximately $265M, which is lower than the prior guidance of ~$338M. The company will report its quarterly results on February 8.

Tone Deaf Management?

Peloton has hired McKinsey & Co. to review its cost structure as it looks to eliminate jobs. Some layoffs from the sales division have already begun, and there seems to be an employee exodus underway. Its apparel division, as well as its brick-and-mortar stores, are on the chopping block. As of June 30, the company operated 123 showrooms in the US, Canada, UK, and Germany.

Bad press, product recalls, and production cuts notwithstanding, the company has curiously decided to hike the prices for its products! It has cited rising inflation and higher supply-chain costs as the reason behind the hike.

Starting January 31, customers will pay an extra $250 for delivery and setup of its Bike products and $350 for Tread. This makes the overall price of these products $1,745 and $2,845 per unit, respectively. Bike+, priced at $2,495 apiece, will remain unchanged, as will the $39.99 monthly subscription fee, which users pay for on-demand content.

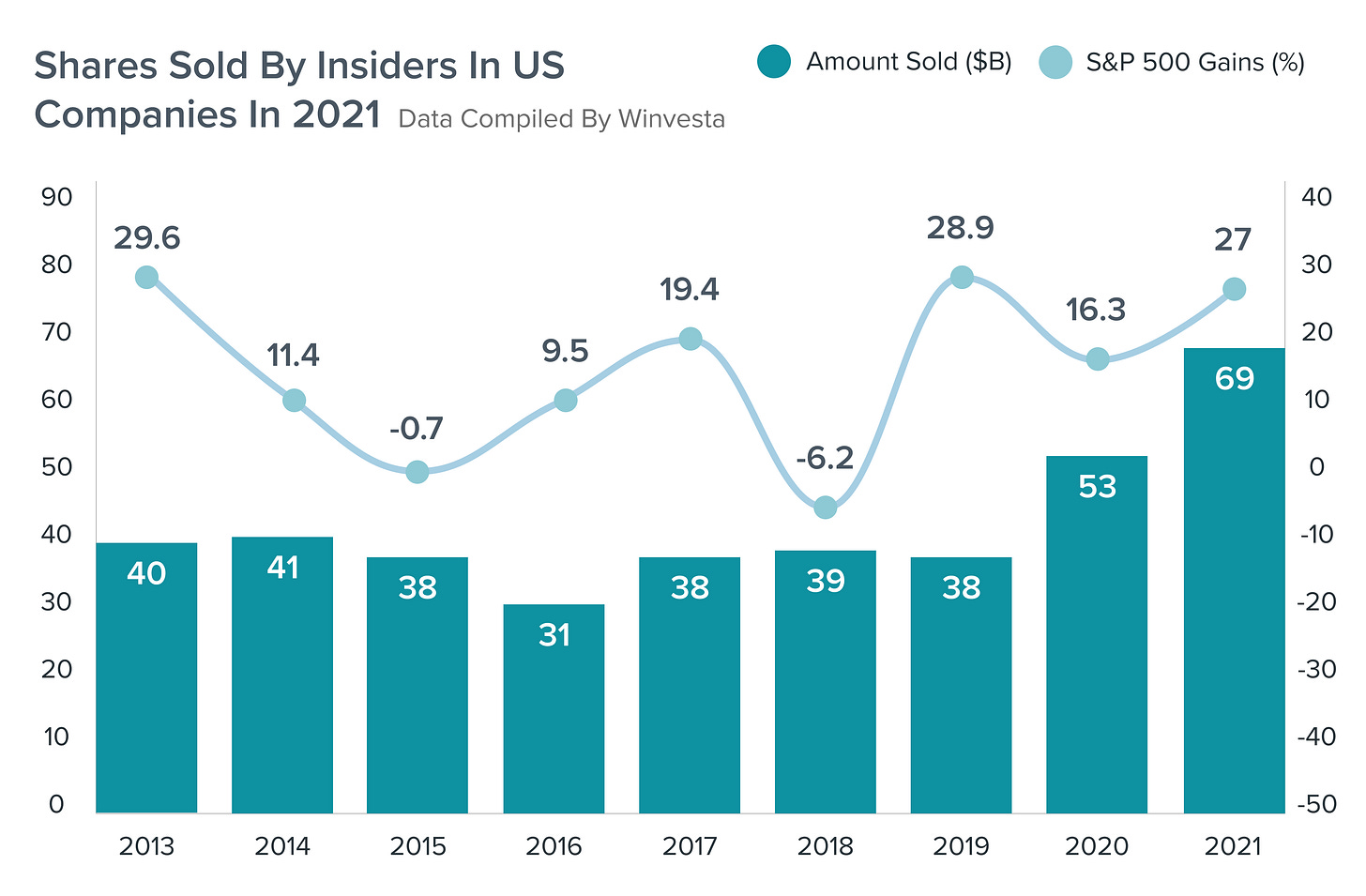

To add insult to injury came the revelation that starting in November 2020, Peloton executives, including the CEO Foley, sold shares worth ~$500M. Foley netted $119M with shares being sold at $110 or higher as part of a "prearranged plan to managing his personal finances." Peloton's shares are down 73% since August last year. Investors can read between the lines.

Blackwells Capital, an activist investor with less than a 5% stake in Peloton, has called for Foley to be fired. It also wants the company to put itself on the selling block. That's easier said than done since Foley and a handful of insiders wield 80% of the voting power in Peloton as of September 30th through the super-voting class B shares they hold.

So how did the shares of Peloton perform? After hitting a peak of $166.57 in December 2020, shares fell 80% in 2021, and the slide has continued into 2022. As news of a production shutdown emerged, shares sank below their IPO price of $29. The slight rebound over Friday and Monday has ensured that shares have at least managed to scrape past the IPO price again.

The wheels appear to be coming off for Peloton's business and strategy. The management will surely need to sweat it out before even thinking of cycling its way out of the mess it finds itself in.

Market Reaction

PTON ended at $29.71, up 9.79%.

Company Snapshot 📈

PTON $29.71 +2.65 (9.79%)

Analyst Ratings (31 Analysts) BUY 48% HOLD 45% SELL 6%

Newsworthy 📰

Beginning: IBM marks strong start to new chapter as cloud revenue booms (IBM +2.46%)

Allays: Shopify eases concerns over fulfillment network changes, shares rebound (SHOP +6.39%)

Speed: Facebook parent Meta says its new AI supercomputer will be the world's fastest (FB +1.83%)

Later Today 🕒

Microsoft Corp. Earnings (MSFT)

General Electric Corp. Earnings (GE)

Verizon Communications Earnings (VZ)

Johnson & Johnson Earnings (JNJ)

American Express Co. Earnings (AXP)

Lockheed Martin Corp. Earnings (LMT)

Raytheon Technologies Corp. Earnings (RTX)

3M Co. Earnings (MMM)

Texas Instruments Inc. Earnings (TXN)

Capital One Financial Corp. Earnings (COF)

8:30 PM IST: Consumer Confidence Index

Today's Market Terminology: American Depositary Receipt (ADR)

An ADR is a certificate issued by a US depository bank, representing foreign shares held by the bank. One ADR may represent a portion of a foreign share, one share or a bundle of shares of a foreign corporation

You can start investing in US stocks with platforms like Winvesta. Get an account in as little as 15 minutes and start building your global portfolio today. *Capital is at risk.